Hashdex Files Unique Bitcoin ETF Application with Focus on CME Market

Crypto News – Cryptocurrency asset management company, Hashdex, has officially thrown its hat into the ring for a spot Bitcoin ETF in the United States. Differing from recent applications, Hashdex’s submission to the U.S. Securities and Exchange Commission (SEC) seeks to create a Bitcoin futures ETF that directly holds spot Bitcoin. Interestingly, the firm plans to forgo the typical reliance on the Coinbase surveillance sharing agreement and instead acquire spot Bitcoin through established physical exchanges within the CME market.

Details of Hashdex’s Bitcoin ETF Filing

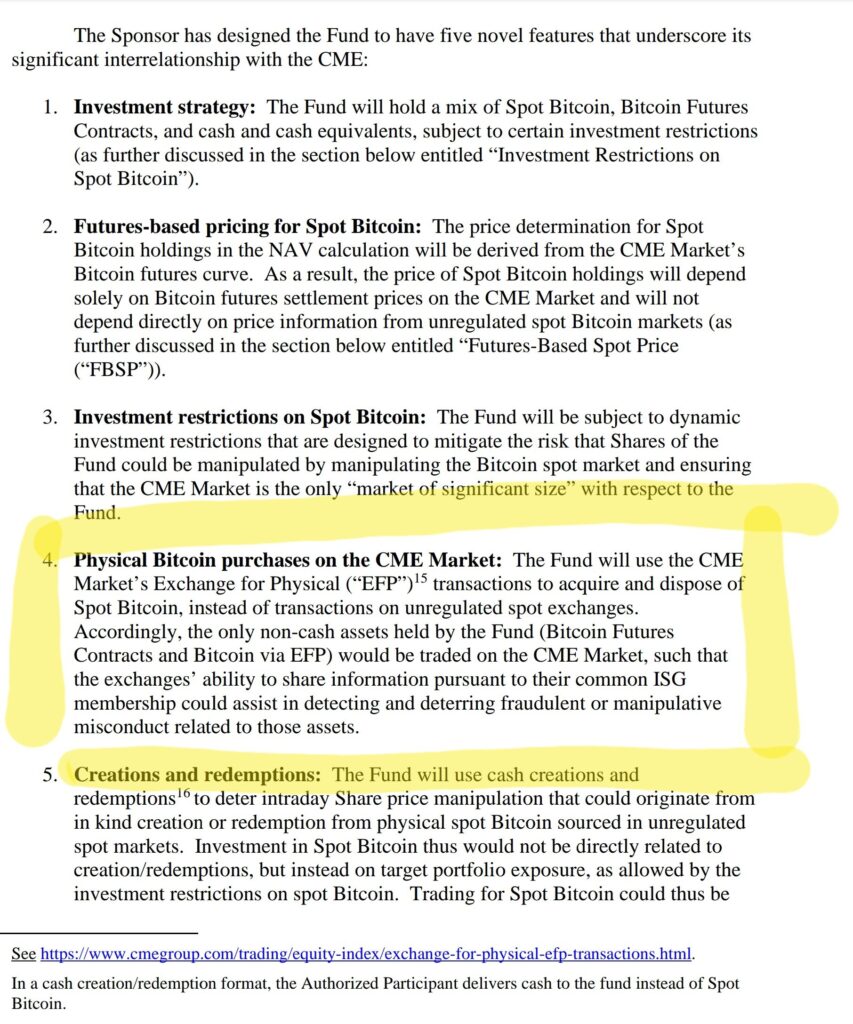

In the filed 19b-4 document with the US SEC, Hashdex outlines its intention to incorporate spot Bitcoin holdings within its Bitcoin futures ETF. This innovative approach indicates a commitment to actual Bitcoin exposure, setting it apart from ETFs that primarily engage with futures contracts. Hashdex also aims to modify the ETF’s name from its original DeFi-focused ticker to “Hashdex Bitcoin ETF.”

Bloomberg Analyst’s Perspective

Notably, Bloomberg analyst James Seyffart highlights the distinctiveness of Hashdex’s filing. The company’s decision to bypass the Coinbase surveillance sharing agreement and acquire spot Bitcoin directly from the CME market is a departure from the norm. Additionally, Hashdex’s strategy centers around Exchange for Related Positions (EFRP) transactions, emphasizing the exchange of futures contracts to achieve equivalent spot exposure instead of direct cash purchases.

Potential SEC Approval Amid Industry Pressures

Seyffart speculates that Hashdex’s unconventional approach could improve its chances of gaining SEC approval. The regulatory body’s Chair, Gary Gensler, has been facing mounting pressure due to factors like the Grayscale lawsuit, Ethereum futures applications, and BlackRock’s introduction of the Coinbase surveillance sharing agreement.

Expert Reactions and Market Outlook

Several industry experts, including Nate Geraci, President of The ETF Store, investor Alistair Milne, and finance lawyer Scott Johnsson, have responded positively to Hashdex’s distinctive Bitcoin ETF application. They believe that this approach could address some of the SEC’s concerns regarding market manipulation and liquidity in the Bitcoin space.

Meanwhile, neither the SEC nor Gary Gensler has provided official commentary on the growing number of spot Bitcoin ETF applications, the surge in Ethereum ETF proposals, or the potential approval of a spot Bitcoin ETF within the current year. Earlier reports from Bloomberg analysts suggest that Ethereum ETFs may have higher approval prospects than Bitcoin ETFs for this year.

As of the most recent update, the price of Bitcoin (BTC) is trading at $26,045, experiencing a period of sideways movement for nearly a week amid market uncertainty. Over the past 24 hours, trading volume has decreased by 9%.

Leave a comment