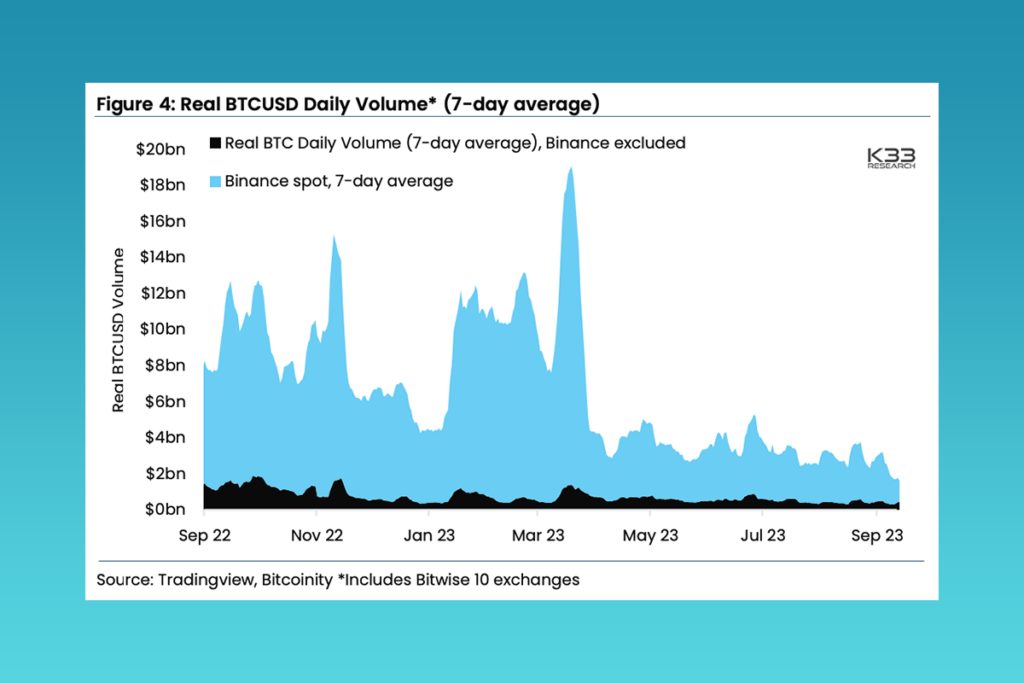

Crypto News- In a report by K33 Research, Binance has been singled out as the primary catalyst for the significant 48% reduction in trading volumes across the cryptocurrency industry during September. The report highlights that Binance’s seven-day average bitcoin spot volume plummeted by a substantial 57% since the month’s outset.

Binance at the Helm: K33’s Analysis of Bitcoin Spot Volume Decline in September

K33 Senior Analyst Vetle Lunde and Vice President Anders Helseth shed light on the additional 8% dip in bitcoin spot volumes witnessed over the past week, marking a 35-month low. They attribute this decline to the diminished activity on Binance, which is currently grappling with ongoing legal challenges from both the U.S. Department of Justice (DOJ) and the Securities and Exchange Commission (SEC).

In stark contrast, Coinbase, another major crypto exchange embroiled in an SEC lawsuit, defied this trend by registering a 9% uptick in bitcoin spot trading volume for the same month.

Despite the overall slump in trading volumes, bitcoin spearheaded a rally driven by spot trading, resulting in an 8% price surge over the past week and reaching a three-week high. Ether and Binance Coin (BNB) also followed suit, posting 6% gains each.

Furthermore, Toncoin made a notable entry into the top 10 cryptocurrencies by market capitalization after recording an impressive 45% surge in just seven days.

K33’s report also underscores a growing bullish sentiment among derivatives traders on the Chicago Mercantile Exchange (CME), marking a shift away from the prevailing bearish sentiment that had dominated since mid-August. Notably, the past week witnessed a 19% uptick in bitcoin open interest among active traders, accompanied by a rise in futures premiums.

However, the derivatives market isn’t entirely bullish, as CME’s ether open interest experienced a 17% decline in the past week, and ether futures continue to maintain a relative premium discount compared to bitcoin.

K33’s researchers argue that 2023 has seen the direction of the crypto market significantly influenced by crypto-specific events. These include short squeezes, developments related to exchange-traded funds (ETFs), and sell-side pressures stemming from bankruptcy estates and the U.S. government. This divergence becomes evident when examining bitcoin’s correlation with traditional indices like the S&P 500 and the DXY, which have separated since the beginning of the year.

1 Comment