Crypto News– After a year of dormancy, the hacker who pilfered $7.4 million from the decentralized finance (DeFi) protocol Hundred Finance has resumed moving the stolen crypto assets.

the Hundred Finance hacker transfers pilfered assets

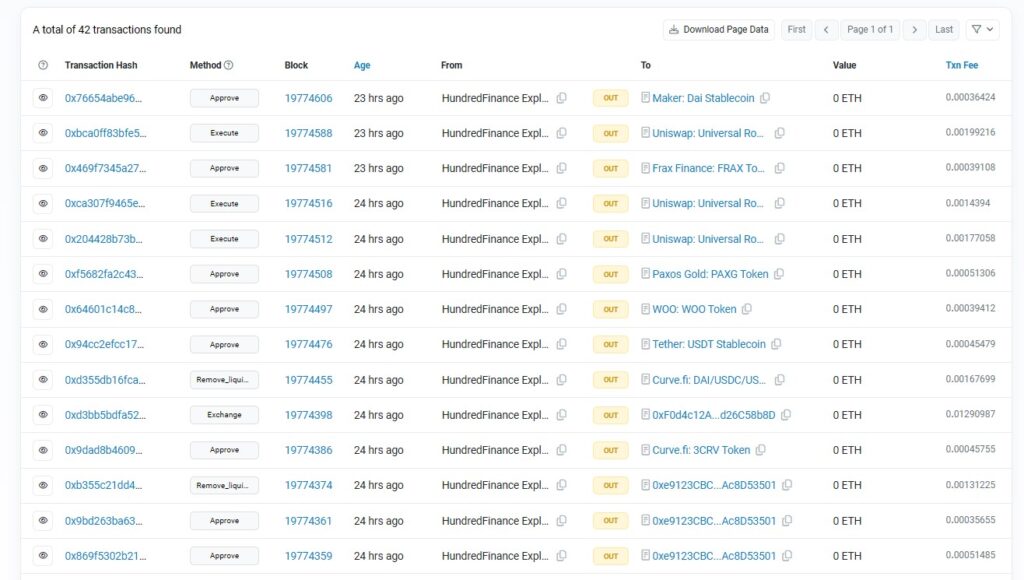

On May 1st, the hacker initiated transfers of Ether (ETH) and Tether (USDT) worth approximately $800,000 from Curve’s decentralized exchange (DEX), where liquidity had been provided over a year ago. Following the withdrawal, the hacker converted USDT and other cryptocurrencies into ETH, augmenting their ETH holdings by over $1 million.

Presently, the hacker holds a total of $4.3 million in assets in their wallet, including various cryptocurrencies such as Dai, Wrapped Ether, Frax, and Wrapped Bitcoin.

The security breach on the layer-2 network Optimism was reported by the DeFi protocol on April 15, 2023. According to blockchain security firm CertiK, the attacker manipulated the exchange rate between ERC-20 tokens and hTOKENS, enabling them to withdraw more tokens than originally deposited. This exploit, known as a flash loan attack, typically involves borrowing substantial funds via uncollateralized loans from lending platforms to manipulate crypto prices on DeFi platforms. In the Hundred Finance hack, significant loans were obtained under falsified exchange rates.

Furthermore, in 2022, Hundred Finance experienced an exploit on the Gnosis Chain, where the protocol’s liquidity was drained through a reentrancy attack, resulting in a $6 million loss.

Despite the havoc wreaked by flash loan attacks in recent years, April 2024 witnessed a notable decrease in losses attributed to this type of hack.

According to a report by CertiK, flash loan attacks resulted in only $129,000 in losses during April, with the largest single incident within the month causing damages of only $55,000. CertiK noted in the report that this marked the lowest amount lost to flash loan attacks since February 2022.

Leave a comment