MSTR Stock Surges: Bernstein Forecasts $600 by 2025

Research and trading firm Bernstein analysts updated their price prediction for MSTR to $600 by the end of 2025, predicting that MicroStrategy’s ownership of Bitcoin will increase from 1.7% of the circulating supply to 4% over the next ten years.

MicroStrategy’s bitcoin treasury model is unprecedented on Wall Street, in our view. A company on an insatiable path to attract billions in global capital to invest in bitcoin.

the analysts led by Gautam Chhugani

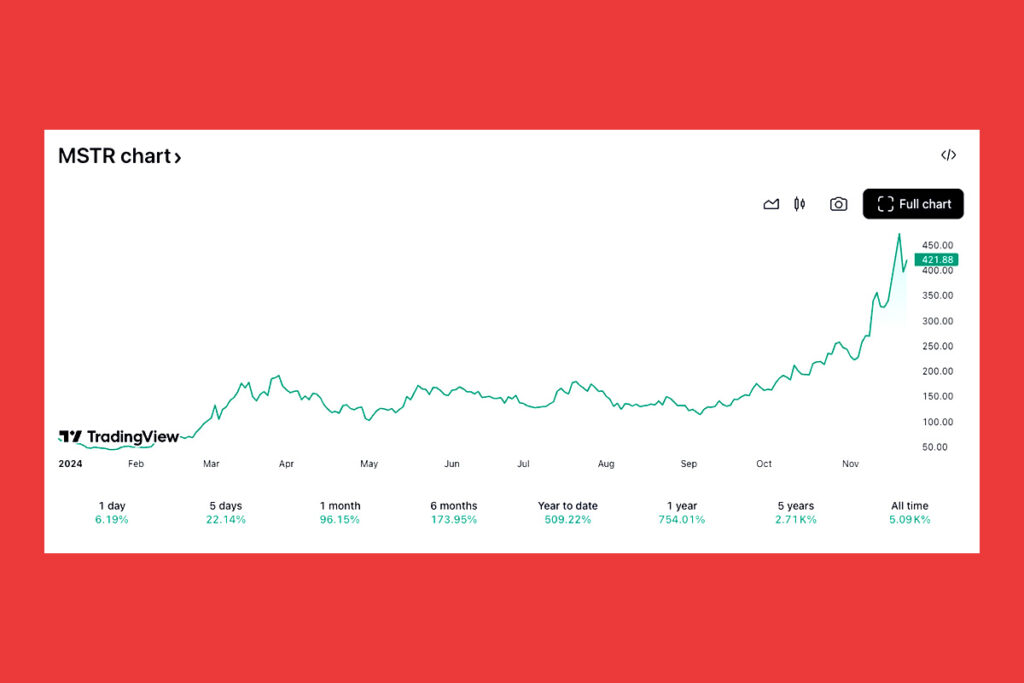

According to TradingView, Bernstein had previously set a target of $290 in June, when the company was trading at about $148. The price was reached on November 11 amid an over 100% increase over the previous month and a 509% year-to-date increase. The new goal, according to MicroStrategy, indicates a 42% upside potential from here. The company’s shares closed up 6.2% on Friday at $421.88. At $447.70 pre-market, MSTR is up 6% at the moment.

Three Key Factors Driving Bernstein’s MicroStrategy $600 Price Target

Three things determine the analysts’ MicroStrategy thesis:

- First, whether investors have a structurally long position in bitcoin.

- Second, whether MicroStrategy faces any risk of insolvency or liquidity issues.

- Third, whether the company can grow its capital over time.

According to them, the U.S. government’s support for Bitcoin under the incoming Trump administration, favorable regulatory conditions, increased institutional use, and a macroeconomic environment of low interest rates, inflation threats, and record fiscal debt have all contributed to the cryptocurrency’s sustained bull market.

MicroStrategy Set to Purchase $830 Billion in Bitcoin by 2033, Analysts Predict

Chhugani stated that despite the volatility of bitcoin, MicroStrategy’s debt is long-term unsecured convertible debt, suggesting a minimal risk to its balance sheet liquidity. The analysts pointed out that although nothing lasts forever, the company is currently outpacing its plans for a $42 billion capital raise ($21 billion in debt and $21 billion in equity) over the next three years. This month alone, the company secured $3 billion in convertible debt and $6.6 billion in equity raises.

With $32.4 billion in possible purchases left, they predict MicroStrategy will finish the strategy ahead of schedule within the next 18 months due to the favorable Bitcoin market conditions. According to the analysts, if MicroStrategy were to purchase 4% of the currently circulating quantity of bitcoin by the end of 2033, the company would own about 830,000 BTC or $830 billion worth of the cryptocurrency for $1 million per bitcoin.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment