Crypto News – With almost $600 million leaving its Grayscale Bitcoin Trust (GBTC), prominent digital asset management company Grayscale has seen yet another day of notable withdrawals from its spot Bitcoin ETF.

Grayscale Outflows Still High: Another $600 Million Outflow Happened

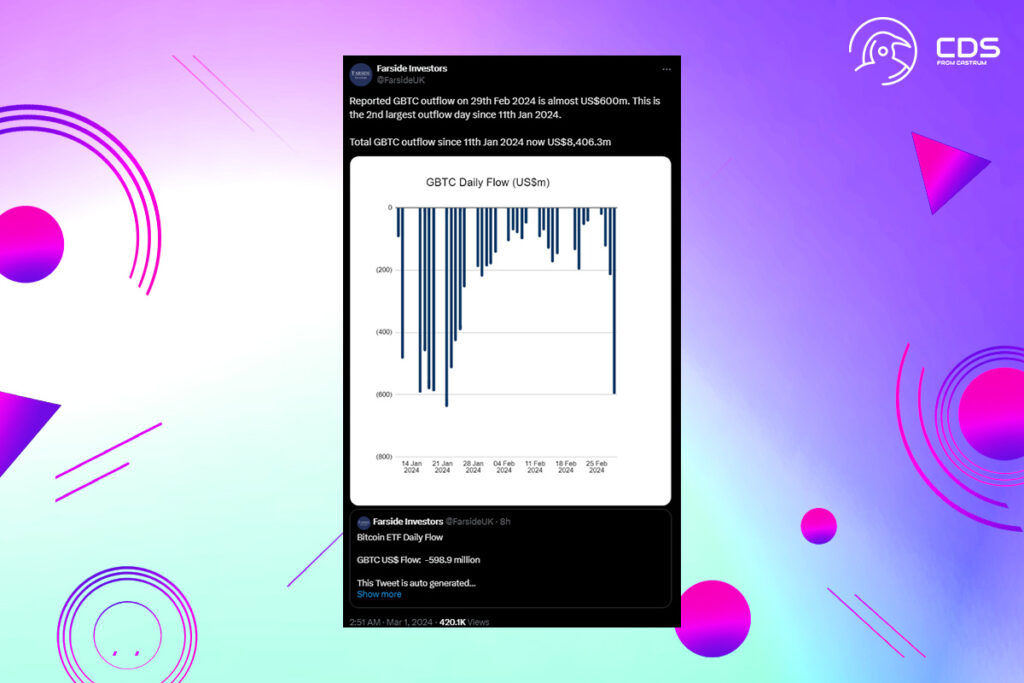

By February 29, $600 million had left GBTC, according to data from Farside Investors, which Grayscale utilized. Since January 11, the cumulative outflow from it has been approximately $8.4 billion.

The other ETFs saw substantial inflows that day as well, with 8 ETFs adding 14,934 BTC. The largest asset management company in the world, BlackRock, contributed 10,140 Bitcoin (valued at $638 million) to its iShares Bitcoin Trust (IBIT). Fidelity’s FBTC added 4,066 Bitcoin (of $255.9 million) next.

Expectations Grow for SEC Approval of Options on GBTC

It’s crucial to remember that, according to Reuters, Grayscale Investments lobbied the US Securities and Exchange Commission (SEC) to approve options on its spot Bitcoin ETF so that it could provide access to a new investor class. Michael Sonnenshein, CEO of Grayscale, asserted that the SEC would “unfairly discriminate” against its shareholders if options on GBTC were rejected. The executive stressed that options on Bitcoin futures ETFs had already been approved by the securities regulator.

It is vital to the interests of GBTC and all spot Bitcoin exchange-traded product investors to access exchange-listed options on GBTC and other spot Bitcoin ETPs,

Sonnenshein

Leave a comment