Crypto News – Understanding the Psychology Behind Panic Selling in Bitcoin

Crypto News – In the next several days, if Bitcoin closes below $60,000, there may be a panic sell-off, according to FxPro trader Alex Kuptsikevich. To qualify as bullish, traders in cryptocurrencies are waiting for a break above $65,000.

Significant and alternative tokens were startled when Bitcoin momentarily surged to above $63,000 on Monday morning in Europe. Over the previous day, ETH, SOL, and DOGE all gained 3%; the majority of these gains followed the surge in BTC. The largest tokens excluding stablecoins, are included in the CoinDesk 20 (CD20), a widely-based liquid index that had a 2.24% increase.

A series of lower highs and lows in the price action, according to Alex Kuptsikevich‘s Monday commentary, indicates that investors are selling into strength during market advances.

There is pressure likely related to asset sell-offs by miners and fears of tighter regulation of cryptocurrencies. A failure below $60K could trigger something of a panic sell-off. The positive scenario, in our opinion, will become the main one with a rise above $65K, fixing the price at the 50-day moving average and the reversal area in early May,

Kuptsikevich

Short-Term Bitcoin Traders May Soon Profit

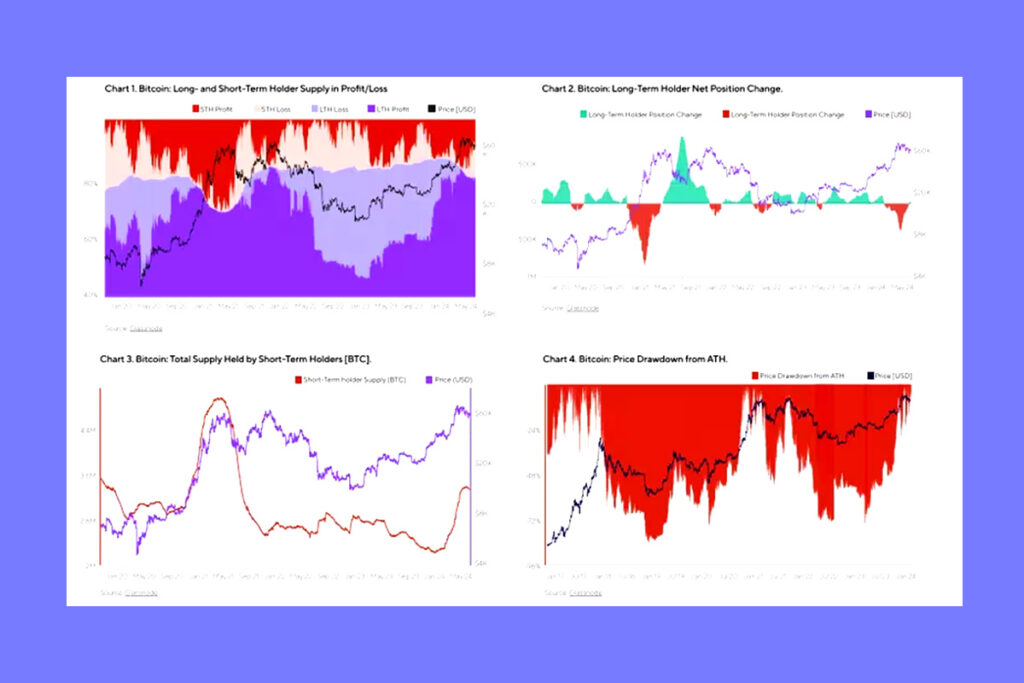

In a weekly statement, analysts at cryptocurrency investment firm Ryze Labs stated that short-term bitcoin holders—those who have held the tokens for fewer than 155 days—could have a significant impact on market movements in the months ahead. Three times, from mid-November 2017 to mid-April 2017, mid-February to mid-April 2021, and most recently, from the end of February 2024 to the beginning of April, 94% of both long- and short-term Bitcoin investors were profitable, according to Ryze Labs.

The cycle inverted, with short-term sellers selling to long-term holders, after these peaks, as short-term holder losses spiked. The team saw that historically, there have been large declines in the price of Bitcoin within the next four to six months after this change.

In the most recent cycle, short-term holders had Bitcoin valued at $218.9 billion. While most were initially in profit, they started to sell actively. About one month after this period, the maximum price drawdown from the period’s high is approximately -6%. The current cycle may differ from previous ones due to institutional demand supported by improving macroeconomic conditions. However, if these supportive factors weaken, a Bitcoin price drawdown similar to past cycles could occur,”

Ryze Labs

FAQ

What is Panic Selling in Crypto?

Prices fall as a result of panic selling, which occurs when many investors desire to sell their shares at once.

What Does the CoinDesk 20 Index Do?

The CoinDesk 20 Index evaluates the performance of the CoinDesk Market Index (CMI)’s top 20 digital assets based on their market capitalization.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment