Grayscale’s GBTC Could Run Out of Bitcoin in 14 Weeks, Says Arkham Analytics; BlackRock’s IBIT Continues to Soar

Crypto News – In a looming crisis for crypto investment, Grayscale‘s flagship product, the Grayscale Bitcoin Trust (GBTC), faces a dire scenario where it could soon run out of Bitcoin reserves for redemptions. According to insights from blockchain analytics firm Arkham, this depletion could occur in as little as 14 weeks.

While BlackRock‘s Bitcoin ETF (IBIT) continues its ascent, setting new records within the ETF industry, GBTC struggles amidst redemption pressures. The recent surge in popularity of spot Bitcoin ETFs has further accentuated the disparity between the two investment vehicles.

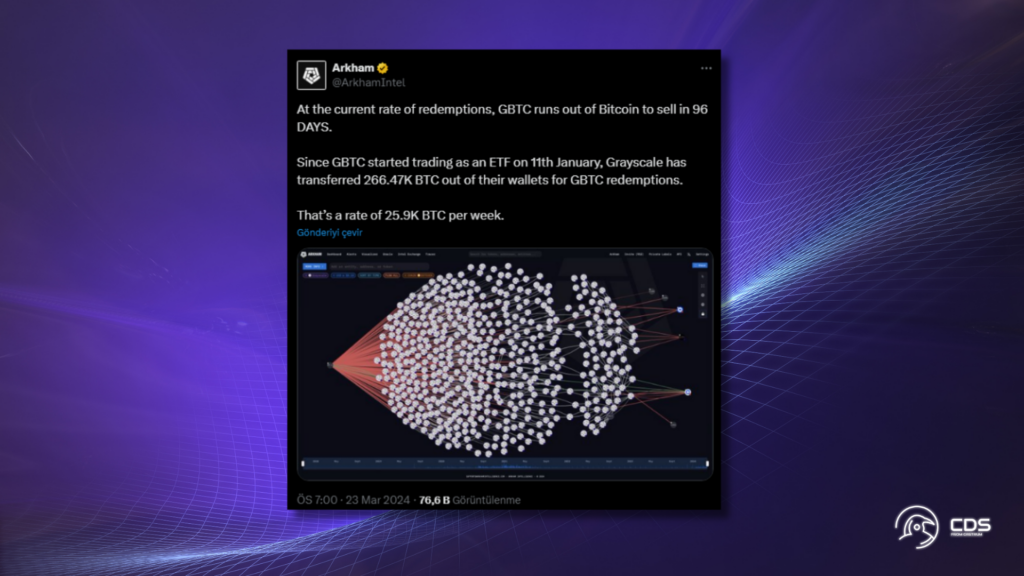

Arkham’s analysis reveals a concerning trend: at the current pace of redemptions, GBTC could deplete its Bitcoin reserves in just 96 days. This projection is based on the substantial outflow of 266,470 BTC from Grayscale’s wallets since the fund transitioned into an ETF on January 11th.

Comparing data, it’s evident that GBTC’s Bitcoin holdings have dwindled significantly. As of March 23rd, the trust held 356,440 BTC, a notable decline from the 618,280 BTC held in January.

Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) continues to attract substantial daily inflows, averaging 4,120 BTC per day, equivalent to over $274 million at current market prices.

Market observers speculate that IBIT may soon surpass GBTC in total Bitcoin holdings, reflecting the shifting landscape within the crypto investment realm.

However, amidst these challenges, there’s optimism that GBTC may weather the storm. Bloomberg ETF analyst Eric Balchunas suggests that the recent surge in outflows could be attributed to bankruptcies, offering a glimmer of hope for stabilization.

As of March 25, 2024, 04:23 am ET, it’s crucial to note corrections made to the initial data provided by Arkham, with the GBTC figure adjusted from 277,470 BTC to 266,470 BTC. These updates have been made for clarity and accuracy.

1 Comment