Featured News Headlines

July Crypto Market Frenzy- Is the Crypto Market Headed for a Liquidation Cascade?

July Crypto Market Frenzy– While Bitcoin soared past $122,000 in July, the crypto derivatives market faced a sharp rise in liquidation risk. According to Coinglass, Open Interest (OI) across major assets reached historic highs — and traders may be dangerously overleveraged.

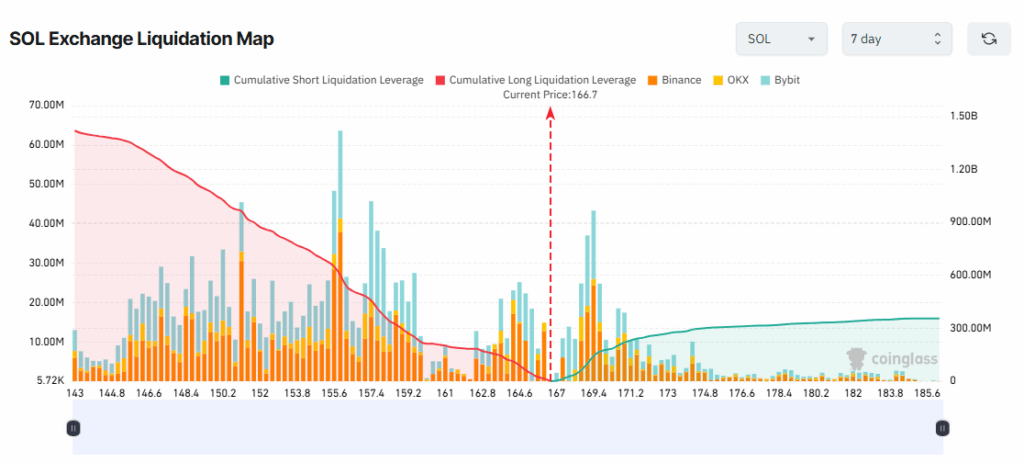

Solana (SOL): $1 Billion at Risk

Solana’s OI surged to $7.9 billion, the highest since January 2025 when SOL peaked at $294. The liquidation mapshows a significant imbalance, with traders heavily favoring long positions. If SOL dips below $150 (a 10% drop from its current $167 level), over $1 billion in longs could be wiped out.

Meanwhile, FTX unstaked 190,000 SOL (~$31 million), triggering market concerns amid creditor pressure — a red flag for bulls banking on further upside.

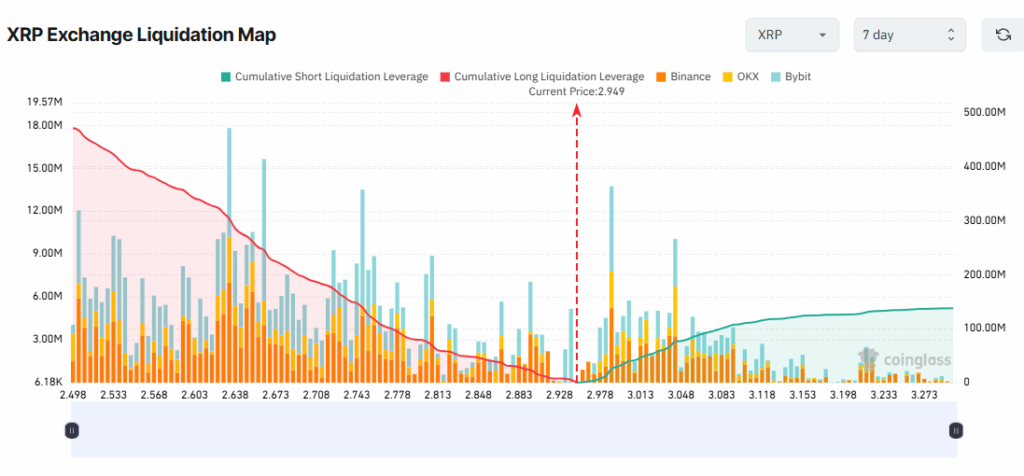

XRP: Rally Losing Steam?

XRP’s Open Interest hit $7.6 billion, just shy of its January peak. Like Solana, XRP traders are skewed toward longs. However, if XRP falls below $2.5, it could trigger up to $500 million in long liquidations. Given XRP’s history of 20–30% intraday swings, this is a volatile setup.

Recent analysis hints that the rally may be cooling, as some traders eye profit-taking zones.

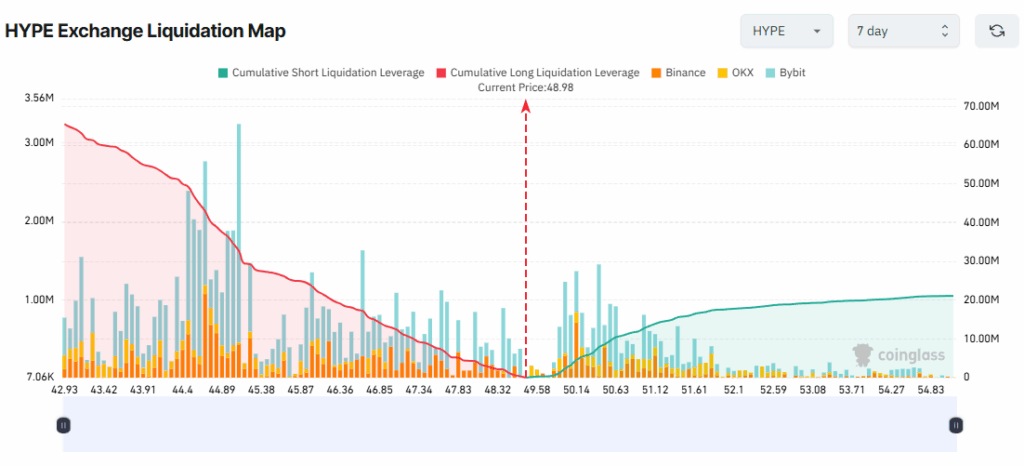

Hypeliquid (HYPE): Bullish Frenzy or Trap?

HYPE reached a record $2.1 billion in OI, with a rising long/short ratio and six consecutive green days. It hit a new high of $49.8, but if prices slip below $43, over $60 million in longs could be liquidated.

Derivatives Market at Record Heat

Coinglass reports that BTC perpetual futures volume is now 11.5x higher than spot trading — the highest ratio ever. With leverage maxed out, even small corrections could spark massive cascading liquidations across the board.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.