Crypto News – The number of stablecoins available on Ethereum has been progressively declining, according to recent research by Sixdegree Lab. It decreased by 34% from its peak of $100 billion to $66 billion.

The Value of Stablecoins on Ethereum dropped by 34%

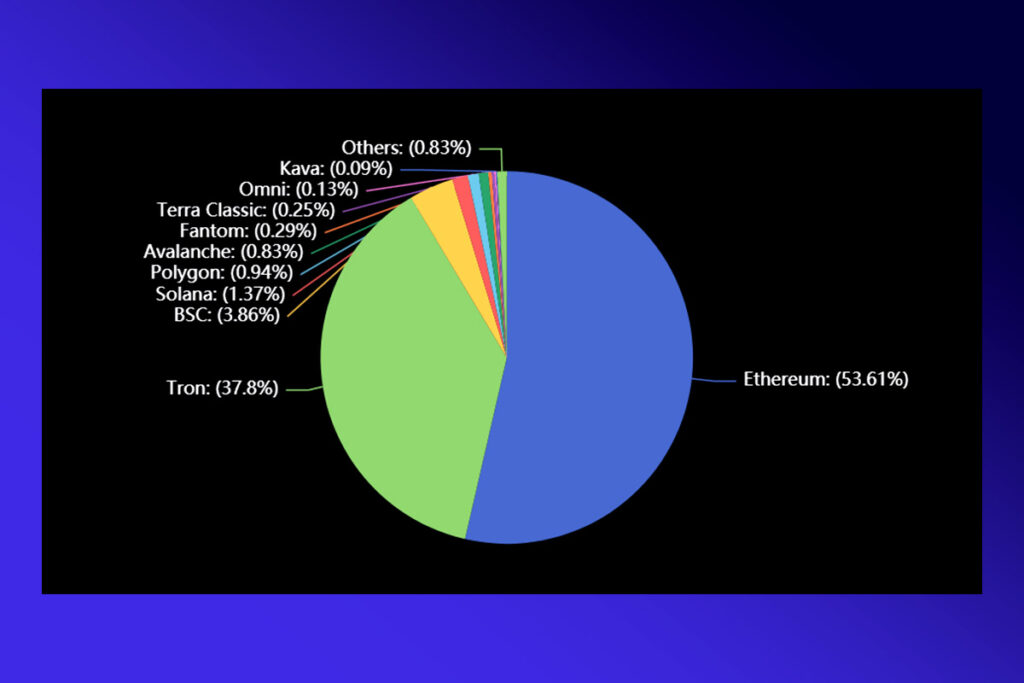

Comparatively, Tron’s stablecoin supply has increased steadily, rising from $31 billion in 2022 to $48.9 billion at present. This noteworthy 56.7 percent gain is consistent with the general trend in market prices. Although there has been a recent bull market, stablecoins‘ aggregate value has not increased much. A 31% decrease from its peak value of $188 billion is evident in the current overall market value of stablecoins, which is $129.5 billion.

Stablecoin Amount in Ethereum DeFi Protocols Also Decreased

DAI (5.07%), USD Coin (USDC) (30.5%), and Tether (USDT) (56.3%) are the three stablecoins with the largest market shares. The total market capitalization of these three stablecoins is $40.03 billion, $21.7 billion, and $3.6 billion, respectively. 30% of stablecoins are held on centralized exchanges (CEXes), while roughly 50% are held by externally owned accounts (EOAs). DeFi protocols, on the other hand, have significantly decreased from their peak of over 25% in January 2022 to now holding about 5.5% of stablecoins.

The rise of Ethereum Layer2 solutions could be the reason for the decline in stablecoin supply inside DeFi protocols on Ethereum. An environment that is more conducive to the development of DeFi and novel protocols has been made possible by these Layer 2 solutions. Among Ethereum stablecoin investors, the majority (94.2%) own less than $1,000 worth of tokens, making up just 9.28% of total stablecoin holdings. Conversely, accounts with more than 100,000 stablecoins account for around 0.562% of all addresses, yet they possess a sizeable 87.6% of all stablecoins.

Leave a comment