Uniswap’s V3 version has achieved remarkable success by minimizing slippage within a specific range, mitigating Impermanent Loss, and optimizing liquidity utilization. However, Uniswap is not resting on its laurels, as the recent announcement on Uniswap Labs’ Twitter account reveals the forthcoming release of Uniswap V4 in the near future.

Uniswap V4: Reduce Costs While Ensuring Efficiency

As per the announcement made by the Uniswap team, the development of the V4 version involved contributions from both the Uniswap team and certain members of Paradigm. The primary focus of Uniswap V4 is to lower transaction fees, enhance liquidity optimization, and increase profitability for liquidity providers.

Despite introducing the centralized liquidity model (CLMM) in V4, Uniswap still upholds its vision of enabling individuals to generate ideas and develop products through the utilization of “Hooks.”

Hooks are contracts that execute at different stages during transaction operations within the pool. The team has the flexibility to maintain the same trade-offs as V3 or introduce entirely new functionalities.

The team is currently testing the following new products:

- Time-weighted average market maker (TWAMM)

- Dynamic fees based on volatility or other inputs

- On-chain limit orders

- Depositing out-of-range liquidity into lending protocols

- Customized on-chain oracles, such as geomean oracles

- Autocompounding LP fees back into the LP positions

- Distributing internalized MEV profits back to LPs

Hooks

Uniswap V4 stands out with its remarkable feature known as Hooks. Hooks are segments of code that execute at specific stages in the life cycle of a pool, such as during its creation, when liquidity providers add or remove their assets, or before and after a swap. Hooks play a crucial role as they provide a higher level of customization compared to previous versions of Uniswap.

For instance, Hooks enable the creation of pools with dynamic swap fees that adjust according to market conditions, rather than relying on fixed and predetermined fees.

Additionally, Hooks empower traders to execute more sophisticated orders, including limit orders or TWAP (Time-Weighted Average Price) orders, which allow for the purchase or sale of a specific token amount over a specified timeframe.

Hooks also enable the utilization of Uniswap liquidity in various ways. Similar to Balancer’s booster pool, liquidity outside the pool’s scope can be deposited into other protocols, such as lending platforms, to generate additional profits.

The aforementioned examples are just a glimpse of what the Uniswap team has devised. Anyone has the freedom to create and deploy their own hooks without requiring permission.

With Uniswap V4 hooks, aggregators can establish more flexible and customizable centralized liquidity pools. Hooks have the ability to modify pool parameters, introduce new functions and features, such as a time-weighted average market maker (TWAMM), limit orders, dynamic fees, internal MEV mechanism, redundancy measures for loan agreements, and custom functions, including oracles that can be flexibly managed through contract hooks.

Developers can build diverse DApps utilizing Uniswap hooks, enriching the functionalities of Uniswap V4. Hook contracts can also allocate a portion of transaction fees to themselves. However, users should exercise caution when utilizing these features as they bring new challenges and necessitate risk management considerations.

The Singleton

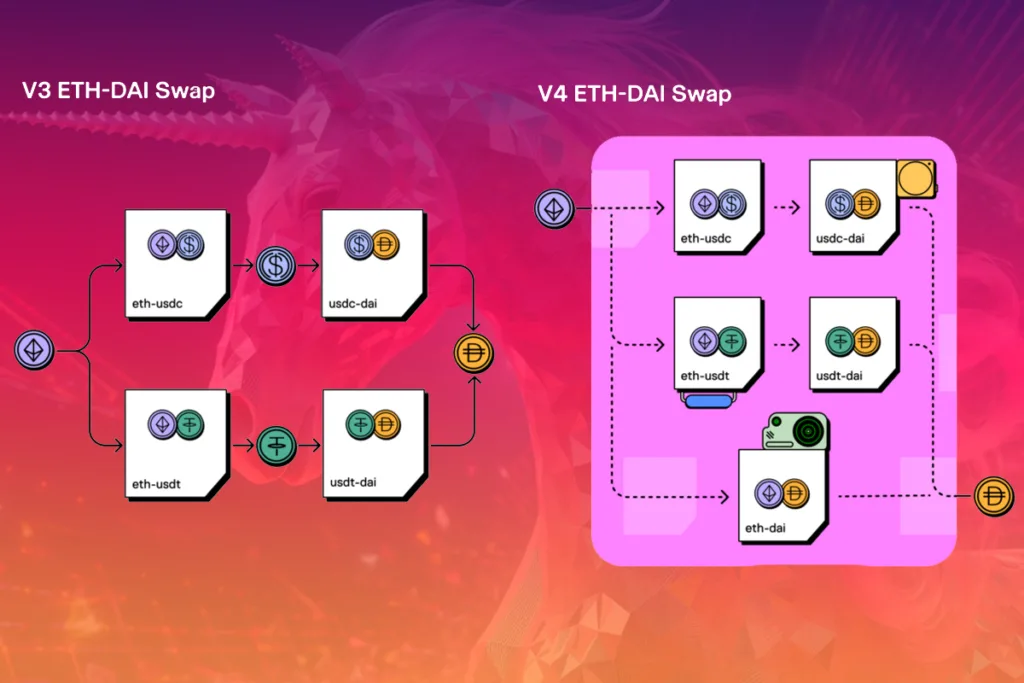

Uniswap V4 has brought significant changes to its architectural design by replacing the Factory/Pool model with the Singleton mode. In the original version, each liquidity pool was independently deployed through the Factory contract, resulting in multiple contracts being involved in multi-step transactions. For example, when transferring ETH to DAI, it might require interactions with ETH-USDC and USDC-DAI contracts from two different liquidity pools.

In the new Singleton contract, all liquidity pools are consolidated into a single contract, enabling the completion of multi-step transactions through contract interactions.

This consolidation reduces the gas fees required for transactions, as swaps no longer need to transfer tokens between pools held in separate contracts. Initial estimates indicate that v4 reduces pooling gas costs by 99%. Hooks offer a vast array of possibilities, and the singleton allows for efficient routing across all of them.

The singleton is accompanied by a new “rapid accounting” system. Unlike in v3, where assets were moved in and out of the pool after each swap, this system only transfers the net balance, resulting in a much more efficient process that saves additional gas in Uniswap V4.

Moreover, the singleton employs a “flash accounting” system introduced by Uniswap Labs. This system further reduces gas costs for trading on the DEX by transferring only the net balance of tokens out of a pool upon the completion of a swap.

This differs from Uniswap V3, where all assets involved in a trade were transferred in and out of a pool during the swap process. In Uniswap V4, each operation updates only one “internal net balance” and postpones external transfers until the end. This simplifies multi-step transactions, adds liquidity and complexity to atomic transactions, and reduces gas fees.

Furthermore, the upcoming Ethereum upgrade in Cancun will incorporate EIP-1153, introducing “temporary” storage that eliminates the need for an account to update its memory temporarily every time the balance changes. This change further reduces gas fees incurred by transactions.

Admin Mechanism

Uniswap V4 introduces a new governance mechanism that enables transaction fees and liquidity pool withdrawals. This governance system allows for the distribution of these fees to reward users and developers who contribute to the Uniswap ecosystem.

This feature can be particularly useful in hook contracts, as it enables the hook contract developer to charge fees to liquidity providers (LPs).

However, considering Uniswap’s current slow progress in implementing transaction fees, if fees were to be charged, the developer income would be calculated first. This portion of the fee is relatively low compared to the value of the UNI tokens held by the users.

The Uniswap V4 update brings significant improvements to Uniswap’s competitiveness by introducing functions such as TWAMM, order limits, dynamic fees, liquidity deposit into loan contracts, and automatic rollover of processing fees.

This update will have broad implications for Uniswap itself and the decentralized finance (DeFi) space as a whole. Additionally, the new architecture allows for significantly reduced gas fees for liquidity providers and traders.

Ultimately, V4 aims to make Uniswap a more user-friendly protocol to adopt. Uniswap V3 has been challenging to build upon due to its limited expressive capabilities and the complexities of managing centralized liquidity positions.

With the inclusion of hooks and singletons, it becomes easier to develop and utilize liquidity in V4 compared to V3. This opens up exciting opportunities for new applications and is expected to foster innovation in DeFi, which is much needed in the industry.

Overall, Uniswap V4 is an anticipated upgrade that will propel the development of DeFi and bring excitement to the space, despite its release being scheduled for a later time. It is set to bring joy to the DeFi community once again.

To access more crypto news: cryptodataspace.com

Leave a comment