Crypto News- Before the amended proposal deadline, two wallets linked to the defunct FTX exchange and sister trading company Alameda Research moved a combined total of $8.3 million in cryptocurrency.

FTX Addresses Move 8.3M Dollars One Day Prior to Revised Proposal Deadline

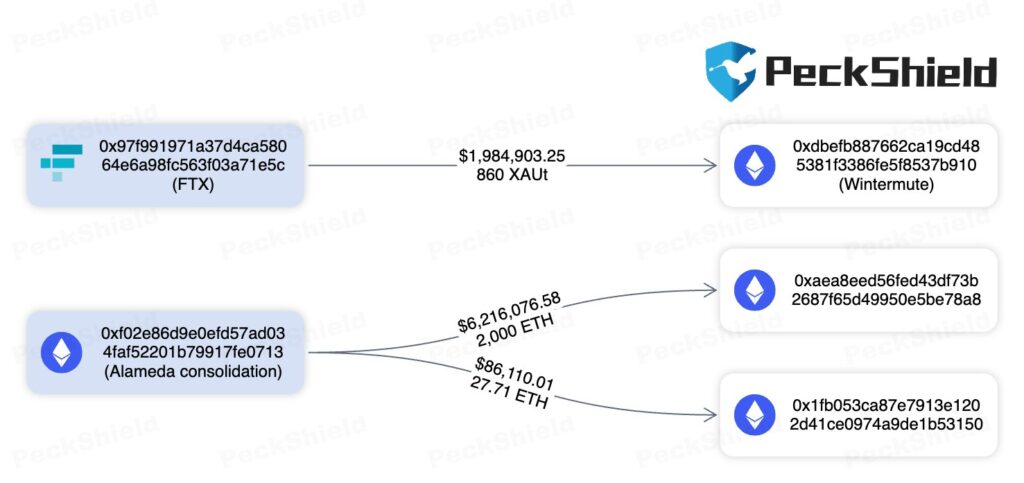

One wallet associated with FTX transferred 860 Tether Gold (XAUT) valued at over $2 million to the algorithmic trading firm Wintermute. Meanwhile, a wallet related to Alameda Research sent a sum of 2,027 Ether (ETH), valued at over $6.3 million, to two undisclosed addresses. These transactions were reported in a May 6th post by PeckShield.

While the motive behind the transactions remains unclear, they occurred a day before the deadline for FTX debtors to submit an amended version of the Plan and Disclosure Statement, scheduled for May 7.

This updated plan could provide FTX creditors with additional information regarding how they will be compensated for their losses. The final deadline for objections is set for June 5.

The collapse of FTX and its more than 130 subsidiaries stands out as one of the crypto industry’s most significant black swan events, resulting in users losing a minimum of $8.9 billion in funds. This collapse triggered one of the industry’s lengthiest crypto winters, during which the price of Bitcoin plummeted from a high of $64,265 to a low of $16,000.

When can FTX creditors expect repayment?

While FTX’s amended plan may provide further clarity on how customers will be compensated, some creditors anticipate unfavorable developments.

A prominent FTX creditor, Sunil, who is part of the largest group comprising over 1,500 FTX creditors — the FTX Customer Ad-Hoc Committee — has urged users to reject the forthcoming plan, which is expected to favor the debtors. Sunil, in a May 5th post, cautioned:

S&C knew of FTX US and FTX Trading Ltd.’s omissions, untruthful and fraudulent conduct, and misappropriation of Class Members’ funds. Despite this knowledge, S&C stood to gain financially from the FTX Group’s misconduct and so agreed, at least impliedly, to assist that unlawful conduct for its own gain.

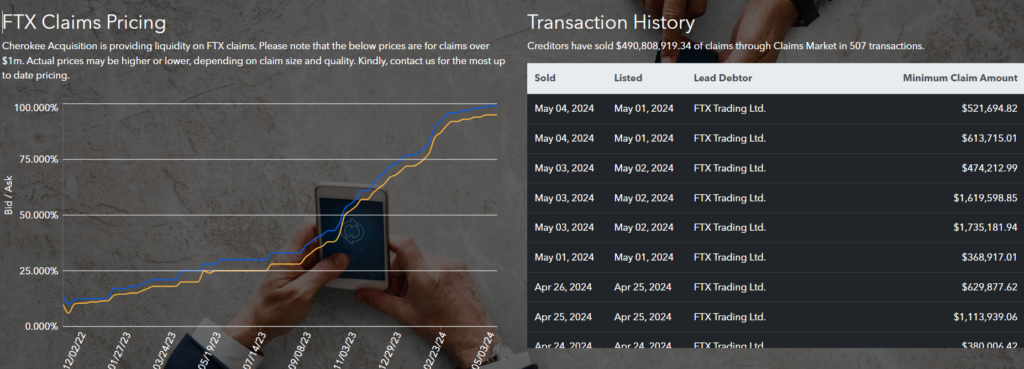

To date, FTX creditors have sold claims worth over $490 million through 507 transactions, as per data from crypto debt broker Claims Market.

Leave a comment