Global Crypto Funds Inflows Surge as Investors Eye Potential Fed Rate Cut

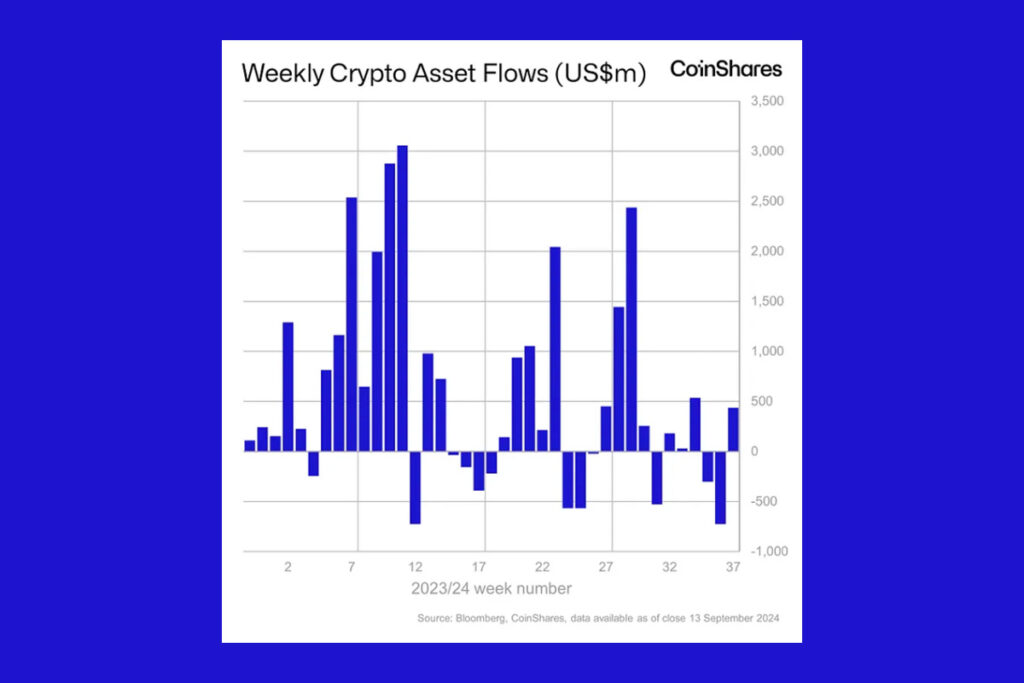

According to CoinShares, following two weeks of net outflows, cryptocurrency funds at asset managers, including BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares, saw net inflows of $436 million globally last week.

We believe the surge in inflows towards the end of the week was driven by a significant shift in market expectations for a potential 50 basis point interest rate cut on September 18,

CoinShares Head of Research James Butterfill

Nonetheless, Butterfill pointed out that the week’s trade volume was unchanged at $8 billion, far less than the average of $14.2 billion for 2024.

Bitcoin ETFs Dominate with $436M Inflows as Ethereum-Based Funds Face Challenges

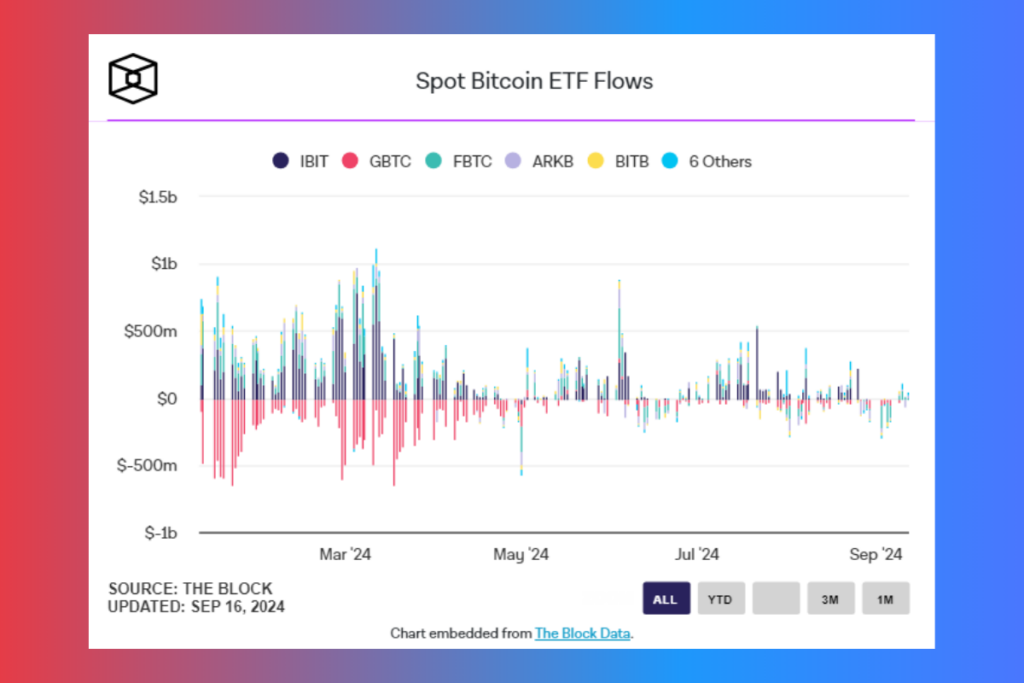

Following 10 days of net outflows totaling $1.2 billion, bitcoin-based funds led the flows once more, recovering to create $436 million in net weekly inflows. After three weeks of inflows, short bitcoin investment product flows also reversed, with net outflows of $8.5 million. The U.S. market was also the largest, with $403.9 million in net weekly inflows coming from spot Bitcoin exchange-traded funds located there.

Additionally, funds domiciled in Switzerland and Germany experienced net inflows of $27 million and $10.6 million, respectively, while products based in Canada saw net withdrawals of $18 million. Nevertheless, Ethereum-based funds were still having trouble. Last week they saw net outflows of $19 million, on top of the $98 million that had been negative the week before.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment