Crypto News – Last week, when bitcoin reached new all-time highs before plunging precipitously, weekly net inflows and trading volume for U.S. spot bitcoin exchange-traded funds reached record highs.

Spot Bitcoin ETF Weekly Inflows Hit $2.57 Billion, Setting a New Record

According to data from BitMEX Research and Farside Investors, net inflows for the ten spot bitcoin ETFs combined reached $2.57 billion last week, up 15% from the $2.24 billion in inflows generated the week before.

IBIT, owned by BlackRock, maintained its lead with $2.48 billion in inflows. With $717.9 million, Fidelity’s FBTC placed second, and VanEck’s HODL, with $247.8 million, took third place. But $1.25 billion was taken out of Grayscale’s converted GBTC fund, and $29.4 million was taken out of Invesco’s BTCO fund as well.

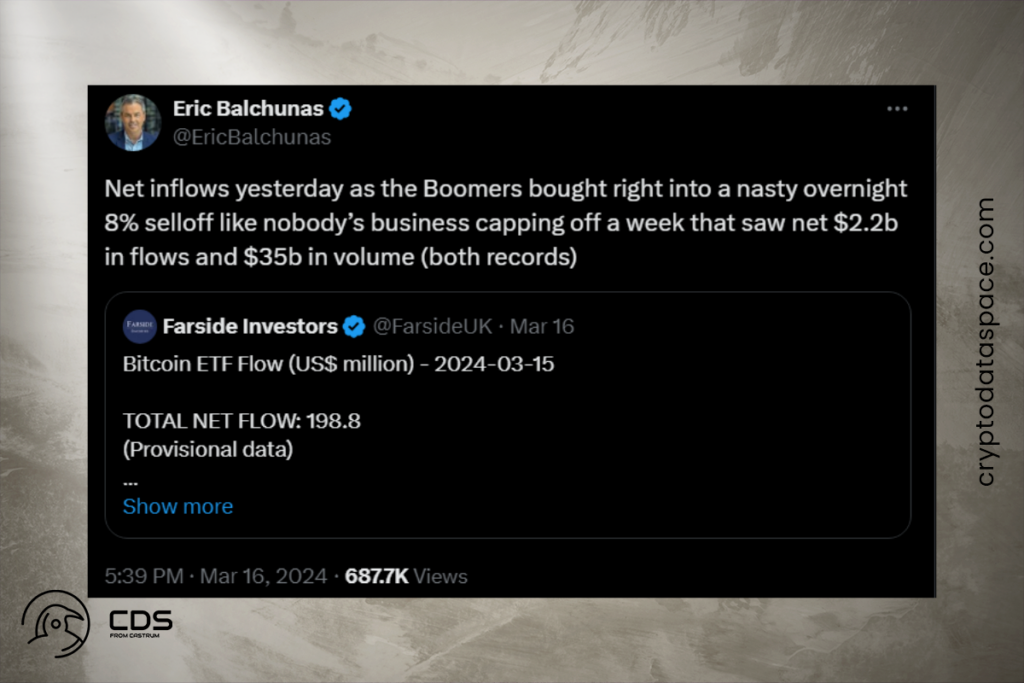

Net inflows yesterday as the Boomers bought right into a nasty overnight 8% selloff like nobody’s business capping off a week that saw net $2.5 billion inflows and $35 billion in volume (both records),

Eric Balchunas

IBIT Maintains First Place in Trading Volume

The total weekly trading volume of the U.S. spot bitcoin ETFs reached a record of $35.1 billion last week, despite the unpredictability of the price movement of bitcoin. The ETFs had 15% more trading volume last week than the $2.24 billion recorded the week before. With a trading volume of $16.17 billion for the week, BlackRock’s IBIT ETF was once again in the lead. The Block’s Data Dashboard shows that the trading volume of GBTC (Grayscale) and FBTC (Fidelity) was $8.24 billion and $6.5 billion, respectively.

At 47%, BlackRock’s spot bitcoin ETF is getting close to 50% of the market share based on trading volume. As for Grayscale, whose higher-fee GBTC fund, as of Friday, has fallen from a 50.5% market share on January 11 to a mere 23.1%.

Leave a comment