FTX News: FTX Token Surges 113% Amid False Repayment Rumors, Investors Brace for Market Movements

FTX News – The price of FTX Token (FTT) experienced a sharp rise on Sunday, climbing 113% at its intra-day high, driven by unfounded rumors of a potential $16 billion creditor repayment. While the excitement initially sent the token skyrocketing, the price corrected before the end of the day, closing 57% higher than its opening value. Investors are now left speculating on the token’s future trajectory.

FTX Token’s Rally and Market Response

The recent surge in FTT prices can be attributed to its significant presence in the cryptocurrency market and heightened investor speculation. The rally gained momentum as rumors spread that FTX might begin repaying creditors on October 1, potentially injecting $16 billion into the market.

However, Sunil, a representative of the largest group of FTX creditors, debunked these claims. He clarified via a tweet that the repayment hearing is scheduled for October 7, refuting the repayment rumors.

Despite this, the price surge has already had a noticeable impact on market activity, with active deposits reaching a ten-month high. Speculation about a potential repayment plan prompted a flurry of trading activity, as investors moved assets to exchanges in anticipation of a possible $19 billion influx. This increase in deposit volumes suggests that many are positioning themselves to take advantage of the price surge, though it also signals some caution as traders eye potential exit strategies.

FTT Price Outlook: Key Levels to Watch

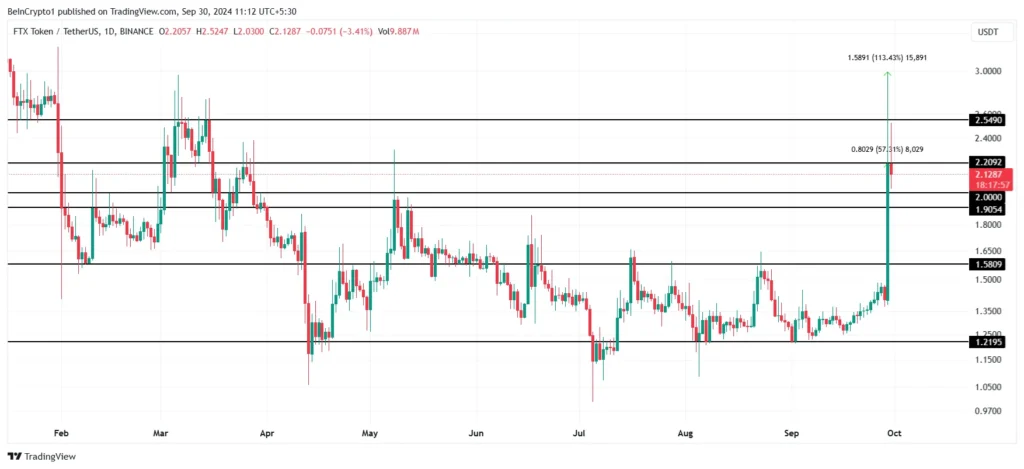

On Sunday, FTX Token saw a dramatic 113% price increase before pulling back, closing the day with a 57% gain. As of this writing, FTT is trading at $2.12, reflecting both the volatility and renewed interest in the token.

Looking ahead, FTT may find support near the $2.00 mark, potentially setting the stage for a rebound. If market sentiment remains positive, the token could break through the $2.20 resistance level. However, with the repayment hearing approaching, the potential for profit-taking at current levels could lead to further downward pressure. Should FTT fall below the $1.90 support, it risks dropping further to $1.58, which would invalidate the current bullish trend.

Leave a comment