Crypto News– In 2023, the tokenized Treasurys market in the United States experienced a remarkable surge of 641%, reaching $845 million in total value, as reported by CoinGecko, a digital asset data tracker.

In 2023, the market for tokenized US Treasurys expanded to 845 million Dollars

CoinGecko’s 2024 report titled ‘Rise of Real World Assets in Crypto‘ emphasized the advancement in real-world assets (RWA) tokenization. It highlighted that tokenized Treasurys escalated from $114 million in January to $845 million by year-end, showcasing a substantial growth within the span of a year.

Tokenized securities, backed by real-world assets such as stocks and bonds, have gained traction. For instance, Franklin Templeton, a prominent asset management firm, emerged as a major issuer of tokenized Treasurys, with $332 million worth of tokens issued through its On-Chain U.S. Government Money Fund, constituting 38.6% of the market. Franklin Templeton is also actively involved in the crypto space, having launched a spot Bitcoin ETF in January and pursuing the launch of an Ethereum ETF.

Additionally, protocols featuring yield-bearing stablecoins backed by U.S. Treasury bills, like Mountain Protocol’s USDM tokens, have seen significant growth. USDM tokens surged from $26,000 to $154 million since their launch in September 2023.

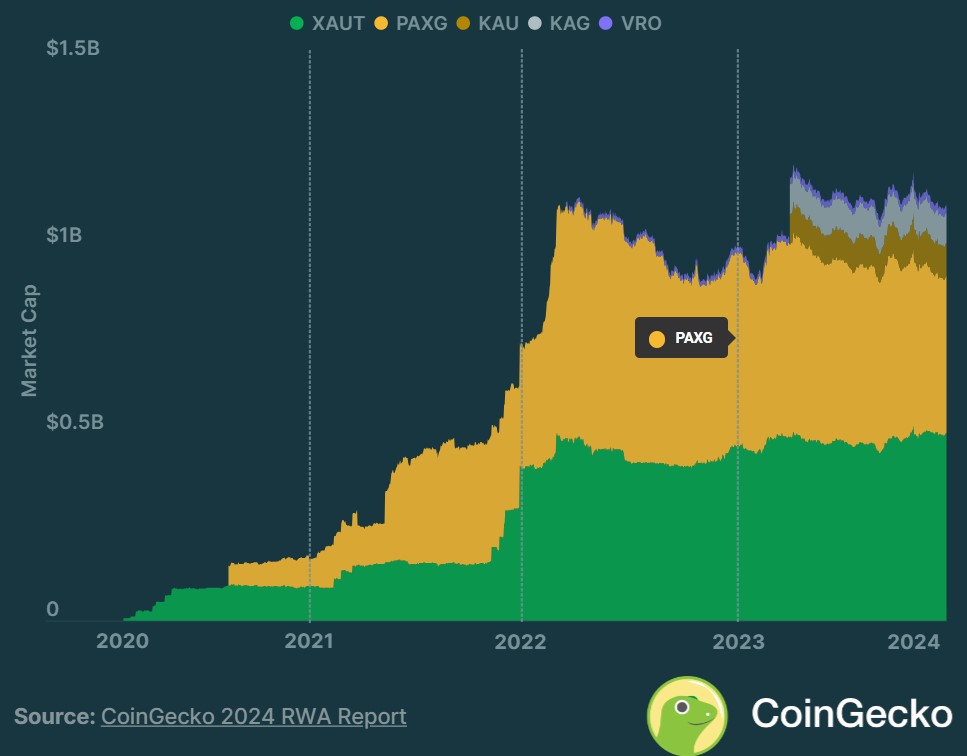

Most tokenized U.S. Treasurys are built on the Ethereum network, accounting for 57.5% of the market, while platforms like Stellar host 39% of tokenized securities. CoinGecko also highlighted the rise of commodity-backed tokens, with a market capitalization of $1.1 billion as of February 1st. Notably, Tether Gold (XAUT) and PAX Gold (PAXG) dominate 83% of the market for tokenized precious metals.

Furthermore, a new project has initiated the tokenization of uranium, offering the redemption of the valuable metal through digital tokens.

Leave a comment