Crypto News– A surge of activity from prominent cryptocurrency investors, commonly referred to as crypto whales, has inundated major exchanges with millions of dollars’ worth of Ethereum (ETH), Uniswap (UNI), and Space ID (ID).

Major Players Move Millions in Ethereum, Uniswap, Space ID to Exchanges

This sudden increase in transactions has caught the attention of the crypto market, prompting speculation about the reasons behind these movements and their potential repercussions on prices.

Whale Surge: Cryptocurrency Floods Exchanges Amidst Increased Activity

Since April 16, 2024, cryptocurrency analysts have been monitoring a series of notable transfers. According to on-chain data, DWF Labs transferred 9.2 million ID tokens valued at $6.69 million to the crypto exchange OKX. Following this transaction, Spot On Chain’s tracking of DWF Labs’ wallets indicates no remaining ID tokens.

Additionally, crypto heavyweight Amber Group appears to be engaged in selling activities. Arkham Intelligence data indicates that Amber Group transferred 1 million Arbitrum (ARB) tokens to Coinbase, totaling $1.13 million. This comes after a prior transfer of $9.43 million worth of ARB to an exchange address last month, leaving $3.57 million behind.

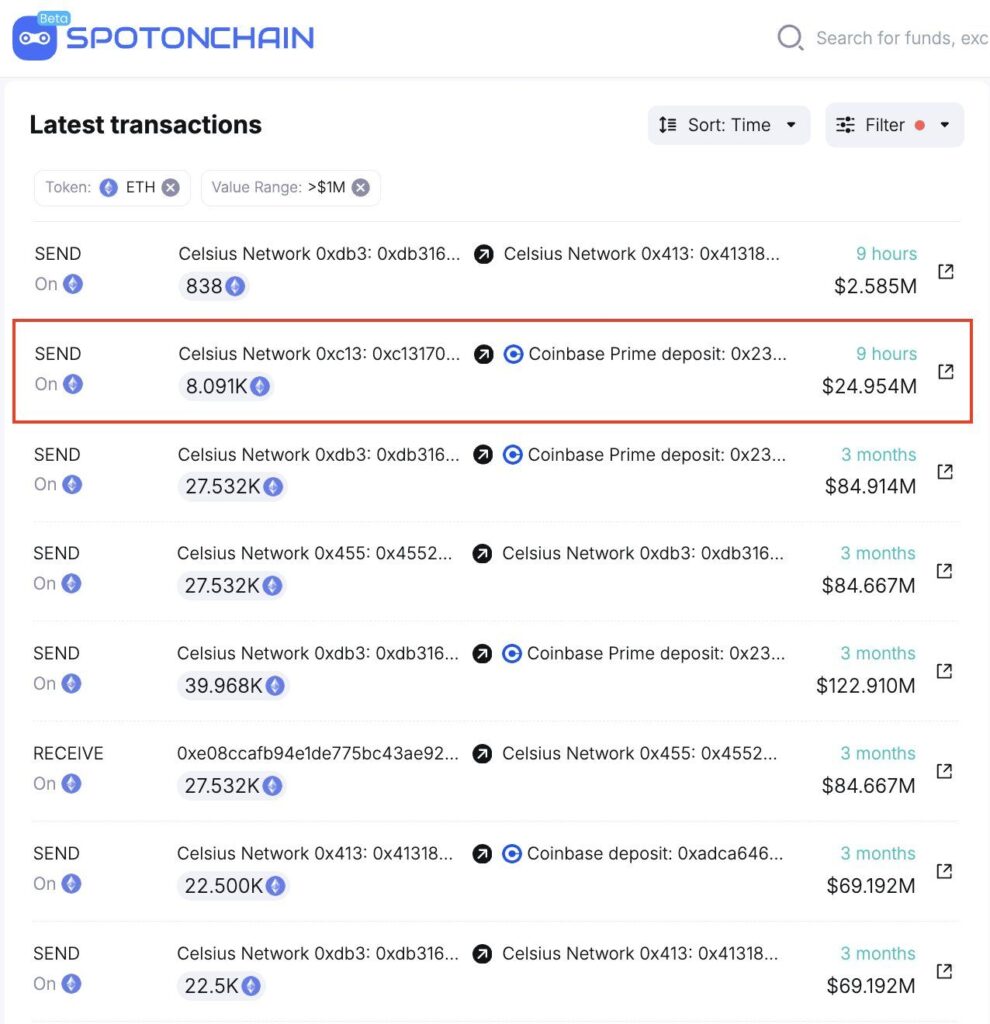

In a separate yet noteworthy transaction, Celsius Network transferred 8,091 ETH (approximately $24.5 million) to Coinbase. This transaction was reported by blockchain analysis firm Spot On Chain on April 17.

Another noteworthy activity involves the withdrawal of 6,513 staked ETH from Lido by the multi-signature address 0xA97…08Ddc. The owner of the wallet subsequently deposited 5,100 of these ETH, valued at $15.72 million, into OKX. It’s worth mentioning that this address still retains a significant cryptocurrency balance, with 10,389 ETH and 50 WBTC, totaling $64.65 million.

Moreover, a Uniswap (UNI) whale has been accumulating tokens since October 2023, initially withdrawing from the MEXC exchange and subsequently purchasing on-chain at an average price of $6.20. Recently, this whale decided to sell their UNI holdings at $6.83, realizing a profit of $0.25 million (approximately +10%).

In another noteworthy transaction, Lookonchain observed Tron’s founder, Justin Sun, withdrawing 196 million USDT from Huobi and transferring it to Binance. However, the motive behind this transfer remains unclear.

Leave a comment