Crypto News – Monday saw a rise in the S&P 500 index that culminated in a new record of 4,927.93, up 0.76%.

S and P 500 Record Set by Fed Rate Decision and Wall Street Gains

From its prior record close of 4,894.16 on January 25, there has been a gain of 0.69% to this new record. The general market is expecting data on earnings reports from multiple companies, which is why the S&P 500 is rising.

The S&P 500’s growth is comparable to that of other indices, such as the Nasdaq Composite and the Dow Jones Industrial Average. The Nasdaq saw a larger boost, jumping 1.12% to close at 15,628.04, compared to the DIJA’s 0.59% rise to close at 38,333.45.

Fed’s Decision on Interest Rates is Highly Anticipated

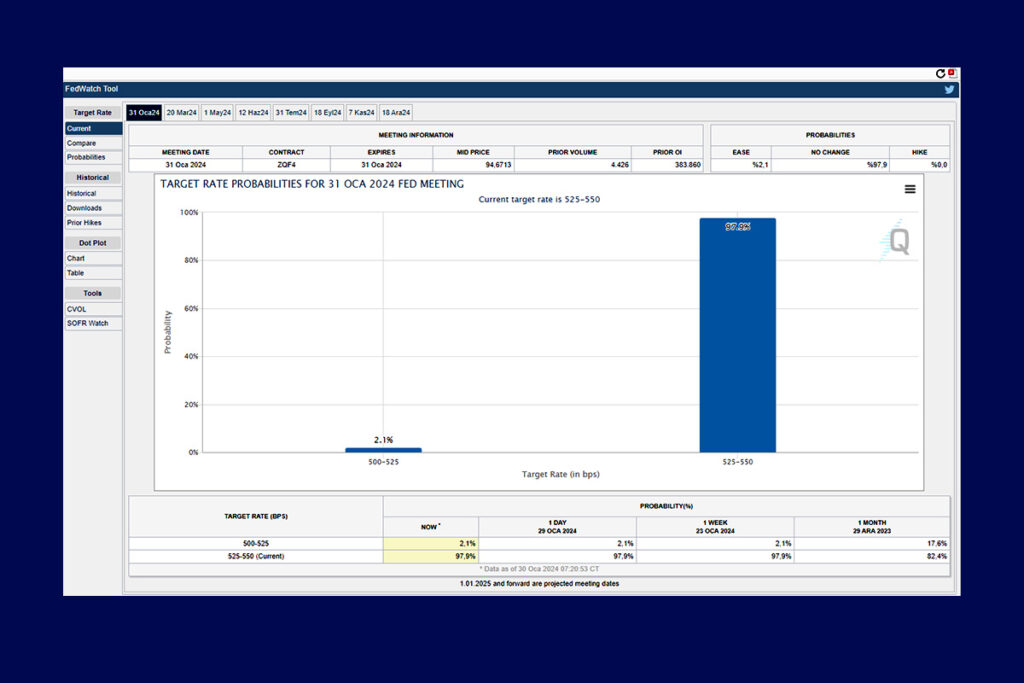

Today is the first day of the policy meeting of the Federal Open Market Committee (FOMC). By the end of the two days of meetings, it should be known if the apex institution will decide to keep the existing interest rate the same, raise it, or lower it. Trader expectations of the Fed cutting rates from 5.00% to 5.25% are 2.1%, according to the CME FedWatch Tool. Yet, the tool indicates a 97.9% chance that the Fed will stick with the present rate of between 5.25% and 5.50%.

Investors await the release of earnings results from several of the largest Wall Street firms in addition to the anticipated news from the FOMC. Many large-cap IT businesses are expected to announce their performance and earnings this week. This week matters, says Chris Larkin, Head of Trading and Investing at E-Trade.

If the market is going to sustain its latest breakout, it may need to avoid earnings disappointments from this week’s Big Tech lineup, get encouraging news from the Fed on interest rates, and see jobs numbers that are solid, but not too hot.

Larkin

Leave a comment