Crypto News – With around $4.8 billion in January inflows, BlackRock and Fidelity‘s spot Bitcoin exchange-traded funds (ETFs) rank among the ETFs with the highest monthly flows.

BlackRock and Fidelity Top 10 in January ETF Flow List

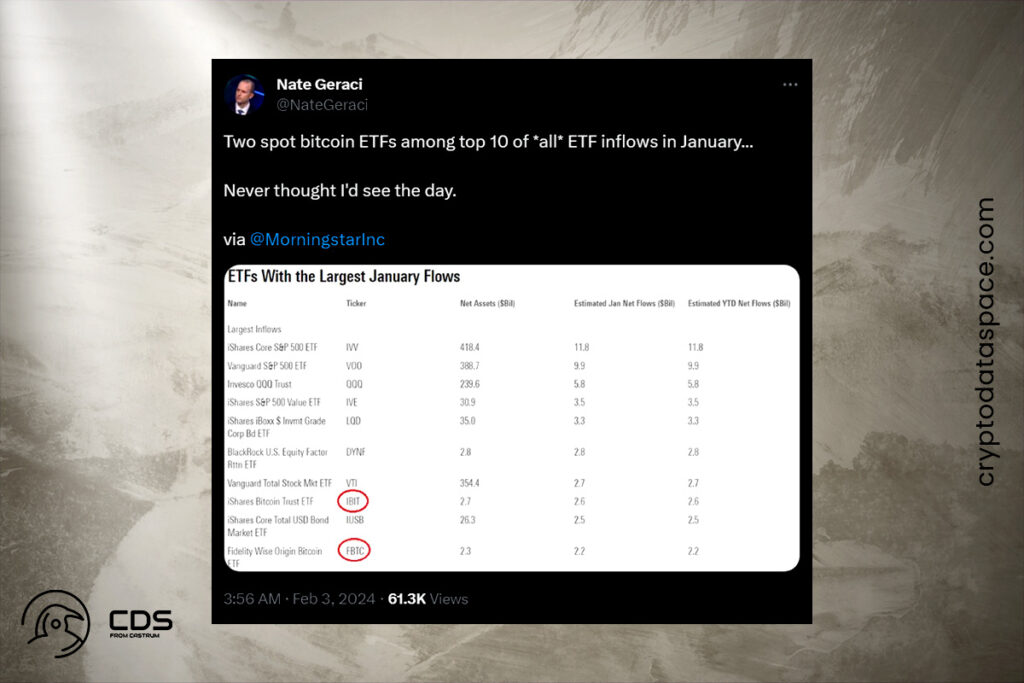

According to a report published on February 3 by Morningstar research analyst Lan Anh Tran, using approximate data from the issuer’s websites, BlackRock’s iShares Bitcoin Trust (IBIT) ranked eighth with estimated net flows of $2.6 billion, while the Fidelity Wise Origin Bitcoin ETF (FBTC) came in at number ten with net flows of $2.2 billion. Additionally, the statistics revealed that the Grayscale Bitcoin Trust (GBTC), with an estimated net outflow of $5.7 billion during the month of January, had the second-highest withdrawals among all ETFs.

Never thought I’d see the day,

Nate Geraci, the president of ETF Store

ETFs Experienced Net Inflows of $715 Million in the Last 6 Days

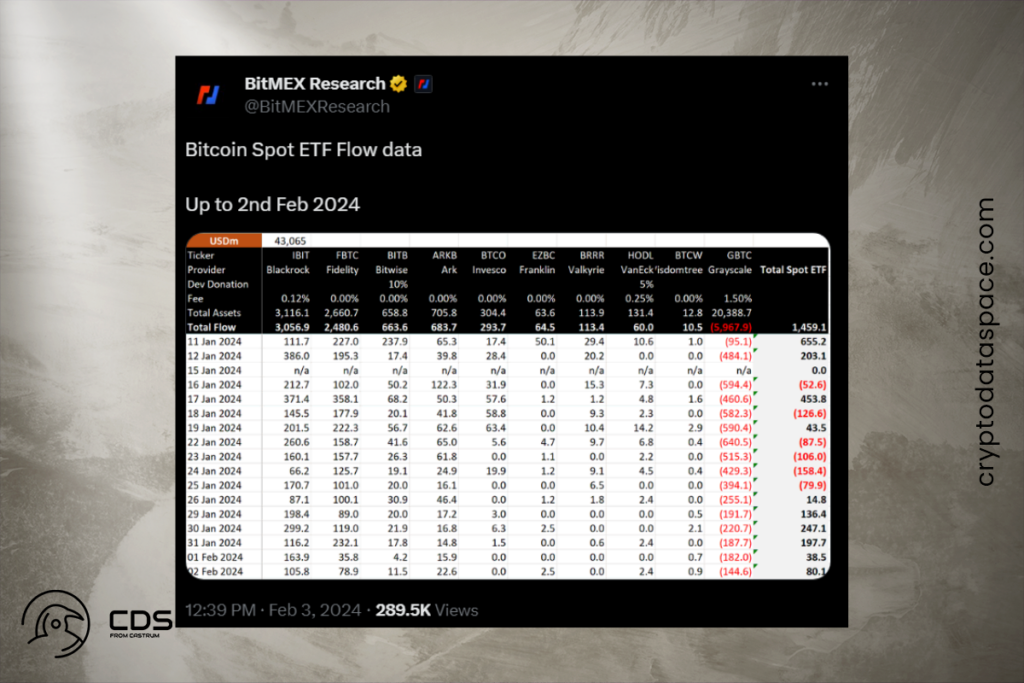

According to data published to X on February 3 by BitMEX Research, the majority of the almost $715 million in net positive inflows that U.S. spot Bitcoin ETFs have seen over the past six days came from the funds of BlackRock and Fidelity. This news coincides with the release of Morningstar’s research.

During the week of January 26–February 2, there were more inflows into the nine new spot Bitcoin funds than outflows from GBTC. On February 2, the ETF experienced its second-lowest outflow day, totaling $144.6 million. After a four-day outburst that peaked between January 22 and 25, during which $431.8 million net left the 10 ETFs, there was a six-day streak of inflows.

Leave a comment