Loopring (LRC) Scores Low Risk Rating in Latest InvestorsObserver Analysis Amidst Price Volatility

Crypto News – InvestorsObserver‘s latest research reveals that Loopring has achieved a low risk analysis, indicating favorable conditions for investors. Employing a proprietary system, InvestorsObserver assesses the susceptibility of tokens to manipulation by scrutinizing the amount of capital required to influence their price over a 24-hour period, alongside recent fluctuations in volume and market capitalization. This assessment is graded on a scale of 0 to 100, with lower scores signaling higher risk and higher scores suggesting lower risk.

In terms of trading analysis, the risk gauge rank for Loopring (LRC) denotes it as currently presenting a low risk investment opportunity. This evaluation proves invaluable for traders committed to meticulous risk assessment practices, enabling them to steer clear of precarious investments or, conversely, to consider advantageous ones.

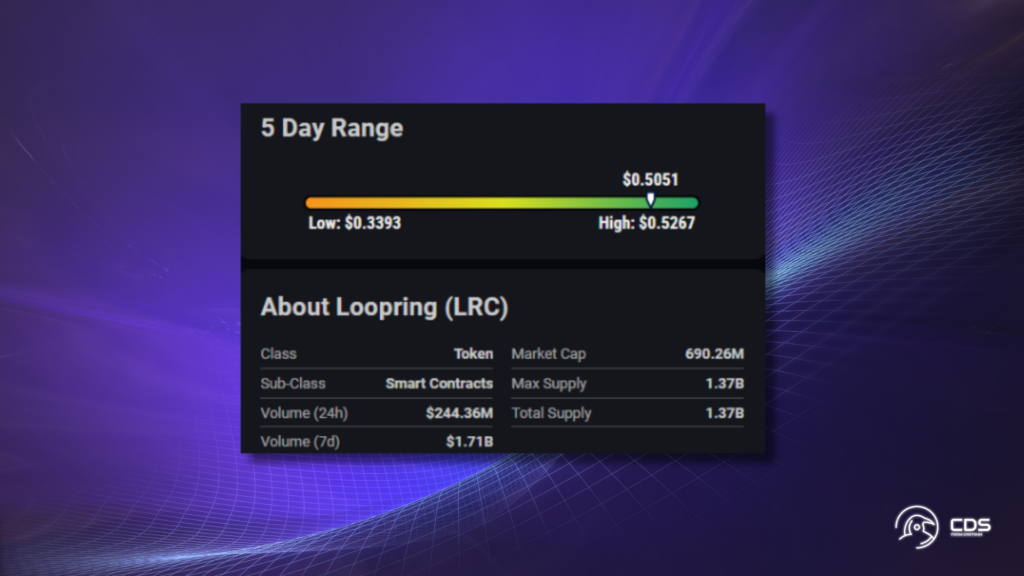

Over the past 24 hours, Loopring has experienced a decrease in price, dropping by -2.66% to reach a value of $0.42. This price decline is accompanied by a volume below its average level, while the token’s market capitalization has also experienced a downturn during this period. Loopring’s market capitalization now stands at $571,706,139.28, with a trading volume of $99,679,410.18 recorded over the same 24-hour span. The observed volatility in price, relative to changes in volume and market capitalization, contributes to Loopring’s classification as presenting a low risk profile.

In summary, the recent price movement of LRC underscores the cryptocurrency’s low risk rating, owing to its past 24 hours of price volatility in conjunction with volume changes. This assessment provides traders with a degree of confidence in the token’s current susceptibility to manipulation.

Leave a comment