Raydium Earns Low Risk Rating in InvestorsObserver Analysis, Bolstering Investor Confidence

Crypto News – Raydium has been bestowed with a low-risk rating in the latest analysis conducted by InvestorsObserver. Their exclusive scoring system meticulously examines the monetary input required to influence price movements within a 24-hour timeframe. By scrutinizing recent alterations in trading volume and market capitalization, this metric effectively assesses a token’s susceptibility to manipulation through limited trading activity. The scoring scale, ranging from 0 to 100, inversely correlates low scores with heightened risk and elevated values with diminished risk.

Delving into the trading analysis, the risk gauge assessment for RAY affirms its status as a low-risk investment at present. This insight is particularly invaluable for traders with a keen focus on risk assessment, enabling them to steer clear of perilous ventures or potentially capitalize on lucrative opportunities.

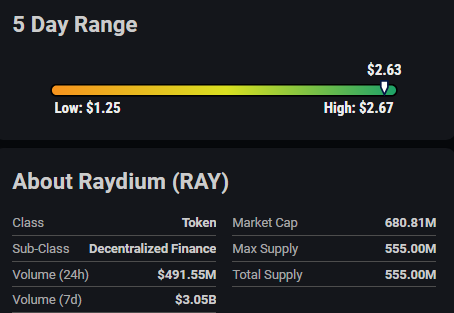

Over the past 24 hours, the price of Raydium has experienced a decline of -3.60%, culminating in its current valuation of $1.40. This downturn in price aligns with a below-average trading volume, while simultaneously witnessing a reduction in the token’s market capitalization during the same period.

Currently standing at $362,723,137.98, the crypto’s market capitalization is reflective of $127,866,334.52 worth of currency being exchanged within the preceding 24 hours. It is the interplay between price volatility and the fluctuating dynamics of trading volume and market capitalization that underscores Raydium’s classification as a low-risk asset.

In summary, the observed price volatility exhibited by RAY within the last 24 hours underscores its low-risk assessment. This conclusion is drawn from the intricate relationship between price volatility and the corresponding shifts in trading volume and market capitalization, thereby instilling confidence among investors regarding the token’s susceptibility to manipulation at this juncture.

Leave a comment