Crypto News– On April 30, 2024, Hong Kong ventured into spot cryptocurrency exchange-traded funds (ETFs) with a blend of enthusiasm and caution. The Hong Kong Stock Exchange (HKEX) introduced six new spot Bitcoin and Ethereum ETFs.

The Debut of Hong Kong Spot Crypto ETFs: Mixed Reception Among Experts

Issued by China Asset Management, Bosera HashKey, and Harvest International, these ETFs represent a notable milestone for Asia’s crypto market. Nevertheless, the initial trading day saw relatively subdued activity compared to similar offerings in the US.

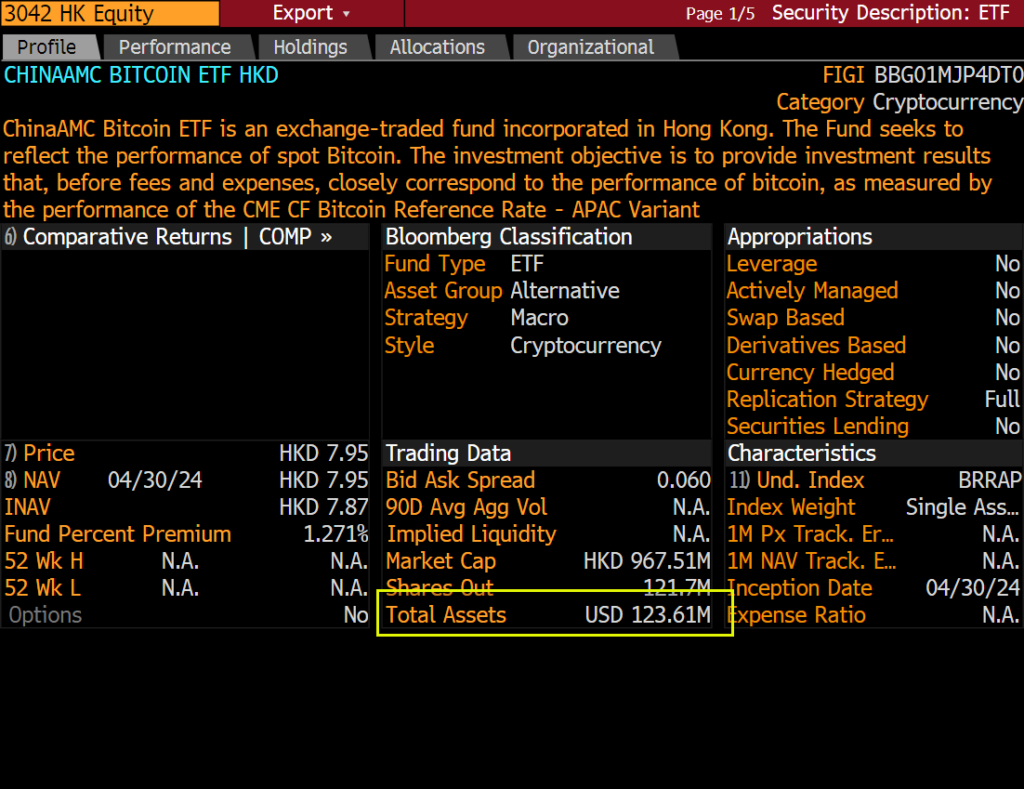

A local media outlet reported that the initial launch size of the ChinaAMC Bitcoin ETF (CAM BTC) and ChinaAMC Ether ETF (CAM ETH) were HKD 950 million and HKD 160 million, respectively. Additionally, data from Bloomberg Intelligence revealed that the CAM BTC ETF recorded $123.61 million in total assets.

These figures highlight CAM BTC’s status as the largest launch of the day, with a 1.53% increase in its closing price. In contrast, CAM ETH experienced a decline of 0.78%.

Similarly, Bosera Hashkey and Harvest International witnessed a mix of minor gains and modest losses across their respective ETF offerings.

Hong Kong’s Spot Crypto ETFs: A Blend of Success and Caution

The Bosera Hashkey Bitcoin ETF saw an appreciation of 1.80%, while its Ethereum ETF experienced a decrease of 0.45%. On the other hand, the Harvest Bitcoin Spot ETF (HGI BTC) and Harvest Ether Spot ETF (HGI ETH) observed increases of 1.57% and decreases of 0.73%, respectively.

According to data from Arkham Intelligence, Bosera Hashkey’s ETFs hold approximately $70.34 million in assets, consisting of 964 Bitcoin ($57.55 million) and 4,290 Ethereum ($12.80 million).

These results indicate a greater interest in Hong Kong’s spot Bitcoin ETFs compared to Ethereum counterparts on the first day of trading.

To distinguish themselves in the competitive market, Hong Kong ETF issuers have implemented various management fee strategies. For example, Harvest International has notably established a low management fee of 0.3% for its ETFs, with this rate being waived for the first six months after listing.

Leave a comment