Crypto News – Reasons Behind ONDO Crypto Price’s 7% Soar

Crypto News – Due to the successful completion of a fund data tokenization pilot by the DTCC and Chainlink in association with significant U.S. institutions, the ONDO price has surged over the past 24 hours. Whales consequently keep snatching up ONDO in anticipation of future price rises.

In order to improve the tokenization of traditional finance funds, DTCC, the largest settlement system in the world, and blockchain oracle Chainlink have concluded a pilot program with multiple significant U.S. banks. A May 16 DTCC report states that the goal of the Smart NAV Pilot initiative was to use Chainlink’s CCIP to standardize the process of supplying net asset value (NAV) data for funds across blockchains.

The pilot demonstrated that by delivering structured data on-chain and establishing standard roles and processes, foundational data could be integrated into various on-chain applications, such as tokenized funds and ‘bulk consumer’ smart contracts, which are contracts that manage data for multiple funds.

The report

Whale Activity Seen in ONDO Tokens

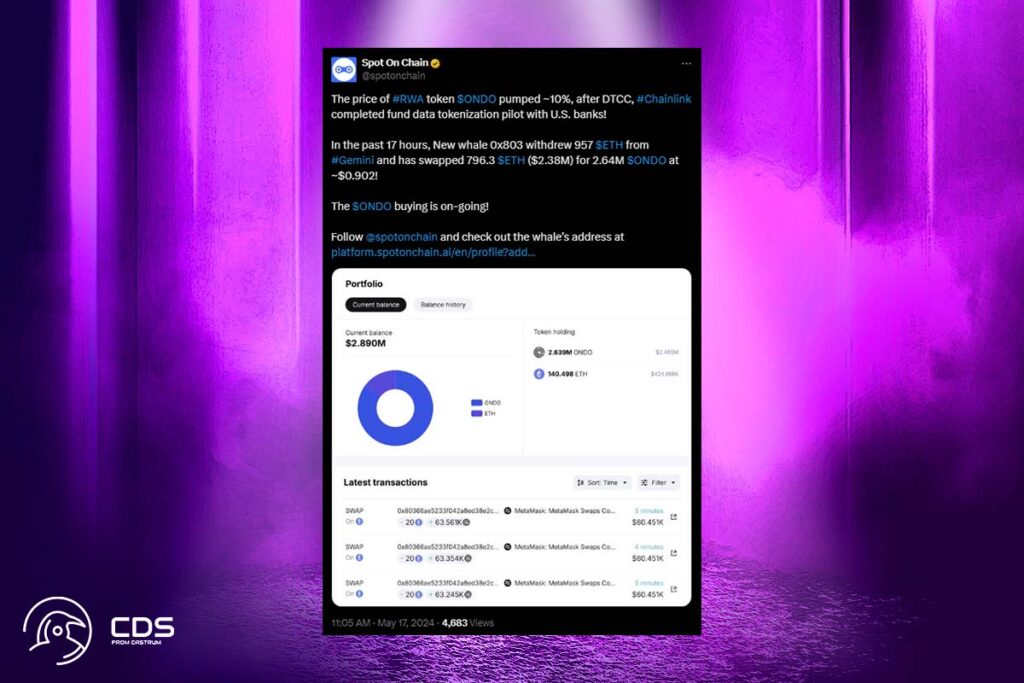

This announcement caused a sharp increase in RWA tokens, especially ONDO, which saw a gain of more than 7.53% in the previous day. One factor adding to the enthusiasm around ONDO is the notable whale activity that has been seen over the last 20 hours. According to the Spot on chain, a new whale going by the address 0x803 made a significant move by taking 957 ETH off of the Gemini exchange.

The whale went on to exchange 2.64 million ONDO tokens at an average price of $0.902 per token for 796.3 ETH, or around $2.38 million. The acquisition of a significant amount of ONDO has contributed to the continuous bullish attitude surrounding ONDO. Whale behaviors during a price increase typically signal confidence in the potential of a token.

FAQ

What Does Ondo do?

By tokenizing real-world assets (RWAs), Ondo Finance is a DeFi protocol that seeks to make institutional-grade financial products and services more accessible.

What are Real World Assets (RWA) in Crypto?

In the field of cryptocurrency, real-world assets (RWA) refer to the tokenization of physical goods that are brought onto a chain. They also include the increasing tokenization and on-chain sale of digital assets to retail clients in the form of capital market products.

What Does DTCC Actually Do?

DTCC offers clearing, settlement, and information services for cash market instruments, corporate and municipal bonds, unit investment trusts, government and mortgage-backed securities, and over-the-counter derivatives through its subsidiaries.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment