Uniswap Hits $38 Billion in Monthly Trading Volume, Outpacing Competitors in DeFi

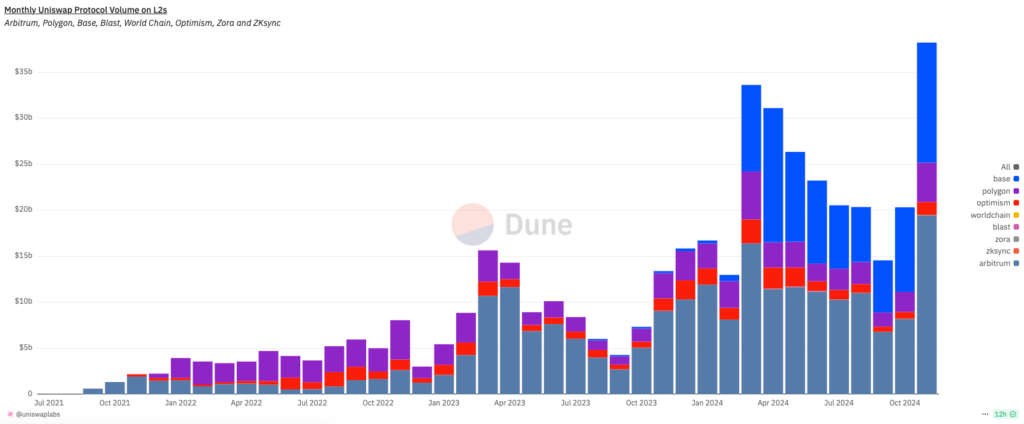

Uniswap has achieved a significant milestone in the decentralized finance (DeFi) ecosystem, smashing its monthly volume record across Ethereum Layer-2 networks. The popular decentralized exchange (DEX) recorded a remarkable $38 billion in volume across major Layer-2 platforms, including Base, Arbitrum, Polygon, and Optimism. This impressive feat marks a significant increase from the previous record, set in March, by $4 billion.

Surge in Uniswap’s Volume Reflects Growing DeFi Demand

Data from Dune Analytics highlights that Uniswap’s performance is closely tied to an overall resurgence in demand for assets and stablecoins within the broader DeFi space. The sharp uptick in Uniswap’s volume coincides with the broader trend of increasing demand for decentralized finance solutions, with Ethereum Layer-2 networks seeing an influx of liquidity.

Henrik Andersson, Chief Investment Officer at Apollo Crypto, suggests that the increased volume is indicative of a DeFi renaissance, with more users engaging with decentralized platforms. He also points out that on-chain yields have risen, making DeFi more attractive as an investment option.

Ethereum and Bitcoin Rally Drives DeFi Activity

Andersson further notes that the ETH/BTC trading pair has experienced a notable increase, which has likely contributed to a resurgence in DeFi activity. He predicts that this spike in activity could mark the beginning of a long-awaited outperformance for the Ethereum ecosystem, especially as Bitcoin approaches the $100,000 mark. Historically, such price movements in Bitcoin have been closely followed by gains in Ethereum and other DeFi-related tokens.

Arbitrum Leads Uniswap’s Layer-2 Volume Surge

Uniswap’s volume surge was particularly prominent on the Arbitrum network, which accounted for the largest share of the platform’s monthly volume at $19.5 billion. In close competition, Base, a Layer-2 network incubated by Coinbase, recorded $13 billion in volume. Other Ethereum Layer-2s, including Polygon and Optimism, contributed to the overall growth but were not as significant in comparison.

The overall growth of Uniswap’s volume across these networks signifies increasing user adoption and the expanding importance of Layer-2 solutions in the DeFi ecosystem. The lower transaction costs and faster confirmation times offered by Layer-2 networks make them an appealing choice for traders looking to engage with Ethereum-based DeFi protocols.

Uniswap Dominates the DeFi Space, Raking in $90 Million in Fees

Alongside record trading volumes, Uniswap also saw a significant boost in its protocol fees. The DEX generated over $90 million in fees over the last month, securing its position as the sixth-largest protocol in terms of fees across the entire crypto space. This places Uniswap ahead of notable competitors like Solana’s memecoin launchpad, Pump.fun, and even well-established networks such as Tron and Maker.

Uniswap’s fee performance underscores its dominance in the decentralized exchange sector, with its fees consistently surpassing those of rival platforms. This trend highlights the growing preference for Uniswap as a go-to platform for DeFi trading, particularly on Ethereum Layer-2s, where users are increasingly seeking cost-efficient alternatives to Ethereum’s mainnet congestion.

UNI Token Sees Significant Price Growth Amidst Uniswap’s Success

As a reflection of the increased activity on Uniswap, the price of its native token, UNI, has surged significantly. Over the past week, UNI has gained more than 42%, with its price currently standing at $12.58. This marks a 10% increase in just the last 24 hours, reflecting growing investor confidence in the protocol.

The recent growth in UNI’s price has positioned it as the top-performing decentralized exchange (DEX) token, outpacing other prominent tokens like Raydium (RAY), based on Solana, which has seen a 2.2% decline over the last week. UNI has also outperformed Jupiter (JUP), another DEX token, which has seen a more modest 7.7% increase in the same period.

Disclaimer: This website’s content is for informational purposes only and does not constitute financial advice, with all cryptocurrency purchases carrying inherent risks.

Leave a comment