Nvda Stock – Analyzing Unusual Options Activity and the Impending Stock Split: Insights into NVDA’s Rise and Potential

Today, there’s been a surge in unusual activity surrounding Nvidia Inc (NVDA) put options ahead of the anticipated 10-for-1 stock split, set to take effect after June 7. This indicates that trading puts and calls will become more accessible for most investors.

As a result of this unusual activity, NVDA’s stock has risen by approximately 3% to $1,199.44 in midday trading on June 5. Over the past month and a half since April 22, when NVDA was priced at $764, it has experienced a remarkable 56.8% increase. Furthermore, since May 22, when the company disclosed its fiscal Q1 results and announced the stock split, NVDA has surged by 26.2%, reaching $949.50 per share.

Effects of the Stock Split

Following the 10-for-1 stock split, scheduled after the market close on Friday, June 7, NVDA’s stock price will begin trading on Monday, June 10, at a value 90% lower than the previous close (i.e., one-tenth of the former price).

This adjustment also impacts option strike prices proportionally, making it easier to buy and sell puts and calls since each contract represents 100 shares.

Typically, NVDA’s high stock volatility resulted in options premiums with substantial dollar values. For instance, a put premium of $12.20 will now adjust to $1.22. Consequently, instead of paying $1,220 for one contract, the cost will decrease to $122, potentially encouraging more trading in puts and calls.

Moreover, short sellers of puts and calls won’t require as much capital. For example, a put strike price of $1,185 would necessitate a new short seller starting on Monday to secure only $1,185 per contract shorted, rather than $118,500. The same principle applies to covered calls, making shorting out-of-the-money puts and calls more accessible and allowing investors to exercise puts and calls with less capital.

Unusual Put Option Activity

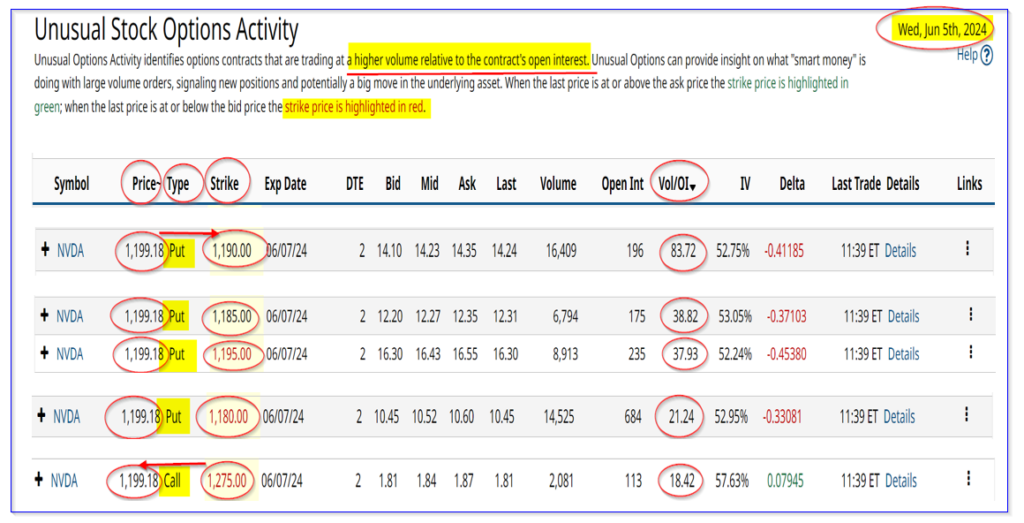

The Barchart Unusual Stock Options Activity Report for today highlights 4 put tranches and 1 call option exhibiting highly unusual trading activity in NVDA.

Each of these strike prices is out-of-the-money (OTM), with the puts having strike prices below today’s price and the lone call having a price above today’s price. Notably, all these tranches have a June 7 closing expiration date.

The unusual activity is evident in the number of contracts, some as much as 83 times the outstanding contracts before today.

Analysis of the Situation

It appears that traders are capitalizing on the high options premiums by shorting them. For instance, the first tranche indicates a bid premium of $14.10 for an OTM $1,190 strike price expiring on Friday, providing the short seller with an immediate premium yield of 1.18%.

Similarly, the $1,185 put tranche offers a $12.20 premium on the bid side, resulting in an immediate yield of 1.03% to the short seller. The $1,180 put tranche yields 0.885% to the short seller.

The call option tranche provides a short seller, likely a covered call seller, with an immediate yield of 0.15%. However, the strike price being $1,275 or 6.3% over today’s price presents a potentially high return even if the stock rises to that level.

Why NVDA Stock Could Continue to Rise

I’ve previously discussed why NVDA stock still appears undervalued in my recent Barchart articles. In my May 29 piece, I suggested that NVDA stock could potentially reach $149 post-split.

This valuation is underpinned by the company’s robust free cash flow (FCF). As explained in my May 24 article, Nvidia’s substantial FCF margins could potentially justify a valuation of 45% more at $150 post-split.

This estimation is based on a 53.5% FCF margin on a next 12-month (NTM) revenue forecast of $137.69 billion, resulting in an NTM FCF estimate of $73.66 billion. Assuming a 2.00% FCF yield metric, the forecast yields a $3,683 billion market cap, representing a 24.9% increase over today’s market cap of $2.95 billion. Consequently, NVDA stock could be valued at $149.78 post-split.

However, this could take at least a year to materialize. Moreover, as analysts’ revenue forecasts increase and assuming FCF margins hold steady, the price target could further rise.

In essence, NVDA stock still appears undervalued, and options traders are leveraging the upcoming 10-for-1 stock split.

Leave a comment