Crypto News – Prime Minister Rishi Sunak promised to establish the United Kingdom as a cryptocurrency hub while he headed the Treasury Department.

Rishi Sunak Crypto Targets: Prime Minister’s Targets in Jeopardy as Only 4 Firms Approved

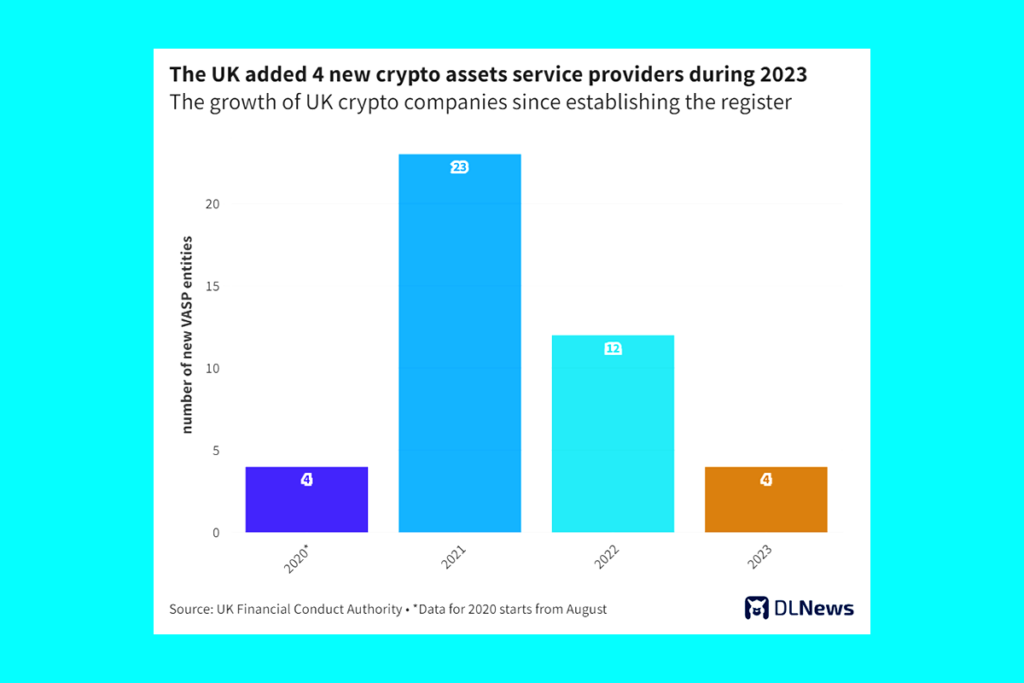

Industry insiders caution that two years later, a low rate of firm registrations is impeding their goals. A register of virtual asset service providers was created in the UK in 2020 by the Financial Conduct Authority, the watchdog. DL News has investigated this registry.

According to registry statistics, just four of the 28 applications submitted by organizations to offer crypto asset services over the previous year were authorized by the FCA, representing an 11% rejection rate. The four include payments giant PayPal, cryptocurrency exchange Bitstamp, Nomura-backed cryptocurrency custodian Komainu, and brokerage business Interactive Brokers.

There needs to be a better understanding of the system, better guidance throughout the application process, better understanding of what is coming down the pipeline, and what people can expect from the FCA,

Oliver Linch, CEO and general counsel of defunct crypto exchange Bittrex Global

FCA Provides Specific Feedback to Firms

For financial companies operating in the UK, the FCA establishes stringent anti-money laundering and anti-terror funding guidelines. Many companies that have applied in the past to offer cryptocurrency services have failed to convince the regulator that they have the proper procedures in place.

Firms may just have assumed that they would be fast-tracked by the FCA or given an easy ride, and they’re now discovering that they underestimated the rigour of the system. That is a good thing.

Linch

Additionally, he mentioned how involved the FCA is in the sector. It even offers firms a pre-application meeting to assist them in understanding the requirements, and it often provides individual firms with specific criticism when applicants are unable to demonstrate compliance with the laws.

Leave a comment