Crypto News – According to CoinShares, wealth managers and hedge funds have dramatically increased their holdings to Solana, one of the altcoins that institutional investors appear to be expanding their exposure to.

Solana Institutional Portfolios Dramatically Increase, According to CoinShares Report

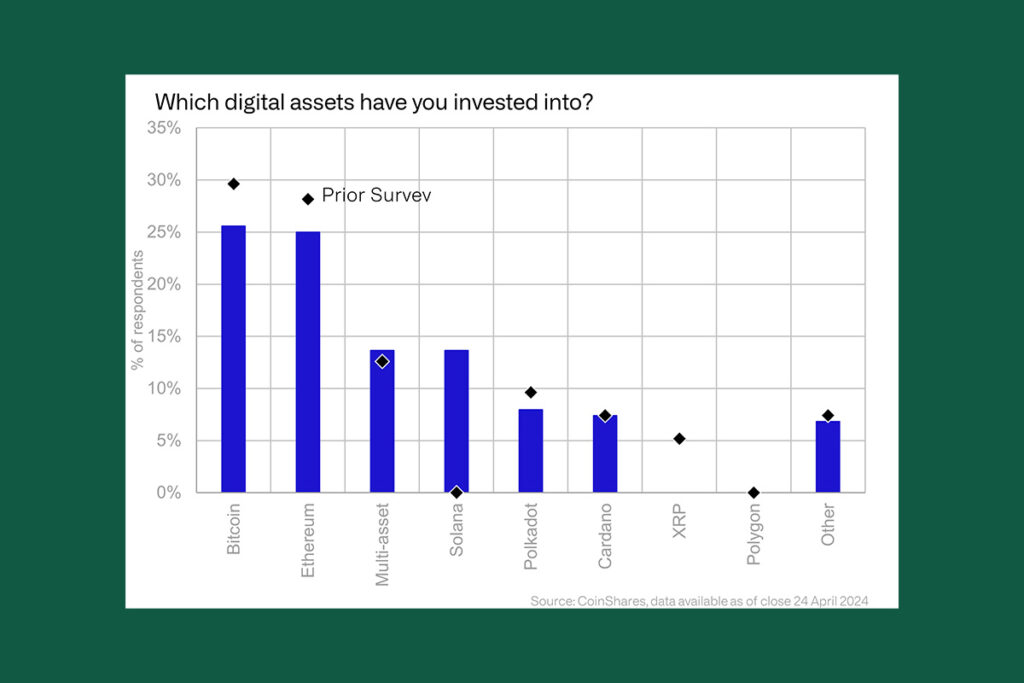

In a report released on April 24, James Butterfill, the head of research at the asset manager, stated that investors have increased their optimism about Solana. The analysis was based on a poll conducted among 64 investors who have assets under control totaling $600 billion. As compared to CoinShares’ January survey, which revealed no respondents had any interest in the altcoin, nearly 15% of investors asked stated they had invested in SOL.

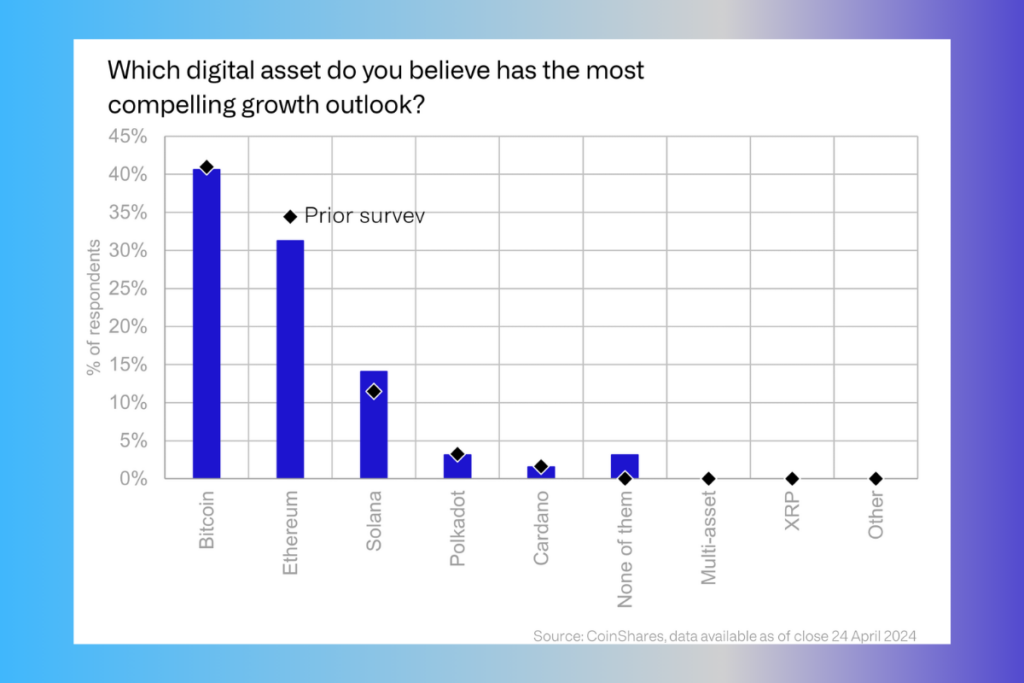

Bitcoin Still Has the Most Attractive Growth Potential

When compared to the January poll, Butterfill observed that XRP had significantly decreased, with none of the respondents owning it at this time. CoinShares‘ data indicates that there were small inflows of $1.3 million to XRP products for the week ending April 19, despite the fact that the institutions surveyed in this study did not possess XRP.

With just less than 15% of respondents agreeing, Solana scored third when it came to the most compelling growth prospect. This is an increase from the over 10% who agreed in the January survey. Still, 41% of investors said that Bitcoin had the strongest growth potential, keeping it at the top of the list. With just more than 30% of respondents optimistic about its growth, ether came in second.

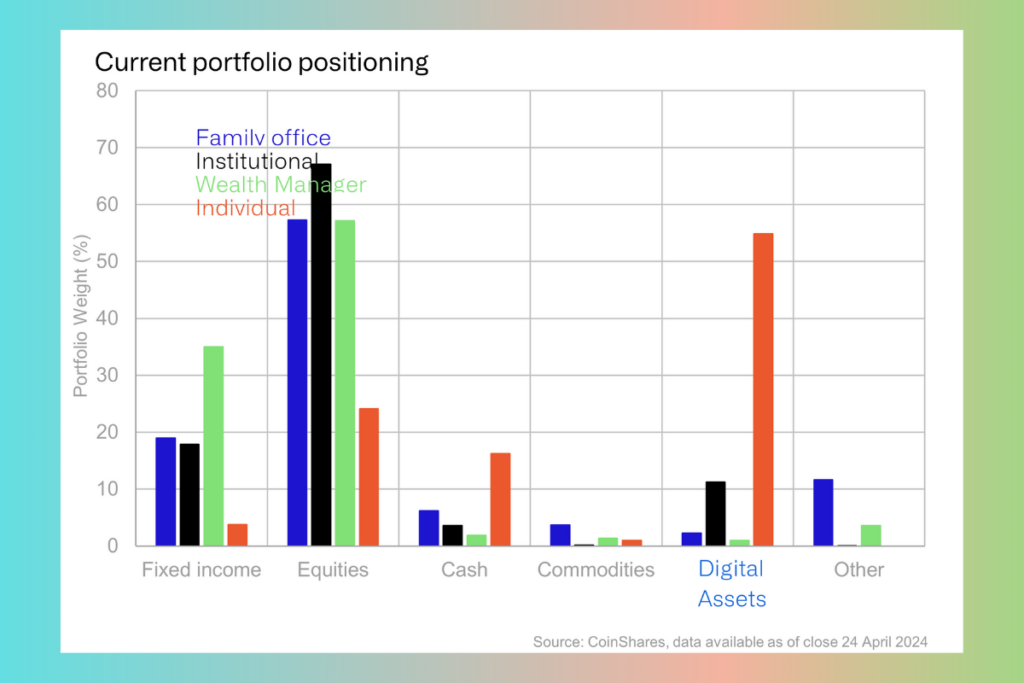

According to Butterfill, this is the biggest weighting since the study’s inception in 2021. The survey also revealed that investors’ portfolios’ percentage of cryptocurrencies increased to 3% from 1.3% in January.

Unsurprisingly, some of the largest contributors to this were allocation from institutional investors who finally had the ability to gain exposure to Bitcoin via the U.S. ETFs,

Butterfill

Leave a comment