Matic Price Garners Attention as Polygon Rebranding Approaches: Will It Revive the Struggling Token?

As the crypto community anticipates the upcoming rebranding of the MATIC token to POL, set to take place on September 4, the term “Matic price“ is becoming increasingly prominent. This rebranding is a pivotal part of the Polygon 2.0 roadmap, designed to enhance the blockchain’s security and utility. However, with 97.74% of MATIC holders currently facing losses, questions arise about whether the rebrand will generate enough momentum to lift the struggling token.

Concerning On-Chain Metrics Ahead of the Rebrand

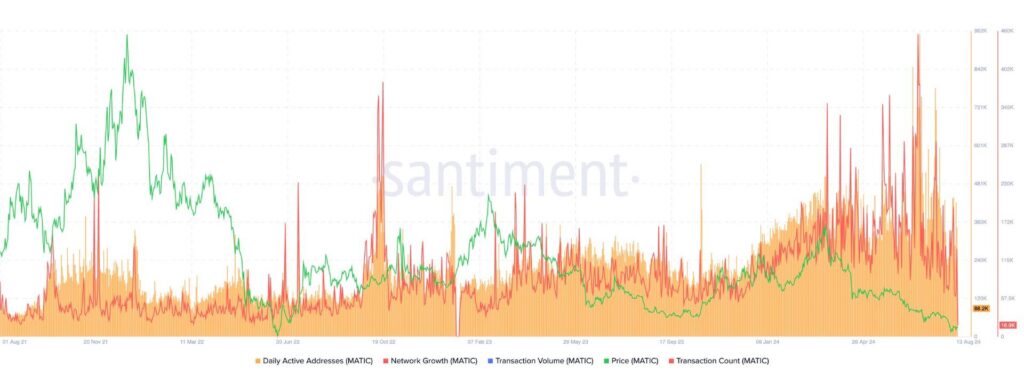

MATIC investors have been facing challenging market conditions recently. Since mid-April 2024, Polygon’s daily active addresses and overall network growth have seen a general decline, only interrupted by sporadic spikes. A particularly sharp drop occurred between August 11 and 12, with active addresses plummeting from over 500,000 to just 88,200. Similarly, transaction counts have dropped significantly, from over 130,000 to 16,900, indicating a steep decline in user engagement and network activity.

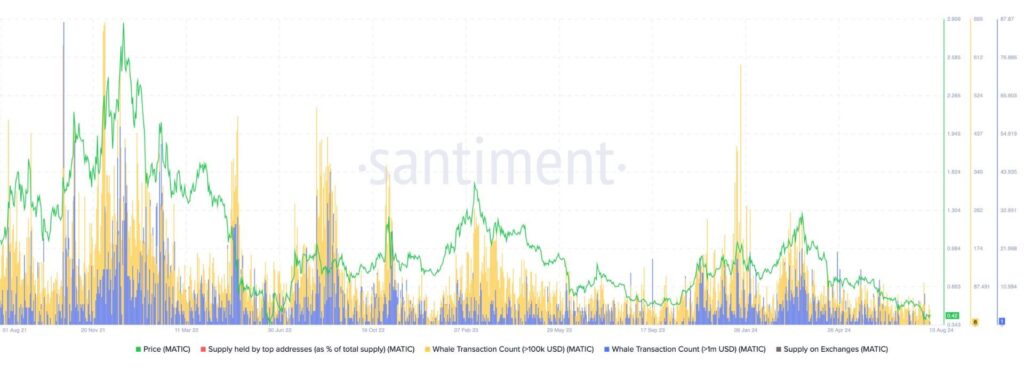

Adding to these difficulties, the majority of MATIC holders are deep in the red. Data from IntoTheBlock reveals that 97.74% of MATIC holders, holding more than $32 million worth of tokens, are currently “out of the money,” with only 1.49% in profit.

Furthermore, whale activity has spiked only following price rallies, suggesting a trend of profit-taking rather than accumulation. This behavior has exacerbated the downward pressure on MATIC price.

Year-to-date, MATIC has emerged as one of the worst-performing large-cap cryptocurrencies, with a 56% decline as of August 11. This drop is consistent with other underperforming assets such as Lido Finance (-60%), Optimism (-62%), Arbitrum (-63%), and DYDX (-65%).

Despite these challenges, technical analysis suggests there may still be a glimmer of hope for the Layer 2 network.

Can Bulls Reverse the Downtrend in Matic Price?

In the short term, Matic price shows some bullish tendencies, with higher lows and the formation of an ascending triangle pattern. However, the overall trend remains bearish, as the price is trading below the 200-day EMA (black line at $0.5047) and the 50-day EMA (green line at $0.4348).

The ascending triangle pattern emerging at current price levels hints at potential bullish momentum, especially if the price breaks above the upper resistance of the triangle.

Currently, MATIC faces minor resistance around $0.4348. A breakout above this level could prompt a test of the next major resistance at $0.5047. Conversely, a support zone exists around $0.4150; if this level fails, the next support is at $0.4000 (orange zone).

The Relative Strength Index (RSI) stands at 49.14, indicating a neutral position, suggesting the asset is neither overbought nor oversold, allowing room for movement in either direction.

The Chaikin Money Flow (CMF), which measures buying and selling pressure, is positive at 0.13, signaling some buying pressure and aligning with the potential bullish breakout of the ascending triangle.

Overall, while technical indicators for Matic price are currently neutral to slightly bullish in the short term, a breakout above $0.4348 could signal a trend reversal, potentially pushing the asset toward $0.5331. However, for sustained upward momentum, MATIC must break through the major resistance at $0.5047. If the 200-day EMA is surpassed and maintained, a longer-term target could be around $0.6000.

Leave a comment