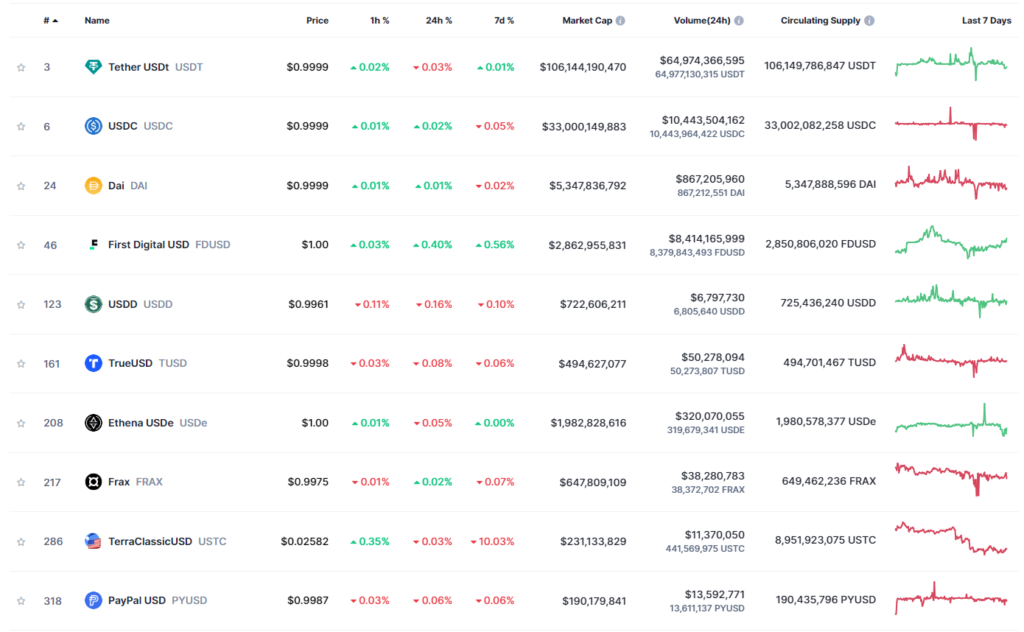

Crypto News– XRP issuer Ripple has revealed its intention to introduce a stablecoin backed by the United States dollar, aiming to challenge Circle and Tether for a portion of the market share in the coming five years.

Ripple announces the launch of a USD-backed stablecoin, aiming to compete against USDT and USDC

Cointelegraph interviewed Ripple’s chief technology officer, David Schwartz, prior to the announcement. The plan involves issuing the stablecoin initially on the XRP Ledger and the Ethereum blockchain. Ripple has been considering launching a stablecoin for more than a year, with Schwartz expressing the view that the current stablecoin ecosystem lacks diversity and robustness.

We think it will be over $2 trillion by 2028, and there’s only two market leaders. We don’t think it’s a winner-take-all-all ecosystem, particularly on the DeFi side.

David Schwartz

Schwartz said, Initially, when Tether first launched, a major concern was whether these individuals would abscond with the funds due to strong incentives. Then, over time, you realize, Wait a minute, these individuals have a long-term business plan.

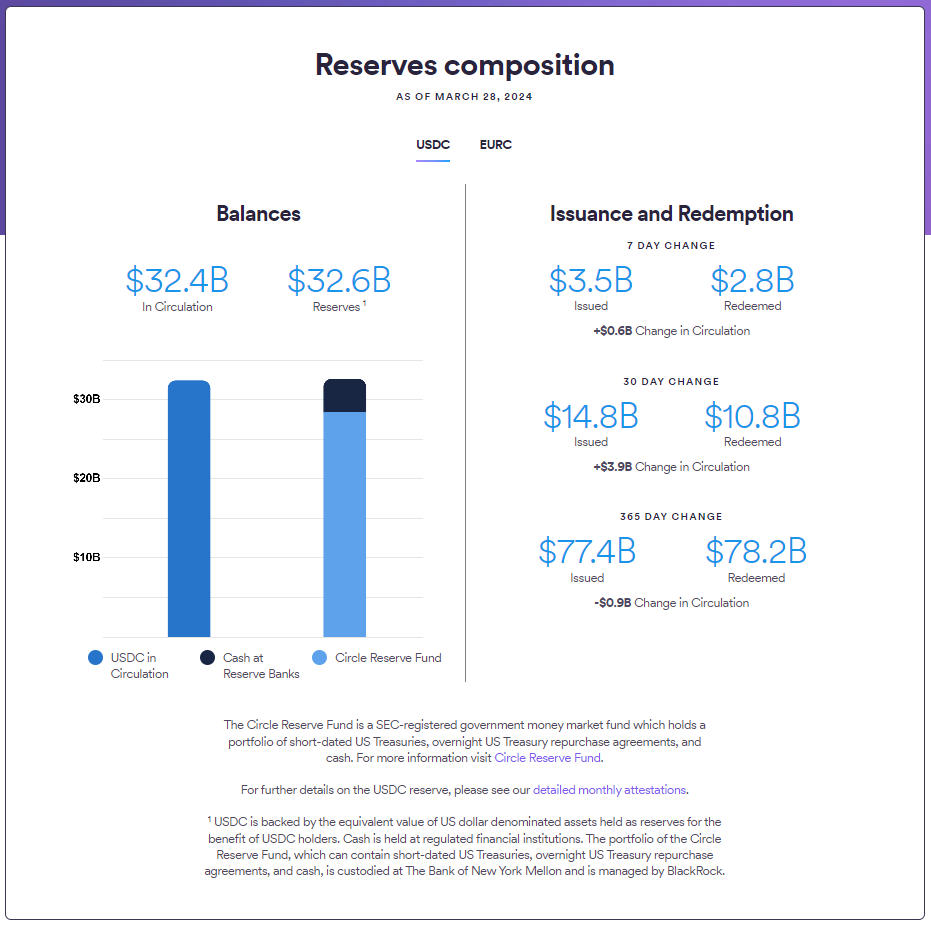

Our angle is going to be very compliance-first. We’re very transparent about how the assets are backed, so we’re kind of going to be directly competing against USDC.

David Schwartz

The Ripple chief technology officer further noted that the prospect of introducing a new stablecoin capable of attracting hundreds of millions, billions, or even tens of billions of dollars naturally raises such concerns. Leveraging its credibility, established track record in the industry, and solid financial standing, the company aims to establish a foothold in the stablecoin market.

I believe we have a legitimate case to be considered among the top contenders. Even if, after two years, we rank third but witness a market expansion of tenfold from its current size, that would still be quite significant, Schwartz remarked.

Cointelegraph also inquired why Ripple was exploring a stablecoin initiative while XRP, currently priced at $0.60, remains positioned as the token for its real-time gross settlement system, currency exchange, and remittance network, primarily serving financial institutions.

Schwartz explained that Ripplenet accommodates non-bank payment firms utilizing XRP for transparent transactions. However, there are certain markets inaccessible to these firms using XRP or requiring additional liquidity.

Leave a comment