Pendle Finance Surpasses $500 Million in Liquidity with Ondo Finance Partnership

Crypto News – Pendle Finance, a decentralized platform, has experienced a significant surge in liquidity, surpassing the impressive milestone of $500 million. This remarkable growth can be attributed to a recent partnership with Ondo Finance, a protocol backed by Coinbase.

Pendle Finance‘s native token, PENDLE, has witnessed a remarkable uptick of more than 18% in value subsequent to the collaboration with Ondo Finance. This partnership, announced through an X post on January 29th, allows users to leverage the “composability of our tokenized cash equivalents” provided by Ondo Finance, although specific details of the collaboration remain undisclosed.

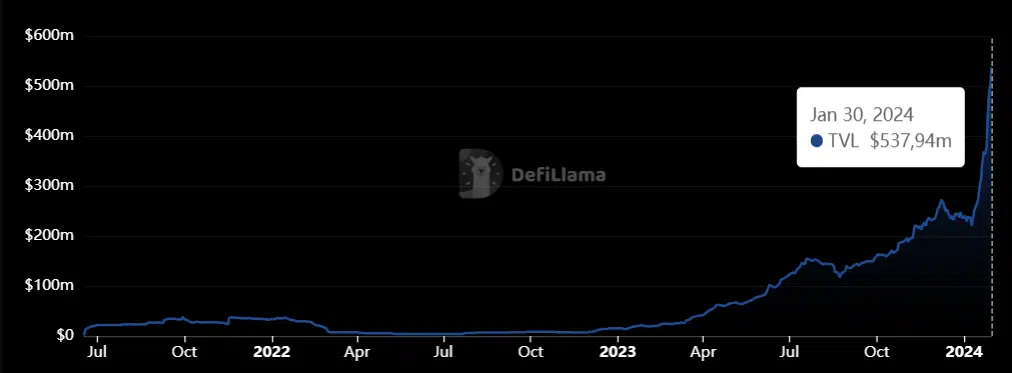

The announcement of this strategic alliance has not only bolstered confidence within the Pendle community but has also resulted in a surge in total value locked (TVL) within Pendle Finance. According to DefiLlama data, TVL reached a new all-time high, coming close to $538 million as of January 30th.

The PENDLE token has displayed substantial activity, with a recorded trading volume of nearly $60 million on January 30th alone, according to available data. This surge in activity propelled the PENDLE token to reach $2.66 in value, surpassing its previous all-time high since its launch, as reported by CoinGecko data. However, the sustainability of this rapid growth in the long term remains uncertain.

Established in 2022, Pendle Finance initially focused its operations on the Ethereum network, offering a platform for tokenizing and trading future yields within the DeFi space. Later in the same year, the platform expanded its presence to other networks, including BNB Chain, Arbitrum, and Optimism.

Pendle Finance’s innovative approach enables users to tokenize and trade future yields generated by assets across various decentralized protocols. This unique feature offers a novel way for users to engage with and speculate on DeFi yields.

Leave a comment