Terra Luna Classic Faces Pressure But Holds Potential for a 480% Surge, Analyst Predicts

Terra Luna Classic (LUNC) has struggled to gain traction recently, declining by 10.95% from its weekly high and trading at the critical psychological support level of $0.00010. Despite this bearish momentum, a prominent crypto analyst anticipates a significant rally, projecting a potential 480% increase in its value.

Analyst Offers a Bullish Outlook for Terra Luna Classic

While major cryptocurrencies like Bitcoin and Solana have seen their values more than double this year, Terra Luna Classic remains in a prolonged bear market. The token has plummeted over 60% from its yearly peak as market demand continues to wane.

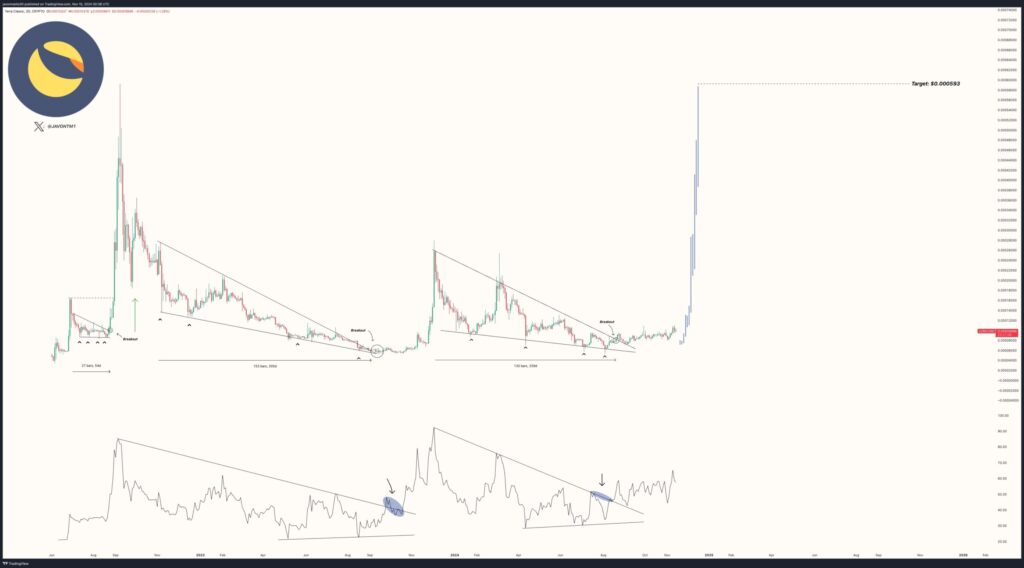

However Javon Marks, a reputable crypto analyst known for accurate forecasts, believes LUNC has untapped growth potential. Marks predicts the token could surge to $0.000593, representing a staggering 480% increase from its current price.

His optimism stems from LUNC’s historical performance and recurring falling wedge patterns—a technical formation often signaling bullish breakouts. Marks notes that the token has already experienced three significant falling wedge patterns, all culminating in upward momentum. If history repeats itself, LUNC could retest $0.000593, inching closer to its all-time high of $0.000064.

A falling wedge is a chart pattern characterized by two descending, converging trendlines. A breakout typically occurs when the price nears the point of convergence, signaling bullish potential.

Key Catalysts for a Terra Luna Classic Rally

Several factors could support LUNC’s anticipated price recovery.

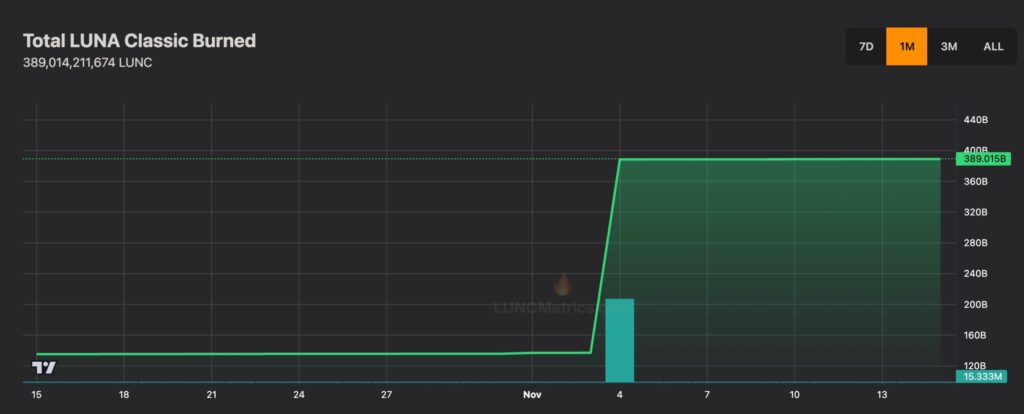

- Burn Rate Acceleration: Over 389 billion LUNC tokens have been burned since the token’s inception. A notable spike in the burn rate occurred when Terraform Labs closed the Shuttle Bridge as part of its bankruptcy proceedings.

- Crypto Market Momentum: A sustained bullish trend in the broader cryptocurrency market could lift LUNC alongside other altcoins.

Technical Analysis Signals Potential Upside

LUNC’s technical indicators point toward bullish momentum. On the daily chart, the token is trading within an ascending regression channel and finding support at the 50-day and 100-day moving averages.

Additionally, the Market Value to Realized Value (MVRV) Z-score, a key metric assessing whether an asset is over or undervalued, has risen to 2.7—its highest level since April. While this could indicate overvaluation, analysts argue that LUNC still has room to climb before hitting $4.6, its annual peak.

A breakout above the upper boundary of the ascending channel at $0.00010 could confirm further gains, potentially pushing LUNC to $0.00013—a 33% increase from current levels.

However, a drop below $0.000085, the lower end of the channel, would invalidate the bullish outlook and open the door for a potential decline to $0.000053.

While Terra Luna Classic remains under pressure, its technical patterns and ongoing token burns offer a promising case for a strong recovery. With favorable market conditions and a bullish breakout, the token could achieve the significant gains forecasted by analysts. Still, investors should remain cautious, watching key levels closely to confirm the next trend direction.

FAQs About Terra Luna Classic (LUNC) Price Forecast

Why has Terra Luna Classic (LUNC) been under pressure recently?

LUNC has been facing selling pressure, declining by 10.95% from its weekly high due to weakened market demand and broader bearish sentiment in the cryptocurrency market.

What is the current price level of LUNC, and why is it significant?

LUNC is trading at approximately $0.00010, a critical psychological support level. This level is important as it could determine whether the token consolidates or continues its downward trend.

What is the bullish price prediction for LUNC?

Crypto analyst Javon Marks predicts that LUNC could rise by 480% to reach $0.000593, citing historical patterns and technical indicators like the falling wedge formation.

What is a falling wedge, and how does it relate to LUNC price?

A falling wedge is a chart pattern characterized by two converging downward-sloping trendlines. It often indicates a bullish breakout when the price nears the point of convergence. LUNC has formed multiple falling wedges in the past, all of which resulted in significant upward moves.

What are the key factors that could drive LUNC’s price higher?

Two main catalysts could support a price increase:

Burn Rate Acceleration: Over 389 billion LUNC tokens have been burned, reducing supply and potentially increasing scarcity.

Market Momentum: A continued bullish trend in the cryptocurrency market could lift LUNC along with other altcoins.

What technical indicators support the bullish outlook for LUNC?

LUNC is trading within an ascending regression channel and is supported by the 50-day and 100-day moving averages. Additionally, its Market Value to Realized Value (MVRV) Z-score indicates room for further growth despite nearing historical highs.

What are the key resistance and support levels for LUNC?

The key resistance level is at $0.00013, while the primary support level is $0.000085. A break above $0.00013 could confirm further gains, while a drop below $0.000085 could invalidate the bullish outlook and lead to a decline toward $0.000053.

How does the LUNC burn mechanism affect its price?

The token burn mechanism reduces the circulating supply of LUNC. A higher burn rate can create scarcity, which, in turn, may drive demand and push the price higher.

How does LUNC compare to other cryptocurrencies like Bitcoin and Solana?

While Bitcoin and Solana have more than doubled in value this year, LUNC remains in a bear market, down over 60% from its yearly high. This underperformance highlights its dependence on unique catalysts like burn rates and technical breakouts.

Is LUNC a good investment based on the current forecast?

The forecast suggests strong potential for gains if the bullish breakout materializes. However, as with any cryptocurrency investment, LUNC carries significant risk and requires careful monitoring of key price levels and market trends.

Leave a comment