Stablecoin Activity Declines in the US, But Grows Over 60% Globally in 2024

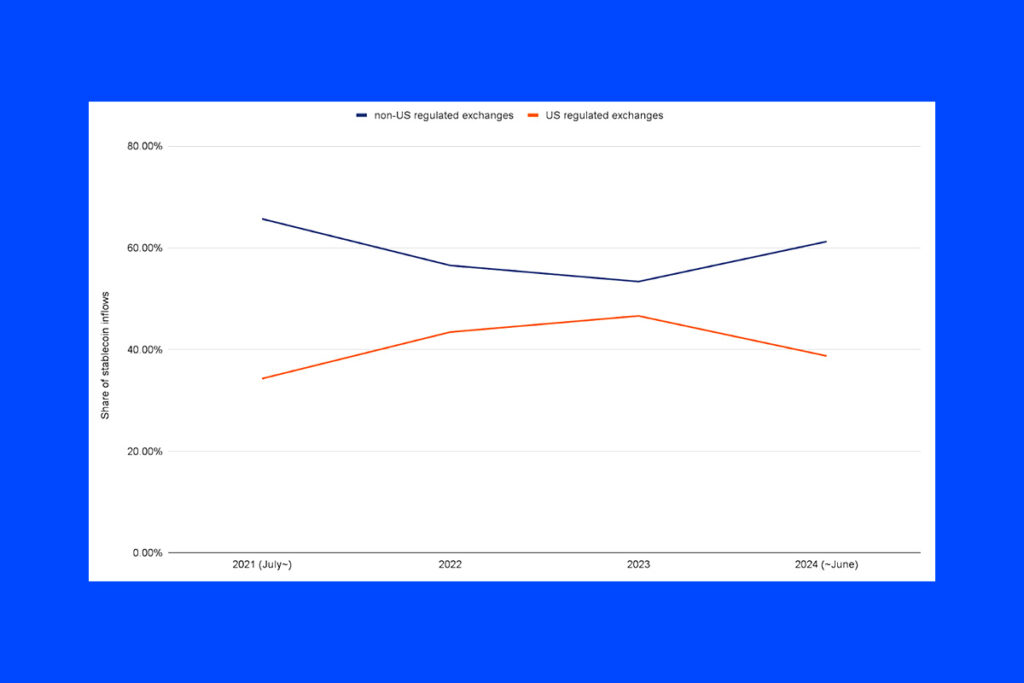

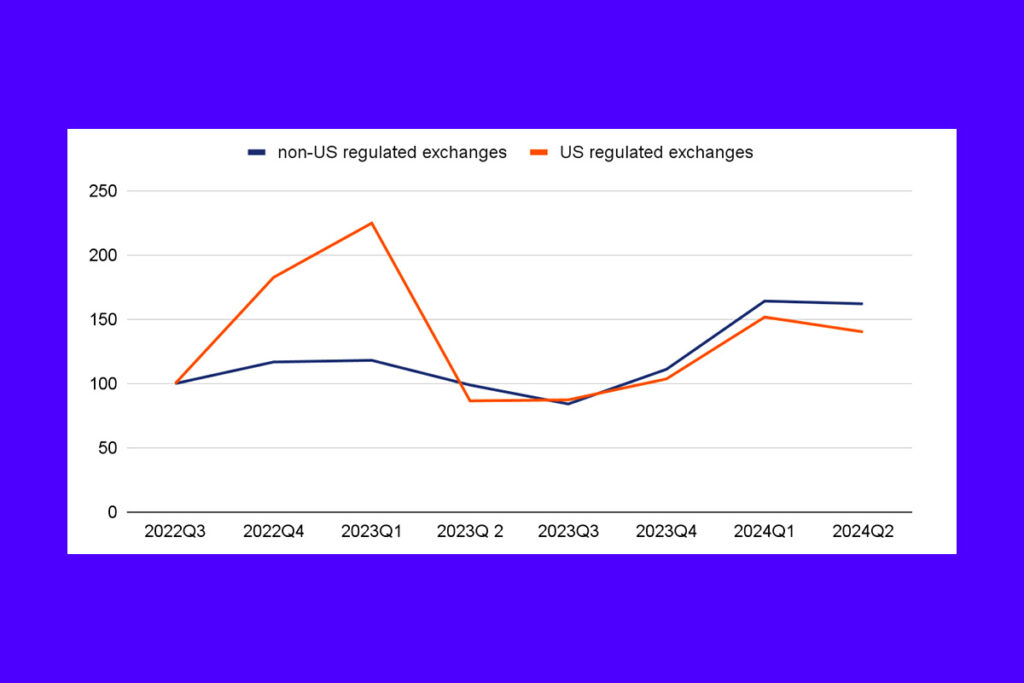

Since spot BTC ETFs were introduced, Bitcoin activity in the US has reached all-time highs. However, according to a Chainalysis analysis released on October 17, stablecoin usage in the US has slowed in 2024 when compared to overseas markets. The percentage of stablecoin transactions on US-regulated exchanges has decreased from almost 50% in 2023 to less than 40% in 2024, reflecting a notable shift in stablecoin activity observed in US markets this year.

However, according to Chainalysis’ most recent analysis on North American crypto adoption trends, the percentage of stablecoin transactions on platforms not governed by the US has increased since 2023 and will surpass 60% in 2024. Chainalysis underlined that the move does not always signify a steep drop in US stablecoin activity but rather the fast-growing significance of stablecoins in non-US jurisdictions and emerging economies.

US Regulatory Uncertainty Slows Stablecoin Adoption as Global Markets Surge

A contributing cause to the global change in stablecoin usage is the growing demand for US dollar-backed assets globally, especially in nations with little access to stable currencies. According to the report, official estimates from the US Federal Reserve indicate that as of late 2022, over $1 trillion in US dollar banknotes, or over half of all US dollar banknotes in circulation, were kept outside of the US.

Another factor that causes the US to lag behind other economies in stablecoin adoption is the regulatory ambiguity surrounding stablecoins and digital assets. Financial centers in Europe and the United Arab Emirates have been able to draw stablecoin initiatives with more hospitable legal frameworks due to the absence of clear crypto legislation in the US, according to stablecoin company Circle.

The absence of a US regulatory framework for dollar-referenced stablecoins represents a threat to American interests,

a spokesperson from Circle

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment