MicroStrategy Expands Bitcoin Holdings Amid Q2 Losses, Announces $2 Billion Equity Offering

Business intelligence firm MicroStrategy made headlines in Q2 2024 by purchasing an additional 12,222 Bitcoin for $805 million, pushing its total Bitcoin holdings to 226,500 BTC, valued at approximately $14.7 billion based on current market prices.

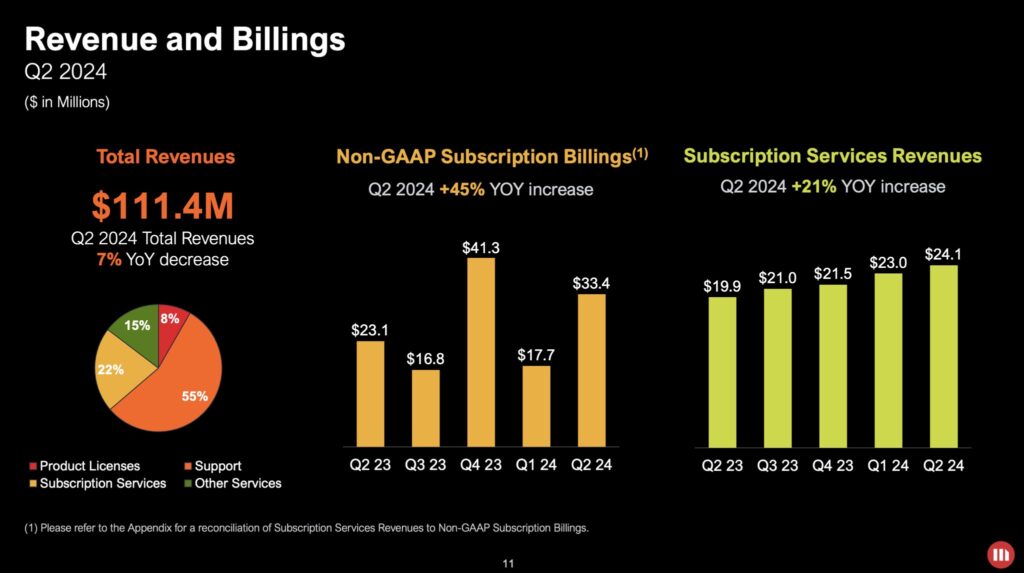

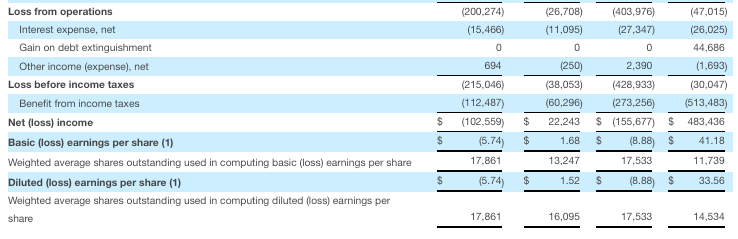

During its Q2 earnings call, MicroStrategy reported significant losses, with a net loss of $5.74 per share on quarterly revenue of $111.4 million, representing a 7% decline compared to the same period last year. These figures fell short of analysts’ predictions, which had anticipated a smaller loss of $0.78 per share and higher revenue of $119.3 million, according to data from a Bloomberg survey.

Despite the disappointing earnings, the firm managed to slightly narrow its net loss to $123 million for Q2 2024, an improvement from the $137 million net loss reported in Q2 2023.

MicroStrategy disclosed that its 226,500 Bitcoin holdings were acquired at a total cost of $8.5 billion, averaging $36,821 per Bitcoin. The firm also introduced a new key performance indicator (KPI) called “Bitcoin Yield,” which measures the percentage change over time in the ratio between its Bitcoin holdings and its diluted outstanding shares. Diluted shares include all common stock and any potential shares from convertible notes or stock options.

The company reported a year-to-date BTC yield of 12.2% and stated that it aims to maintain an annual BTC yield between 4% and 8% over the next three years. According to a company statement, BTC Yield is used to evaluate the effectiveness of its Bitcoin acquisition strategy, which it believes adds value for shareholders.

Additionally, MicroStrategy confirmed that its previously announced 10:1 stock split, which was first revealed on July 11, will take effect on August 7.

Looking ahead, MicroStrategy announced plans to file a registration for a $2 billion at-the-market equity offering to raise more capital, though the specific use of the funds was not disclosed. Historically, the company has used such capital to purchase additional Bitcoin.

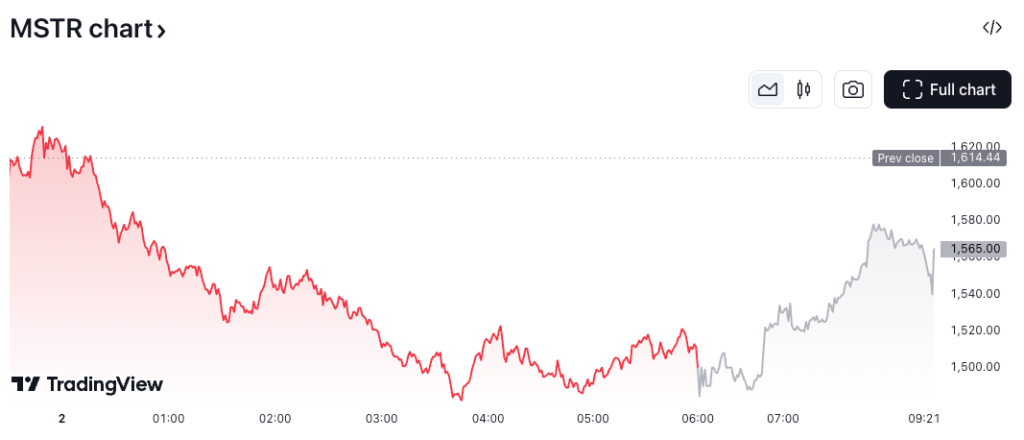

At the time of writing, MicroStrategy’s shares were trading at $1,500, reflecting a 6% decline on August 2. However, the share price rebounded by 1.1% in after-hours trading following the release of its Q2 earnings, according to TradingView data.

Leave a comment