Stolen Funds from Magnate Finance Scam Traced to BNBChain, Raising Concerns in Cryptocurrency Community

Crypto News – A vigilant member of the cryptocurrency community has unearthed a shocking revelation within the Magnate Finance scam, causing ripples of shock throughout the digital currency landscape.

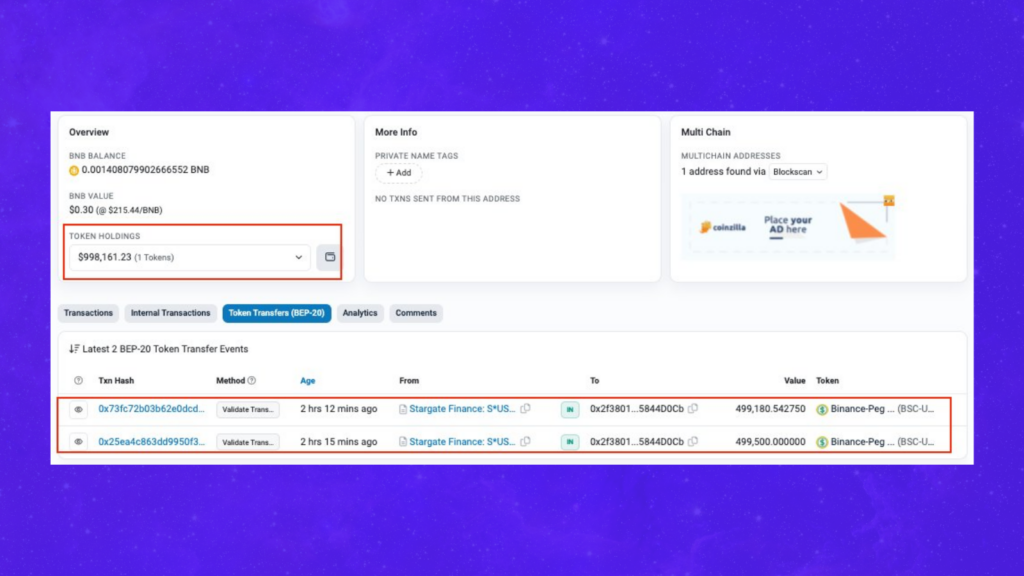

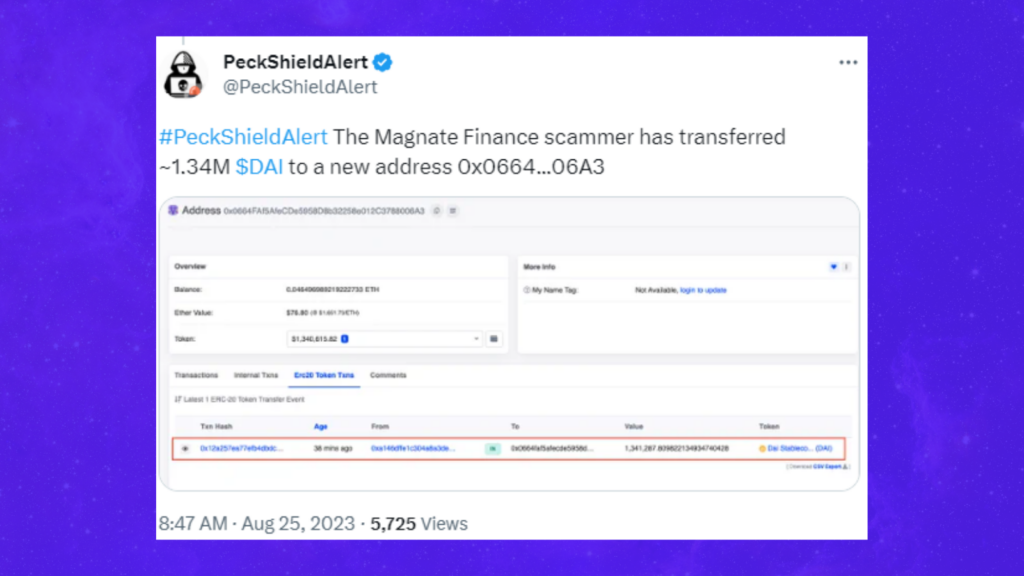

Recent developments have exposed that the elusive perpetrator behind the Magnate Finance scheme has successfully funneled around $1 million worth of pilfered assets into the BNBChain blockchain.

The Magnate Finance saga has become a cautionary tale within the realm of crypto, marked by its audacious heist of investor funds. The community’s unrelenting pursuit of justice has led to this latest breakthrough, as an observant participant stumbled upon a series of transactions that seem to trace back to the scammer. Swift verification of these findings has sparked concerns regarding the security and authenticity of certain cryptocurrency platforms.

The siphoning of stolen funds into BNBChain, a blockchain notably associated with Binance Coin (BNB), has raised questions about the susceptibility of the network to such illicit endeavors. This incident underscores the pressing need for heightened vigilance and enhanced security measures across the cryptocurrency ecosystem, given scammers’ growing adeptness at exploiting technicalities.

Renowned experts within the industry are now advocating for more stringent regulations and bolstered security protocols throughout exchanges and blockchain networks. This occurrence also accentuates the significance of collaborative efforts between communities, contributors, and blockchain platforms to promptly identify and counter fraudulent activities.

The findings have been promptly communicated to law enforcement agencies and cybersecurity firms, with the optimistic anticipation that they can trail and apprehend the scammer responsible. This event serves as a stark reminder that while cryptocurrencies offer immense potential, they also open avenues for criminal elements to capitalize on the absence of regulatory oversight.

1 Comment