Crypto News – Prior to the halving, bitcoin miners began liquidating their holdings, and Bitfinex notes that spot ETFs in the US may have dispersed the possible selling pressure, preventing a significant price decline concurrent with the event.

Post-halving Price Drop: Bitfinex Weekly Report Shows Bitcoin Miners Are Spreading Price Fear in Sales

It referenced data from CryptoQuant that showed miners transferred an average of 374 BTC per day to exchanges in March, a decrease of more than 70% from the daily average of 1,300 BTC, or $86.4 million, in February.

It appears that miners have executed their selling in advance, which has turned out to be advantageous for the market in the short term. We assume miners were already selling their BTC holdings or collateralizing them to upgrade their machinery and infrastructure,

Bitfinex

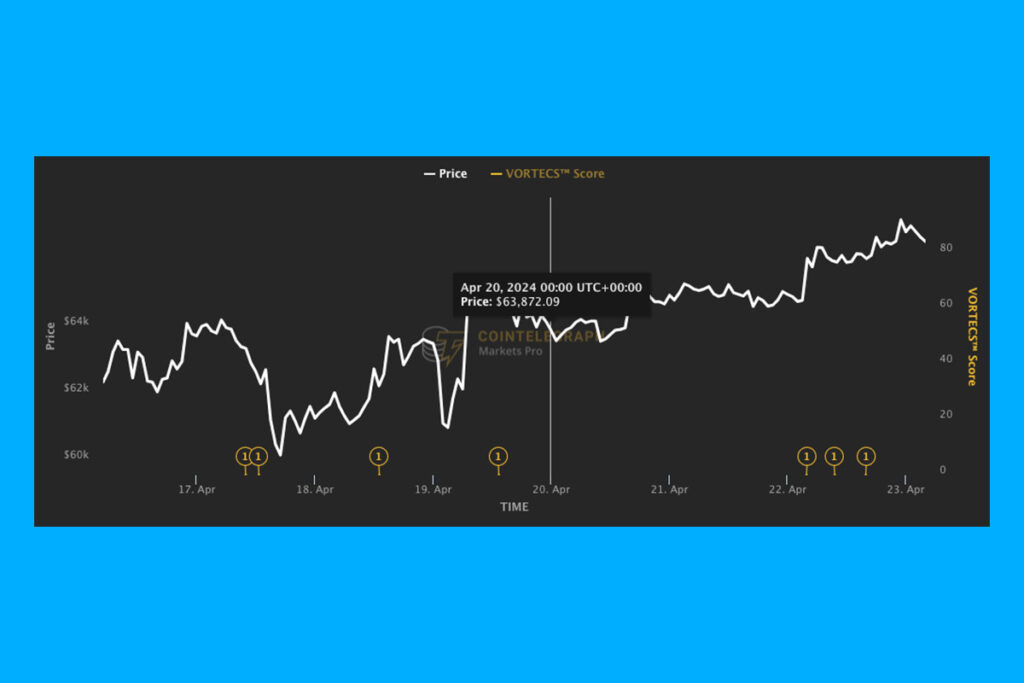

Following an over 40-day low of less than $60,000, Bitcoin has continued its upward trend, climbing over 4.5% to $66,597 since the April 20 halving, according to Cointelegraph Markets Pro.

Bitfinex Believes Negative Market Impacts Will Go Away If Market Dynamics Change

Bitfinex noted that before the revenue stream was effectively chopped by 50%, miners had applied considerable selling pressure in an attempt to maximize profits. This could have resulted in short-term price drops and increased volatility. Yet, in order to make up for the lower payouts, mining operations tend to grow and prices rise. These unfavorable market effects are also frequently transient as market dynamics change.

Bitfinex notes that a possible price stutter brought on by Bitcoin’s revised reward schedule may have been mitigated by institutional demand for the new US spot Bitcoin ETFs. The cryptocurrency exchange reported that although there was still “strong interest,” ETF flows have decreased since their January introduction and occasionally saw net outflows.

The added dynamic of the halving-induced ‘supply shock,’ the combination of ETF demand and constrained supply could drive further price appreciation for BTC.

Bitfinex

1 Comment