Top Trader Eyes Avalanche Over Solana: Is AVAX Primed for a Major Breakout?

In a bold move that has captured the attention of the crypto community, a prominent trader has announced that he is ready to exchange his Solana holdings for Avalanche, should a key signal emerge on the AVAX chart. Both Solana (SOL) and Avalanche (AVAX) rank among the most popular layer-1 blockchain platforms, making this potential trade a significant indicator of the growing competition and volatility within the crypto market.

As of today, AVAX is trading at $28.65, up 2.8% over the past 24 hours. The token briefly surged to $29.26 in the early hours of October 21 before experiencing a minor pullback. The Avalanche price chart remains bullish, with projections suggesting a potential 20%+ upside.

Is AVAX Price Set for a Rally?

Greeny, a well-known trader on X, has been closely monitoring Avalanche’s price action and is contemplating swapping his SOL for AVAX if the asset “breaks out and demonstrates strength.”

I personally would swap $SOL into $AVAX if this breaks up and shows strength.

— Greeny 🇦🇺 (@greenytrades) October 20, 2024

Break up = Hold AVAX

Continue down = Hold SOL

This has been a downtrend for 2 years. In other words AVAX has gone down 83% against SOL.

If we break up, I’d swap some SOL for Avax. https://t.co/SEpjaeobwE pic.twitter.com/eZzOzTeCTB

Over the past two years, AVAX has been underperforming against SOL, down 83% in comparison. However, a reversal could trigger a substantial price surge for AVAX.

The likelihood of a turnaround has increased following the recent announcement of Avalanche9000, a network upgrade designed to deliver near-instant transaction finality, reduce costs, and improve overall network efficiency. Additionally, Avalanche has secured a strategic partnership with Colombian bank Littio, which plans to migrate its Yield Pots platform from Ethereum to Avalanche.

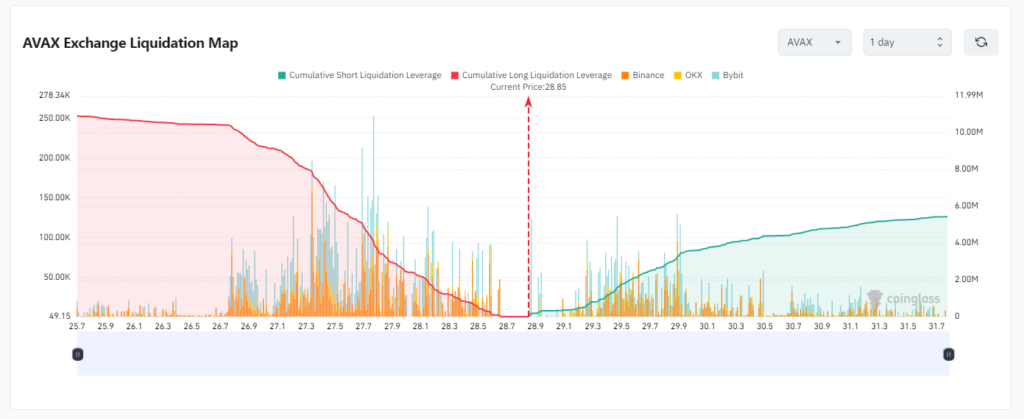

Further supporting a bullish outlook, Coinglass Liquidation Map data reveals that long positions on Avalanche are significantly larger than short positions, with $10.88 million in longs compared to $5.42 million in shorts. Most long positions are concentrated between $27.3 and $27.7, creating solid support in the $26.7 to $28.1 range. In contrast, the short positions are more cautious and spread across smaller, low-leverage trades, indicating a conservative approach to betting against AVAX.

Avalanche Price Prediction: Targeting $35

Avalanche’s price is currently moving within an ascending channel, often signaling the continuation of an uptrend until a breakout or breakdown occurs. With the current price nearing $29, AVAX is approaching the upper resistance of the channel around $35, suggesting a potential 22% gain if the price reaches the upper boundary at $35.25.

Key Support and Resistance Levels:

- $27-$28 Range: This zone offers strong support, reinforced by the lower boundary of the ascending channel and the 50-day EMA (green line) acting as dynamic support.

- $30: The first key resistance level, with the next target at $35, which marks the channel’s upper boundary.

If the bullish momentum continues, AVAX could first aim for $30, followed by a push to $35. However, failure to surpass $30 may lead to a retest of the $27 support level (200-day EMA). A breakdown below this level could invalidate the current bullish trend, potentially shifting market sentiment towards a more bearish outlook.

Leave a comment