MicroStrategy’s $42 Billion Bitcoin Plan: What Investors Need to Know

MicroStrategy, the leading business intelligence firm, has made headlines with its bold and aggressive Bitcoin acquisition strategy. With plans to raise $42 billion in the next three years, the company’s commitment to Bitcoin has sparked investor interest. However, as Bitcoin (BTC) approaches the $100,000 mark, questions arise: Is MicroStrategy’s approach sustainable, or is it setting the stage for a potential market bubble?

How MicroStrategy is Financing Its Bitcoin Buying Spree

MicroStrategy’s “21/21 Plan” is the driving force behind its ambitious Bitcoin purchasing strategy. The plan involves a massive capital raise, split between equity sales and fixed-income securities. In recent months, the company raised $4.6 billion by selling 13.6 million shares and another $2.6 billion through the issuance of convertible bonds. The funds raised from these ventures enabled MicroStrategy to purchase 78,890 Bitcoin, amounting to approximately $6.62 billion.

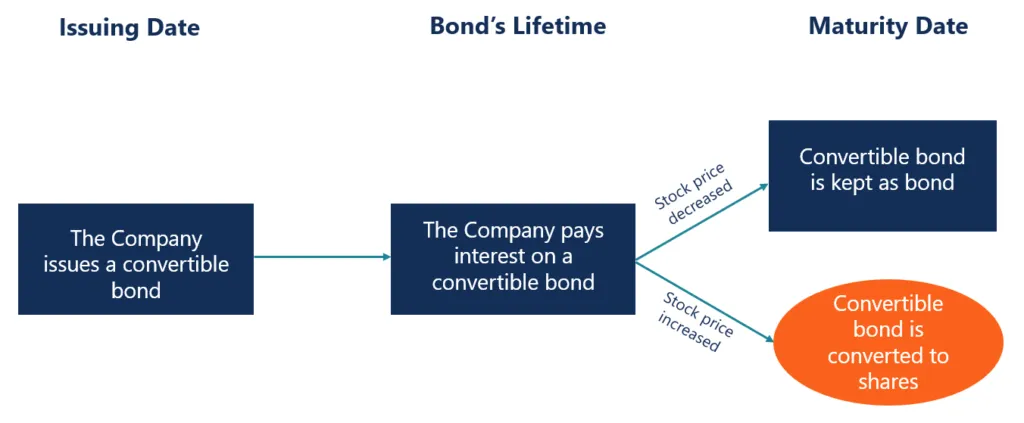

A key innovation in the plan is the issuance of 0% interest convertible bonds. Investors who purchase these bonds receive no regular interest payments. Instead, they stand to profit if MSTR’s stock price rises, as they can convert their bonds into shares at a premium price.

MicroStrategy’s debt is often viewed not as a typical corporate financing tool but rather as a vehicle for Bitcoin investment. The zero or low yield offered by the company reflects a different investor base—those looking for Bitcoin exposure and the potential for equity conversion, rather than traditional bond yields.

For bondholders, the lack of interest payments is balanced by the prospect of large profits from stock price appreciation. However, this strategy ties the financial returns of bondholders and the company’s overall financial stability directly to the highly volatile Bitcoin market.

Could Bitcoin Price Crash Doom MicroStrategy?

While MicroStrategy’s strategy is bold, it is not without its risks. One of the major concerns is the volatility of Bitcoin. The company’s weighted average debt repayment period extends beyond five years, which means its obligations won’t come due until after 2028, offering the company flexibility during market downturns. If Bitcoin’s price remains stable or rises, MicroStrategy should be able to continue operations without the need for urgent refinancing. However, a significant crash in Bitcoin’s price could create substantial risks.

A sharp decline in Bitcoin’s value could expose vulnerabilities in MicroStrategy’s financial position. Since a significant portion of its balance sheet is tied to Bitcoin, a price drop could force the company to sell Bitcoin at unfavorable prices to meet its debt obligations. In this scenario, MicroStrategy could face liquidity issues, potentially putting the company in a difficult position.

Risks for Convertible Bondholders

The convertible bondholders also face risks in this arrangement. If MicroStrategy’s stock price falls significantly, these bondholders may be left with no gains, as they could avoid converting their bonds into shares. In such cases, the company may be forced to repay bondholders in cash rather than equity, further straining its finances.

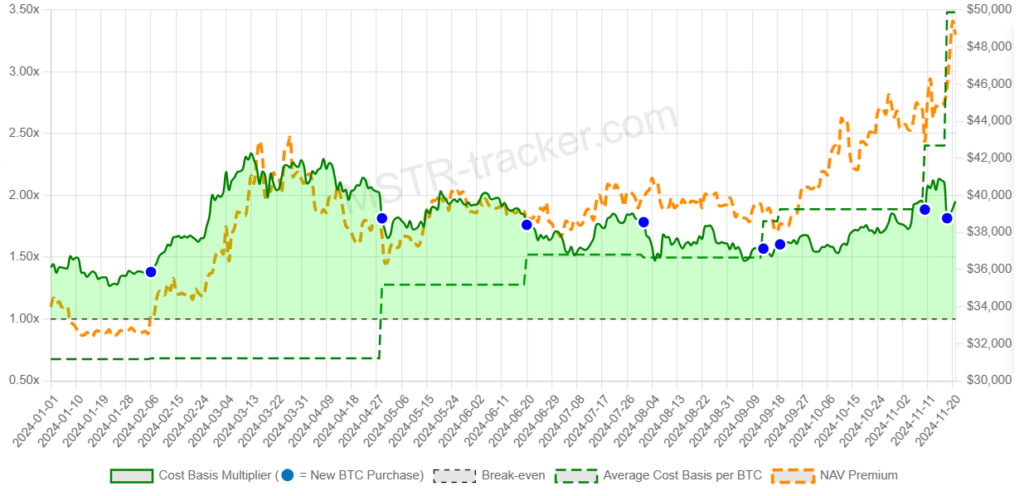

At present, MicroStrategy trades at approximately 3.3 times the value of Bitcoin on its balance sheet, driven by speculative investor confidence in both Bitcoin’s future price appreciation and the company’s leveraged exposure. If the premium drops significantly—say to 1.5x or lower—shareholders could see smaller-than-expected returns, while bondholders might choose not to convert their bonds, especially if the stock price underperforms relative to Bitcoin’s price increase.

To execute a strategy like MicroStrategy’s, a company needs robust financial resources, including strong cash flow and liquidity. It must be large enough to raise substantial capital through debt or equity offerings without endangering its financial health. Additionally, the company must be able to absorb Bitcoin’s inherent volatility without threatening its core operations.

While MicroStrategy offers leveraged exposure to Bitcoin, it amplifies the cryptocurrency’s inherent volatility. Investors might find that directly investing in Bitcoin provides a simpler way to gain exposure to the cryptocurrency without adding layers of risk.

If Bitcoin’s price continues to rise, MicroStrategy could potentially repurchase its convertible bonds to avoid diluting its shareholders. This strategy could help maintain the stock price while providing greater potential returns for investors. However, this move would need to be timed carefully and would require the company to have sufficient liquidity and financial flexibility.

Leave a comment