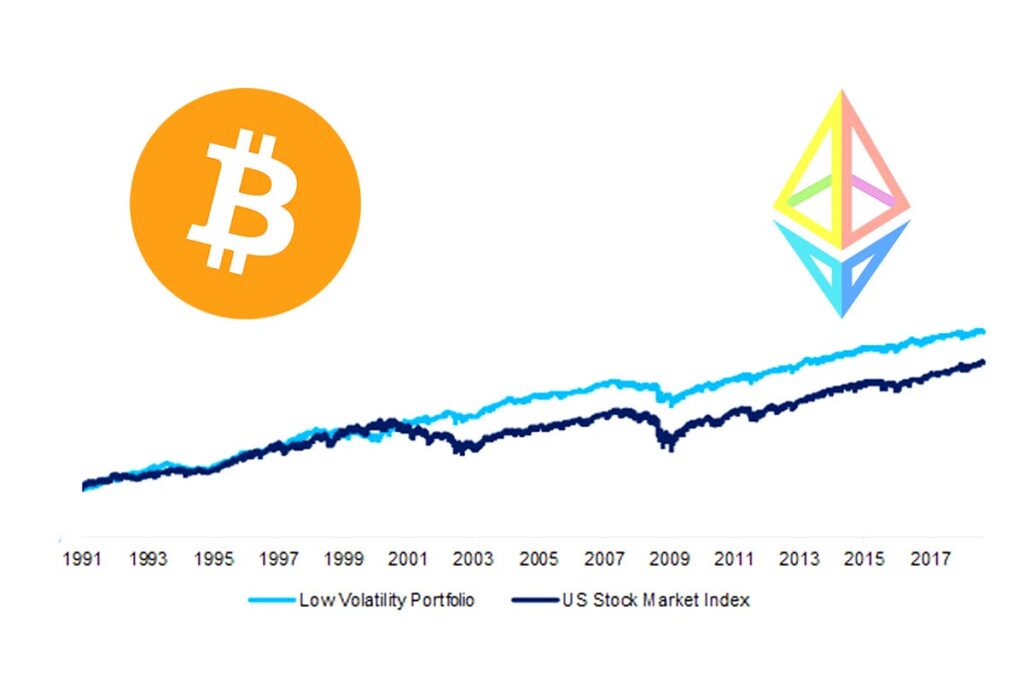

Crypto News, Crypto Takes a Breather Amid the Summer Lull Bitcoin and Ethereum, historically known for their wild price swings, seem to be enjoying a quieter summer, experiencing less volatility.

Oil Outpaces Bitcoin and Ethereum in Volatility, Indicating Maturity of Leading Cryptos

Surprisingly, oil has surpassed the volatility levels of these top digital currencies. As recent data from Kaiko Research shows, 90-day-volatility indexes for Bitcoin and Ethereum have nosedived to multi-year lows, decreasing by 35% and 37%, respectively. This marks a significant shift, making these leading cryptocurrencies less volatile than oil, which currently stands at 41% in terms of volatility.

Understanding Market Volatility

Market volatility represents the degree and frequency of price fluctuations, be it upward or downward. This metric is derived from the variance in price over time, where a higher percentage denotes increased volatility and vice versa. Historically, cryptocurrencies have always exhibited greater volatility compared to oil. Thus, Dessislava Ianeva, an analyst at Kaiko, finds the current scenario quite “unusual.” However, she also notes that this reduction in volatility might be a testament to Bitcoin’s maturation as an asset.

Despite its current lead in volatility, oil has also seen its levels drop from 63% in July 2022, but the trend has been upward since this April. One of the driving factors for this uptick, according to Ianeva, could be the heightened geopolitical tensions coupled with China’s underwhelming economic resurgence after relaxing stringent COVID-19 restrictions.

Liquidity and Trade Volumes in Cryptos at a Low

Further insights from Kaiko’s research highlight another interesting trend: both Bitcoin and Ethereum are currently facing multi-year lows in terms of liquidity and trading volume. This decline in liquidity might be contributing to the reduced volatility and even oil’s surprising surge in volatility.

A potential turnaround for the crypto market could be the introduction of a spot Bitcoin ETF, which Ianeva believes might still be some months away. However, considering BlackRock’s recent ETF application and its consistent success rate in getting approvals, other applicants might follow suit, potentially bringing renewed vigor to the market.

Leave a comment