Solana (SOL) has emerged as one of the top-performing Layer 1 blockchains, showcasing impressive growth in the cryptocurrency market. Since the beginning of 2024, SOL has consistently broken critical resistance levels, riding a broader market rally and gaining significant momentum. Over the past year, its value has surged by an astounding 330%, reflecting strong bullish sentiment among investors. Analysts now speculate that Solana could target a price of $1,500, as it continues to challenge Ethereum’s dominance across key performance metrics.

Solana Outperforms Ethereum Across Vital Metrics

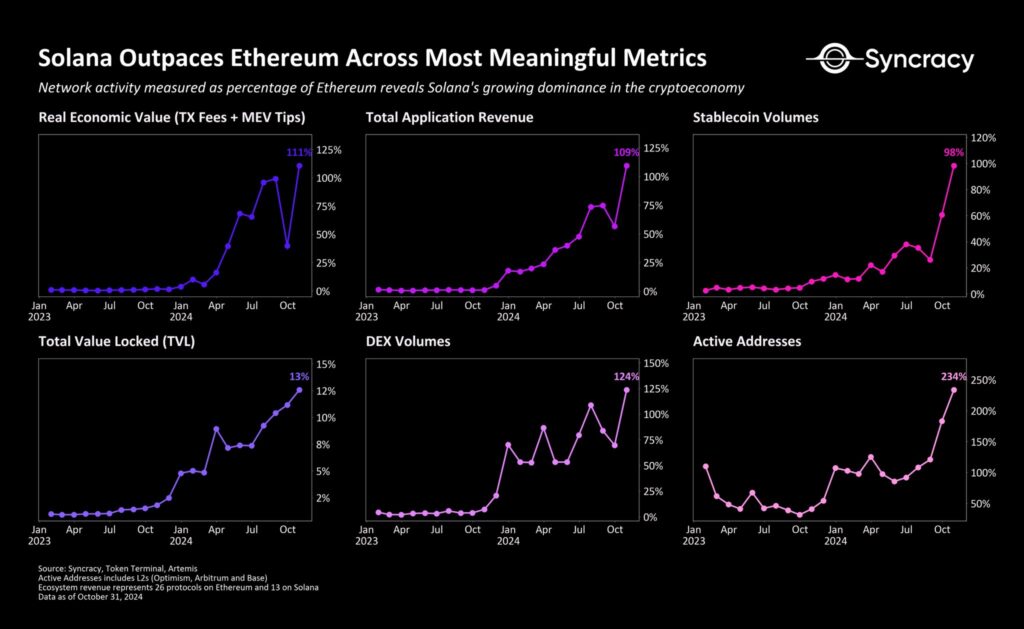

SOL’s recent performance is drawing attention as the blockchain solidifies its position as a formidable competitor to Ethereum. Data reveals that Solana is excelling in crucial metrics such as active addresses, decentralized exchange (DEX) volumes, and total value locked (TVL).

A report from Syncracy highlights SOL’s growing dominance, revealing it has surpassed Ethereum in active addresses with a remarkable 234% share. Meanwhile, Solana’s DEX volumes and stablecoin activity have achieved 124% and 98%, respectively, of Ethereum’s figures, signaling increased adoption and activity within its ecosystem.

Key indicators such as real economic value and total application revenue further underscore Solana’s growth. Real economic value—comprising transaction fees and miner extractable value (MEV) tips—has reached 111% of Ethereum’s level. Additionally, total application revenue has risen to 109%, reflecting the blockchain’s robust network activity and heightened user engagement.

One standout feature of Solana’s strategy is its innovative approach to decentralized physical infrastructure networks (DePIN). This framework enables Solana to expand beyond traditional cryptocurrency applications, offering a competitive edge as Ethereum’s presence in this area remains relatively modest.

In late 2023, Syncracy reported that Solana was significantly undervalued, trading at just 13% of Ethereum’s valuation. Today, Solana commands approximately 33% of Ethereum’s market cap—a marked improvement but one that still leaves ample room for growth.

SOL Price Analysis: Can Solana Reach $1,500?

SOL price has become a focal point in the cryptocurrency market as it maintains its strong upward trajectory. Currently trading around $239, SOL has gained 30% in the past 24 hours, displaying remarkable resilience and consistent upward momentum.

Recent price action indicates that Solana has broken through a key resistance zone near its previous all-time high (ATH) of $260. The cryptocurrency’s long-term ascending trendline, intact since early 2022 lows, further supports the bullish outlook. If this trajectory continues, market analysts believe Solana could achieve its price target of $1,500, marking a substantial increase from its current levels.

The blockchain’s expanding ecosystem reinforces its potential as a long-term winner in the crypto economy. Solana’s ability to rival Ethereum in value creation positions it as a strong contender for market parity. Should the current trends persist, Solana may solidify its role as a major player in blockchain innovation, with its sights firmly set on $1,500.

FAQs About Solana (SOL) Price and Market Performance

What is driving the recent surge in SOL price?

SOL price surge is fueled by its robust ecosystem growth, significant milestones in blockchain performance metrics, and its ability to compete with Ethereum. Key drivers include increasing active addresses, rising decentralized exchange (DEX) volumes, and growing total value locked (TVL).

Why is SOL considered a competitor to Ethereum?

SOL is emerging as a competitor to Ethereum due to its superior performance in various metrics, such as active addresses, transaction volumes, and real economic value. Its innovative approach to decentralized physical infrastructure networks (DePIN) further differentiates it from Ethereum, enabling new use cases and applications.

What is SOL price prediction for the near future?

Analysts predict that Solana could reach $1,500 if its current upward trajectory continues. With its price currently trading around $239, the blockchain shows strong bullish momentum supported by a robust ascending trendline and ecosystem growth.

How does SOL valuation compare to Ethereum’s?

As of now, Solana’s market cap is approximately 33% of Ethereum’s. This represents a significant improvement from late 2023, when it was just 13%. Analysts believe there is still substantial room for growth as Solana continues to expand its market presence.

What are the key metrics where SOL outperforms Ethereum?

SOL outperforms Ethereum in several metrics, including:

Active addresses: 234% of Ethereum’s figures.

DEX volumes: 124% of Ethereum’s levels.

Real economic value: 111% of Ethereum’s performance.

Total application revenue: 109% of Ethereum’s revenue.

What is Solana’s all-time high (ATH) price, and how close is it to breaking it?

SOL all-time high (ATH) price is $260. Recently, SOL has broken a significant resistance zone near this level, signaling a potential move toward higher price targets, including $1,500.

What makes Solana’s ecosystem unique?

SOL’s ecosystem is distinguished by its focus on innovation, particularly its adoption of decentralized physical infrastructure networks (DePIN). This strategy allows Solana to extend its influence beyond traditional blockchain use cases, creating new opportunities for growth.

Is SOL a good investment for the long term?

While no investment is without risk, SOL’s strong performance metrics, innovative ecosystem, and ability to rival Ethereum suggest it has the potential for long-term growth. However, investors should conduct thorough research and consider market volatility before making decisions.

How has SOL’s market cap evolved over time?

In Q4 2023, SOL was valued at just 13% of Ethereum’s market cap. By 2024, it has risen to 33%, reflecting the blockchain’s rapid growth and increasing adoption.

What challenges could SOL face in reaching its $1,500 price target?

Potential challenges include market volatility, competition from other Layer 1 blockchains, and broader economic factors affecting the cryptocurrency market. Despite these risks, SOL’s robust ecosystem and performance metrics provide a strong foundation for further growth.

Leave a comment