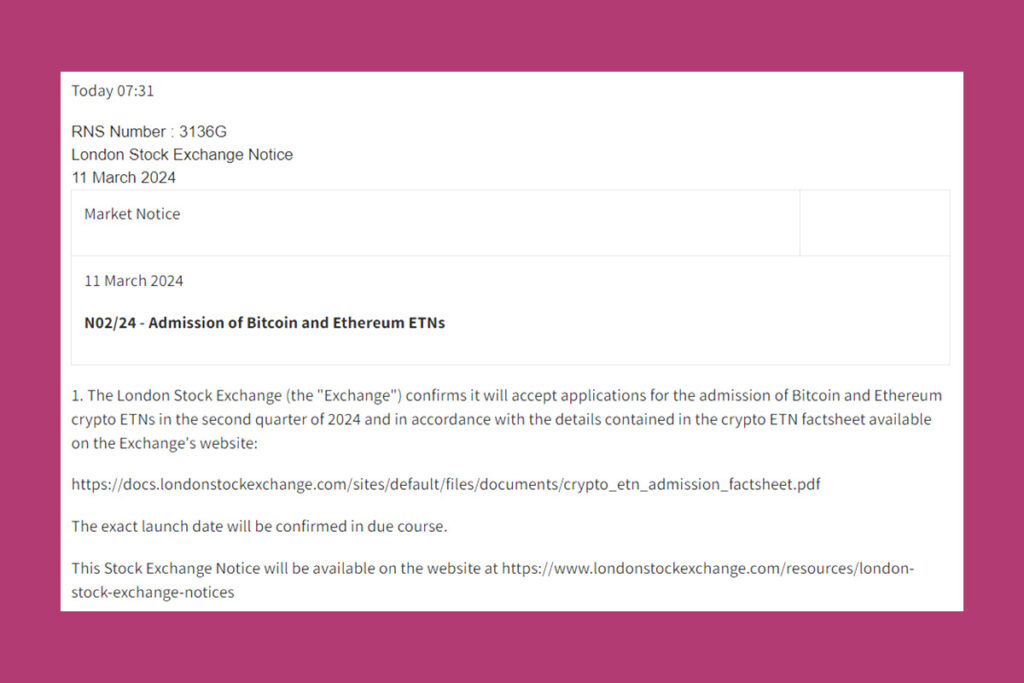

Crypto News – In the second quarter of 2024, the London Stock Exchange (LSE) will begin to accept applications for exchange-traded notes (ETNs) backed by cryptocurrencies such as Bitcoin and Ether.

London ETN Admission: Stock Exchange Won’t Object to BTC and Ether ETN Requests

The exchange declared on March 11 that it would accept applications as long as they adhered to the rules outlined in its Crypto ETN Admission Factsheet. The exchange did not, however, specify the precise day on which it would begin taking applications.

The exchange stated in the factsheet that cryptocurrency ETNs ought to be non-leveraged and physically backed. The exchange made it clear that the underlying cryptocurrency assets were to be kept “wholly or principally” in a cold wallet or a comparable setting. Furthermore, a custodian holding the assets ought to be bound by anti-money laundering regulations in the US, the UK, the EU, or Switzerland.

What is an ETN and How is it Different from an ETF?

ETNs are “debt securities that provide exposure to an underlying asset,” according to the exchange. During the trading hours of the exchange, investors can trade securities that track the performance of cryptocurrency assets by using Crypto ETNs. Many people view an ETN as a mild substitute for exchange-traded funds (ETFs). An ETN, as opposed to an asset pool, is a debt instrument backed by its issuers. Complicated debt strategies that are difficult to incorporate into funds are a common topic of ETFs.

Leave a comment