Quant’s Native Token QNT Surges 10%, Leading the Market in Gains

Quant’s native token QNT, has experienced a significant 10% surge in value over the past 24 hours, positioning it as the top-performing cryptocurrency in the market today.

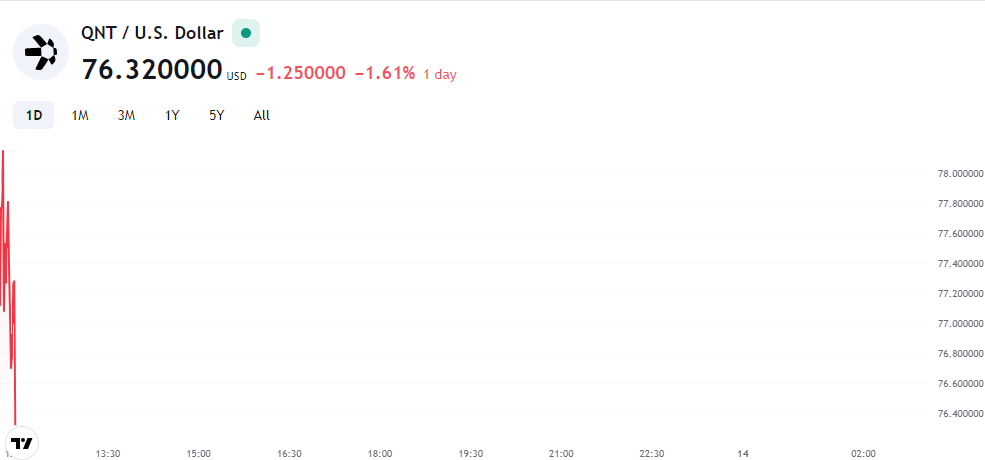

According to price data from crypto.news, QNT was trading at $77.02 at the time of writing, having reached an intraday peak of $77.77. This marks a 37.5% increase from its weekly low of $56.54, signaling strong upward momentum alongside the broader rally in altcoins.

This recent spike in QNT’s value is largely attributed to the announcement of new staking capabilities on Quant’s Overledger Network. The update, confirmed by Quant CEO Gilbert Verdian, introduces revised Terms and Conditions to include staking provisions. This enhancement is expected to boost the utility of QNT by incentivizing long-term holding and reducing its circulating supply.

In addition to potential rewards for stakers, the update strengthens QNT’s intrinsic value by further integrating it into the Overledger Network’s core operations. Investors have responded positively to this development, viewing it as a dual catalyst for driving demand while constraining supply, which could lead to further price appreciation.

Quant is widely recognized for its role in facilitating seamless connections across various blockchain networks, empowering developers to create decentralized multi-chain applications. This capability is crucial for promoting blockchain interoperability, a key component in building a more connected digital economy.

Whale Accumulation and Supply Shortage

Another driving force behind QNT’s price surge is increased activity from large investors, commonly referred to as “whales.” These investors have been accumulating QNT during recent market dips, signaling growing confidence in the token’s future. Data from FishTheWhales highlights a notable rise in whale transactions, indicating renewed optimism around QNT’s prospects.

Supporting this trend, analytics from Into The Block show a sharp increase in netflow among large holders (those controlling at least 0.1% of QNT’s supply), with a shift from a negative -3.1k QNT to a positive 7.42k QNT between early and mid-September.

Additionally, the number of QNT addresses holding the token for more than a year has grown by 37.2%, now totaling over 102.9k addresses. This increase in long-term holding coincides with an 87.4% jump in open interest, rising from $6.47 million to $12.13 million in September, according to Coinglass.

Analysts Predict Further Upside for QNT

Crypto analyst Dami-Defi recently highlighted on X (formerly Twitter) that QNT has broken out of a falling wedge pattern, a technical signal typically associated with bullish market reversals. After clearing the key resistance level of $69, the token now eyes higher price targets.

Dami-Defi forecasts that, if the current momentum persists, QNT could challenge the next resistance level at $82, with the potential to reach as high as $145.5, representing a substantial leap from its present value.

Leave a comment