Crypto News – The goal of exchange-traded funds (ETFs) is to replicate the performance of an index or sector by creating investment baskets.

4 Valuable Reasons Why Hong Kong Spot Crypto ETFs Stand Out

They are comparable to mutual funds in that they use professional fund managers to invest the money after pooling the assets of investors. In 2024, ETFs have become one of the most important components in the crypto space. In particular, Hong Kong‘s recent approval of Bitcoin and Ether ETFs made a big splash. In this direction, Hong Kong’s crypto-friendly attitude has also received great acclaim.

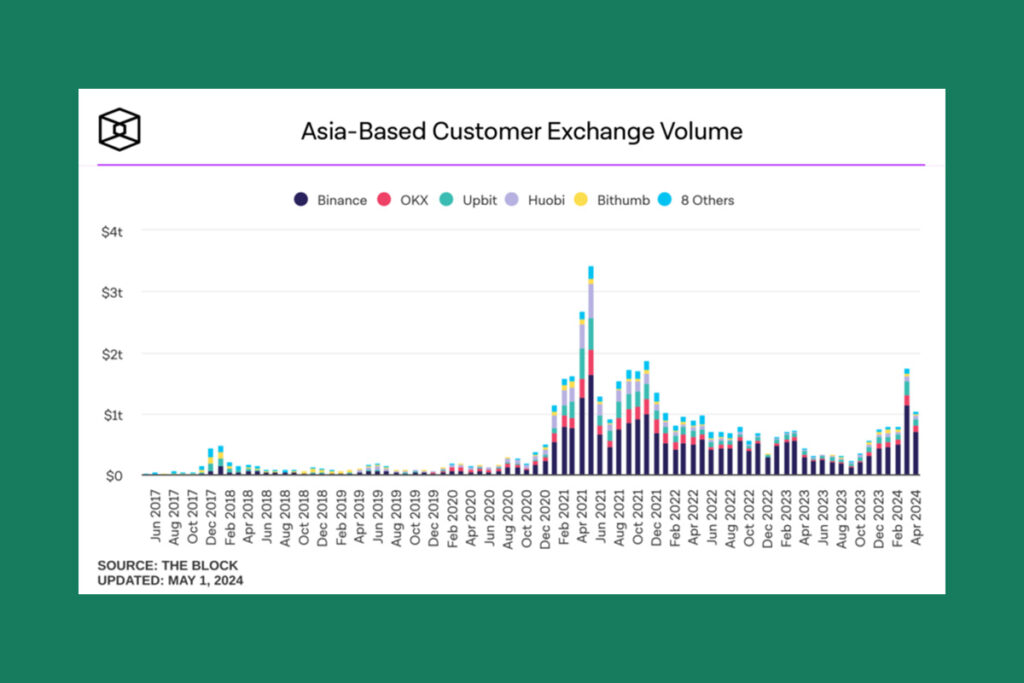

Primarily, the move has attracted so much attention because many believe that Hong Kong ETFs will be a serious competitor to the US markets. The volume of cryptocurrency traded on Asian exchanges in late Q1 and early Q2 of 2024 surpassed $1 trillion. The North American markets, with a monthly trading volume of $100–200 billion, are overshadowed by this. For this very reason, it’s worth examining the 4 key reasons why Hong Kong spot crypto ETFs stand out.

1. Hope for a Bitcoin Price Surge

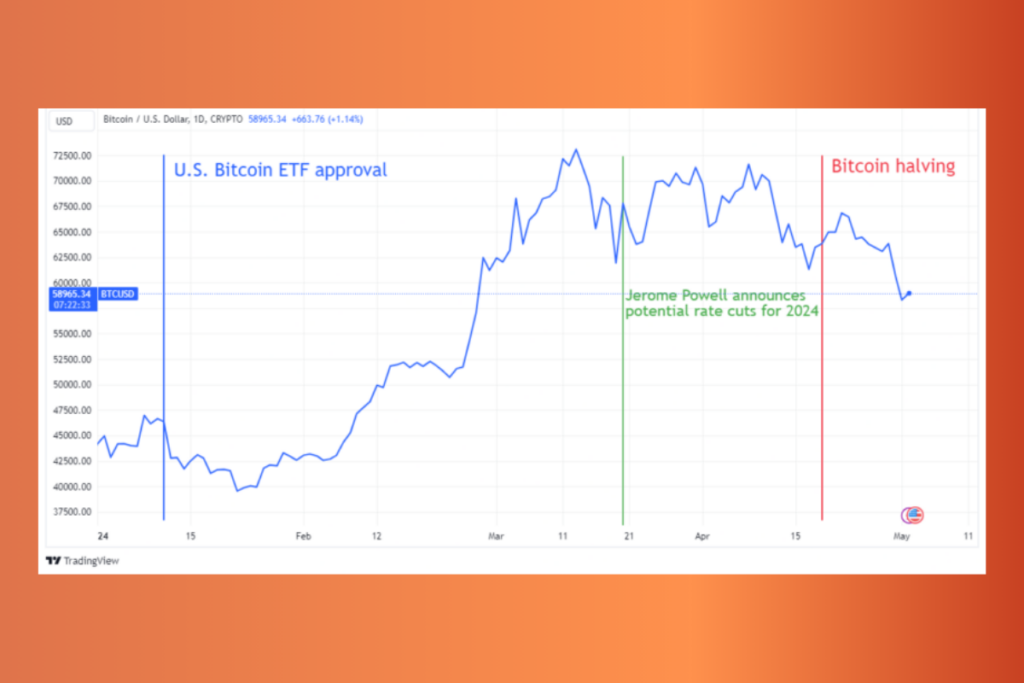

The approval of the Hong Kong ETFs was the final straw for many traders who thought that a series of convergent events would cause the price of Bitcoin to spike dramatically. When the US Federal Reserve announced interest rate pauses and possible reductions in Q1 2024, a series of events got underway.

We believe that our policy rate is likely at its peak for this tightening cycle and that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

Jerome Powell, Federal Reserve Chair

Investors have always considered this to be a bullish development. In other words, a lot of people think that when the Federal Reserve of the United States lowers interest rates, the value of assets like stocks or Bitcoin rises, which is good news for investors everywhere.

2. The Short-Term Impact of ETFs on Bitcoin Price

The impact on Bitcoin’s price was far more muted than many had anticipated, and trade volumes initially appeared to be lower than predicted. After learning that a spot ETF was approved in Hong Kong, the top cryptocurrency asset was able to recover $64,000, but it has since fallen below $60,000.

3. Easier Access to the Asian Market

Hong Kong ETFs are gaining a lot of attention due to their accessibility to Asian markets, especially China, where cryptocurrency was outlawed in 2017. In March and April of 2024, the aggregate customer exchange volume originating from Asia surpassed one trillion dollars. This supports Asia’s growing interest in cryptocurrency, even though it may not immediately transfer to ETF trading.

4. Hong Kong’s Competition with the US Market

The volume of cryptocurrency traded on Asian exchanges exceeded $1 trillion, as previously mentioned. Therefore, many think Hong Kong ETFs will significantly threaten US markets. This comparison is largely based on the perceptions of cryptocurrency in both markets. While the U.S. has adopted a heavy-handed and frequently criticized enforcement strategy against crypto-related activities, firms, and innovators, Hong Kong is positioning itself to become a hub for the cryptocurrency industry.

As an example, and to the dismay of many, the United States approved futures-based cryptocurrency exchange-traded funds (ETFs) prior to legalizing spot-based ETFs. Spot-based ETFs are thought to be better than futures ETFs by many people. Contango risks and roll costs are to blame for this. As a result, Hong Kong has been commended for its progressive laws regarding crypto-based financial products, while the U.S. has been attacked for unintentionally placing users at risk.

Leave a comment