Crypto News – The Ultimate Comparison: Rise of CME vs. Binance Bitcoin Trading

Crypto News – In response to Wall Street’s increasing demand for the most valuable digital asset, the Chicago Mercantile Exchange (CME) is preparing to launch spot Bitcoin trading, the Financial Times reported on May 16. The largest futures BTC trading platform in the world, CME, has been in discussions with cryptocurrency traders to create a regulated spot BTC trading market. It is expected that the platform would be run by EBS, a Swiss currency trading platform renowned for its stringent policies around the trading of cryptocurrency assets.

The Details of the Trading Platform are Not Yet Clear

Trader participation in basis transactions would be possible with the launch of spot trading for Bitcoin on CME. The goal of this trading method is to make money off of the slight price variations between the underlying spot Bitcoin and the futures contracts. Major Wall Street players’ persistent interest in the cryptocurrency space is highlighted by CME’s possible involvement, even if the trading platform’s specifics have not yet been completed.

This event indicates the growing acceptance and integration of digital assets into traditional financial markets, as evidenced by the SEC’s approval of Spot Bitcoin exchange-traded funds (ETFs) in January.

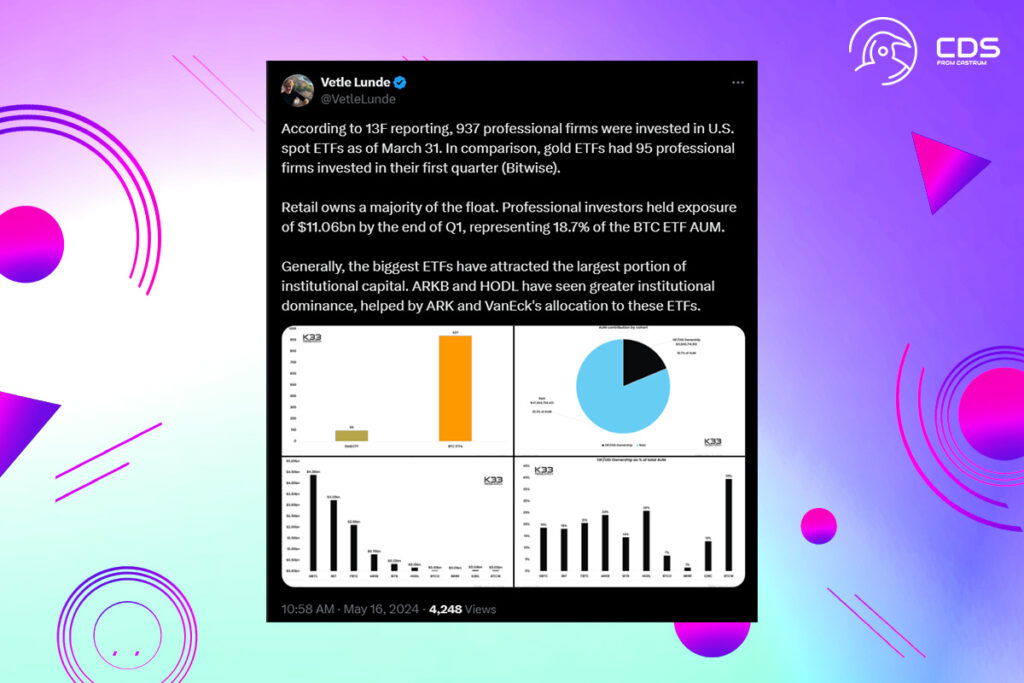

According to 13F reporting, 937 professional firms were invested in U.S. spot ETFs as of March 31. In comparison, gold ETFs had 95 professional firms invested in their first quarter (Bitwise). Retail owns a majority of the float. Professional investors held exposure of $11.06bn by the end of Q1, representing 18.7% of the BTC ETF AUM.

Vetle Lunde, a senior analyst at K33 Research

FAQ

What is the CME Group?

The largest futures market in the US and the second-biggest worldwide for trading futures and options on futures is Chicago Mercantile Exchange (CME).

What is EBS in Trading?

A platform for wholesale electronic trading on the foreign exchange market (FX) with market-making institutions is called Electronic Broking Services (EBS). Before joining CME Group, it was first established as a cooperation by big banks.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment