What Factors Contributed to the Low Stablecoin Trading Volume?

June had the lowest stablecoin trading volume on centralized exchanges (CEX) in seven months, according to a new analysis by CCData. This decrease represents the third month in a row that trading volumes have decreased.

The investigation conducted by CCData indicates a notable decline in stablecoin trading volumes. The amount fell to $97 billion in June, an 18.0% decline. For the ninth consecutive month during the reporting period, however, the total market capitalization of stablecoins increased.

- According to the research, the market capitalization of stablecoins climbed to $161 billion, a month-over-month increase of 0.53%.

- Though the growth pace has slowed since May, the amount represents the biggest stablecoin market capitalization since April 2022.

Despite All the Negativity, Coinbase Sees a Bright Future for Stablecoins

Moreover, stablecoins’ market share rose from 6.22% in May to 6.83% in June, according to CCData. Investors pulling out of riskier digital assets like Bitcoin and Ethereum in favor of stablecoins, which are comparatively safe in an unpredictable market, are thought to be the cause of this growth.

- The top stablecoin by market capitalization, Tether USD (USDT), continued to rule in June. In comparison to May, USDT’s market capitalization grew by 0.97%. During that time, it had a sizable market share of 70.0%.

- The notable monthly growth rates of other stablecoins, like Ethena’s USDe, have attracted notice. For the past six months, USDE’s market capitalization has increased, jumping by 21.2% in June alone.

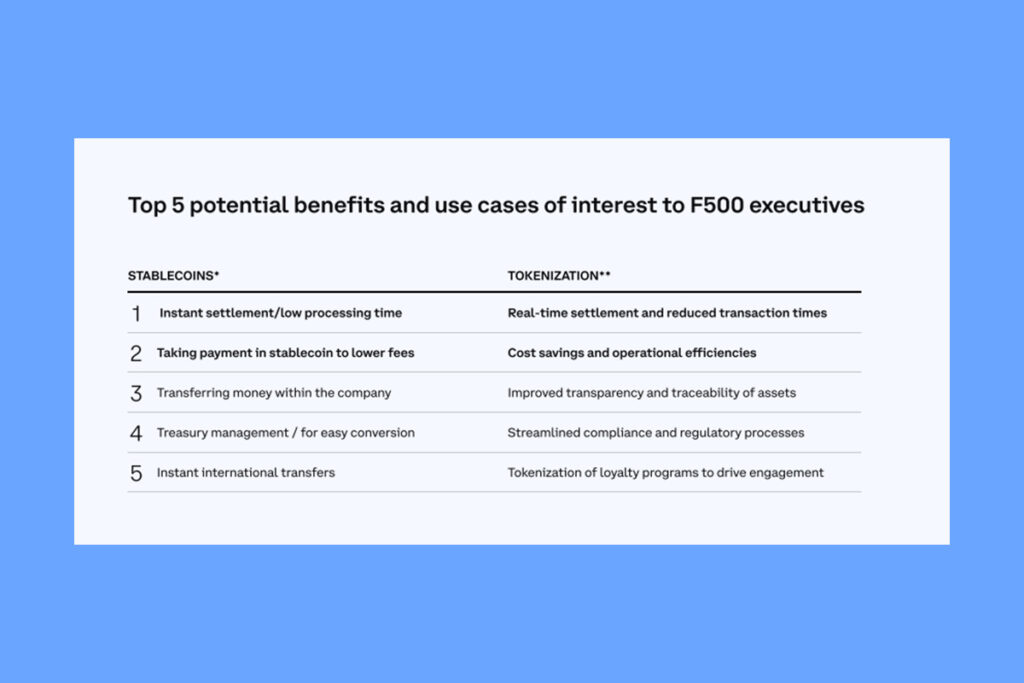

The reduction in trading volumes is indicative of more market uncertainty, even in spite of an overall growth in the stablecoin market value and share. Historically, the Bitcoin halving, which affects trading activity and the behavior of the market as a whole, has coincided with this pattern since April. Long-term prospects, however, are bright for the stablecoin market, according to Coinbase research from June. Particularly in cross-border transactions, the paper emphasizes the growing interest in and utility of stablecoins.

FAQ

What Impact Will the Drop in Stablecoin Trading Volume Have on Other Cryptocurrencies?

The drop in stablecoin trading volume may lead to a decrease in liquidity and trading volume in other cryptocurrencies. This could affect market dynamics and price movements.

Is the Decline in Stablecoins Trading Volume Long-term?

It can be difficult to determine whether the decline in stablecoins trading volume is long-term. Market conditions, regulatory developments, and investor behavior can influence this.

Why is Stablecoins Trading Volume Declining?

Reasons for the decline in stablecoins trading volume could include market volatility, regulatory uncertainty, and changes in investors’ risk appetite.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment