Sygnum Report- Solana vs. Ethereum: The Future of Asset Tokenization

Sygnum Report– Financial institutions looking to implement real-world asset tokenization platforms and stablecoins on Solana may find themselves in a position to seriously challenge Ethereum over the long term, according to a recent report by Swiss crypto bank Sygnum.

Solana’s Advantages Over Ethereum

The report, published on October 1, highlights a growing trend among even conservative institutions that might favor Solana’s scalability over Ethereum’s traditional stability and security advantages. An executive from PayPal recently remarked at a Solana event that Ethereum is not the best solution for payments, underscoring the potential for Solana in the payments space. Additionally, competitor Visa has integrated Solana for USD Coin (USDC) settlements, praising its high throughput and low costs.

Notably, asset manager Franklin Templeton has announced intentions to launch a mutual fund on Solana, while Citi is reportedly exploring Solana for cross-border payment solutions. Despite these developments, Sygnum pointed out that a significant market cap gap still exists between Ether (ETH) and Solana (SOL), with Ether currently valued at around $218 billion more than Solana, according to CoinGecko data.

Challenges and Criticisms Facing Solana

Sygnum also raised concerns about the accuracy of some of Solana’s volume metrics, suggesting that a large portion of the network’s revenue is driven by the issuance and trading of memecoins. Additionally, former US intelligence contractor Edward Snowden has criticized Solana for its centralized nature, claiming that anything significant built on the network could easily face disruption if states choose to act against it.

Despite these criticisms, Ethereum remains the dominant player in both the real-world asset tokenization and stablecoin markets, holding an 81% and 49% market share, respectively. In contrast, Solana has less than 3% of each market segment.

Current Performance and Future Outlook

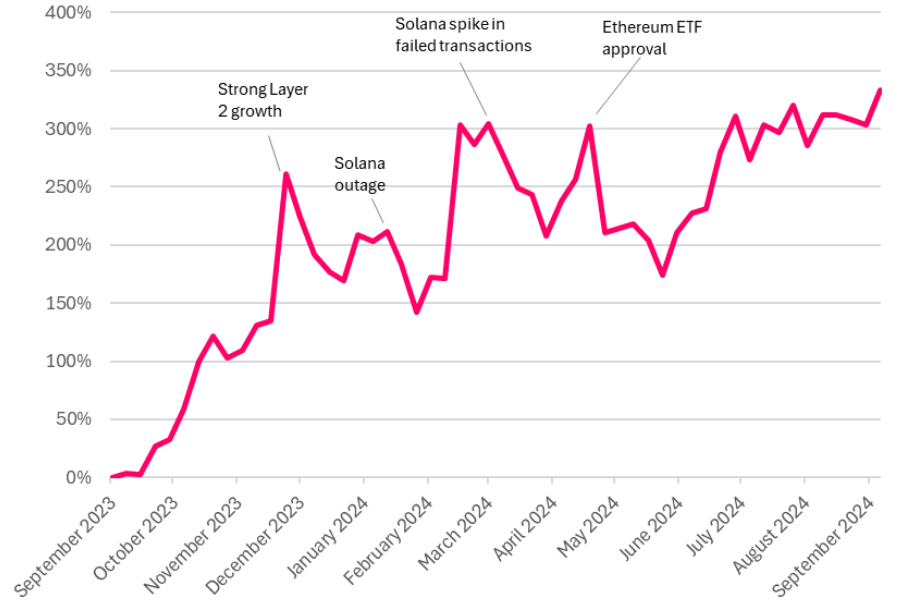

Sygnum’s report noted that the Solana-to-Ether price ratio has surged by 300% year-on-year and 600% since the beginning of 2023. However, the report cautioned that Ether may be poised for a “sharp reversal” following two years of significant underperformance and negative market sentiment.

While Ethereum’s technical roadmap can be perplexing, Sygnum argued that Ether is easier for traditional investors to evaluate than Bitcoin (BTC). The bank explained, Ether derives most of its value from economic activity on the network and from the resulting revenues. [It] is more akin to an equity investment where growth, profits, and cash flows are evaluated – this is more relatable for traditional investors than the digital gold concept.

Moreover, the risks associated with the US securities regulator classifying Ether as a security have substantially decreased after the regulator closed its investigation into Ethereum in June. In contrast, many industry executives believe that Solana is still viewed as a security by the US regulator.

In conclusion, Sygnum stated, Ultimately, for Solana to successfully challenge Ethereum in the long run, it needs to shape future technological cycles and become the birthplace of groundbreaking decentralized applications that capture the market’s imagination and drive widespread adoption.

Sygnum claims to be the world’s first digital asset bank and manages approximately $4.5 billion in client assets, with hubs located in Zurich, Switzerland, and Singapore.

FAQs

What advantages does Solana have over Ethereum in asset tokenization?

Solana offers significant scalability, which can be appealing for financial institutions looking to implement real-world asset tokenization platforms. Its lower transaction costs and high throughput make it suitable for payment processing, as noted by Visa’s integration of Solana for USD Coin settlements.

What challenges does Solana face in competing with Ethereum?

Despite its advantages, Solana faces several challenges, including criticisms about its centralized nature and concerns regarding its market metrics. Additionally, it currently holds less than 3% of the market share for both real-world asset tokenization and stablecoins, while Ethereum dominates these markets with 81% and 49% shares, respectively.

Leave a comment