Crypto News – Since its introduction last week, the massive investment firm BlackRock’s Ethereum-based BUIDL fund has raised $245 million in Ethereum tokens.

The First Week of BUIDL: BlackRock’s Fund Raises $245 Million in 7 Days

Ten transactions have entered the BlackRock USD Institutional Digital Liquidity Fund, starting with $5 million on March 20, the day the fund started, according to statistics from Etherscan. An additional $239.8 million, including $92 million in Ondo Short-Term US Government Treasuries from the tokenized real-world asset platform Ordo Finance, poured into the ERC-20-based fund over the course of the following seven days.

We’re excited to see BlackRock embracing securities tokenization with the launch of BUIDL, especially its broad cooperation with ecosystem participants. Not only does this further validate our original concept of a tokenized US Treasury fund, but it also bolsters our thesis that tokenization of traditional securities on public blockchains represents the next major step in the evolution of financial markets.

Ordo Finance blog post

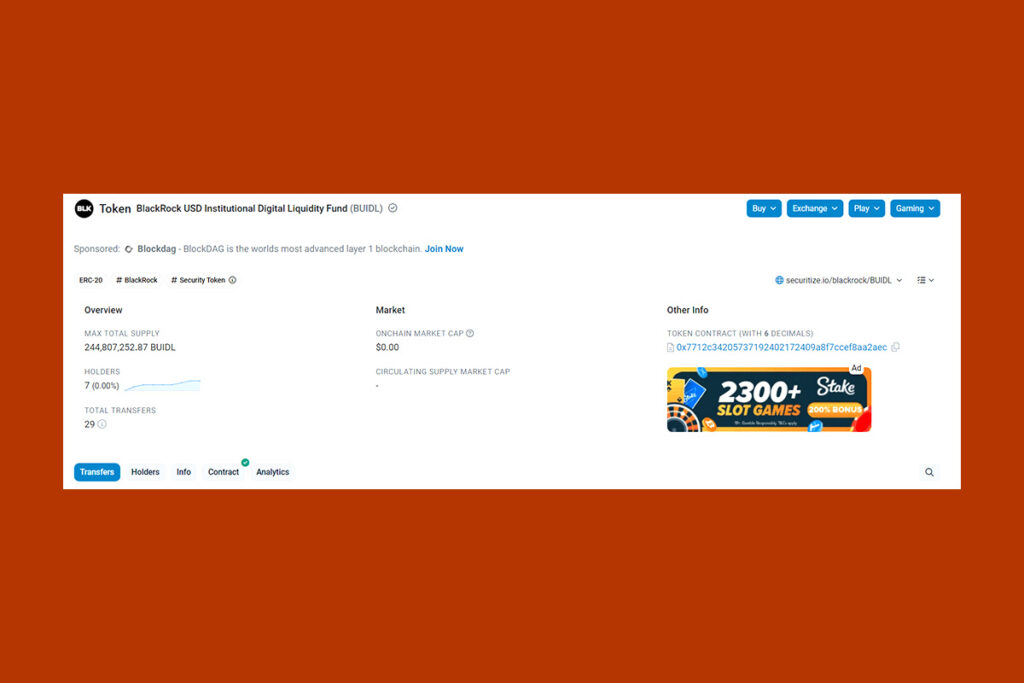

BUIDL Ranks Second According to Data from Real-World Assets Platform

BlackRock states that although BUIDL is not a stablecoin like USDT or USDC, its value is meant to be fixed at $1 for every US dollar, or 1 BUIDL for every $1. According to BlackRock, the fund uses cash, US Treasury notes, and repurchase agreements to invest all of its assets.

The Franklin OnChain U.S. Government Money Fund, managed by Franklin Templeton, has a market value of $360.2 million, making BlackRock’s BUIDL the second-ranked fund, according to information from the Real-World Assets (RWA) platform.

Leave a comment