PAAL AI Faces High Risk Assessment Amidst Significant Price Movement: InvestorsObserver Analysis

Crypto News – InvestorsObserver‘s analysis indicates that PAAL AI is subject to a high risk assessment. Their proprietary scoring system assesses the amount of capital needed to influence price movements over the past 24 hours, factoring in changes in trading volume and market capitalization. This helps identify whether a cryptocurrency may be susceptible to manipulation due to limited trading activity. Lower scores suggest higher risk, while higher scores imply lower risk, with values falling within a 0 to 100 range.

In terms of trading analysis, PAAL’s current risk score denotes it as a relatively high-risk investment. Investors focused on risk management will find this score particularly valuable for making informed decisions to either avoid or potentially explore risky investments.

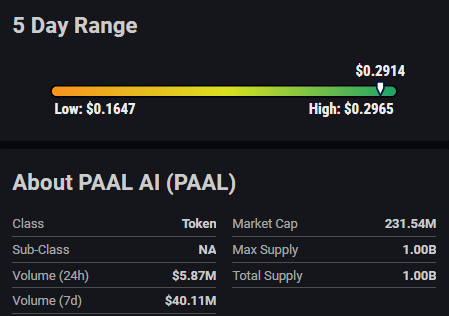

Over the past 24 hours, PAAL has experienced a notable decrease in value, trading 25.92% lower at its current price of $0.23. This decline occurred amidst below-average trading volume, although the token’s market capitalization has increased. Presently, the cryptocurrency holds a market capitalization of $183,307,901.75, with $3,238,888.12 worth of the token traded within the last 24 hours. The significant price change relative to trading volume and market capitalization fluctuations contributes to PAAL AI’s high-risk rating.

In summary, PAAL’s recent price movements in the trading landscape warrant a high-risk classification. The correlation between price fluctuations and trading volume raises concerns among traders regarding the token’s susceptibility to manipulation at this juncture.

Leave a comment