Crypto News – The crypto sector, which has had an active week, did not pass today without incident.

February 9 Crypto News: What Happened in the Crypto Sector Today?

So, what was interesting in terms of news today? First of all, spot Bitcoin ETFs in the U.S. yesterday attracted 403 million daily inflows. Then, it was learned that BlackRock and Fidelity‘s ETF products have amassed more assets in about a month than any US ETF in the last 30 years. Finally, Kraken announced that it has received regulatory approval to operate in the Netherlands. Let’s examine each story in detail.

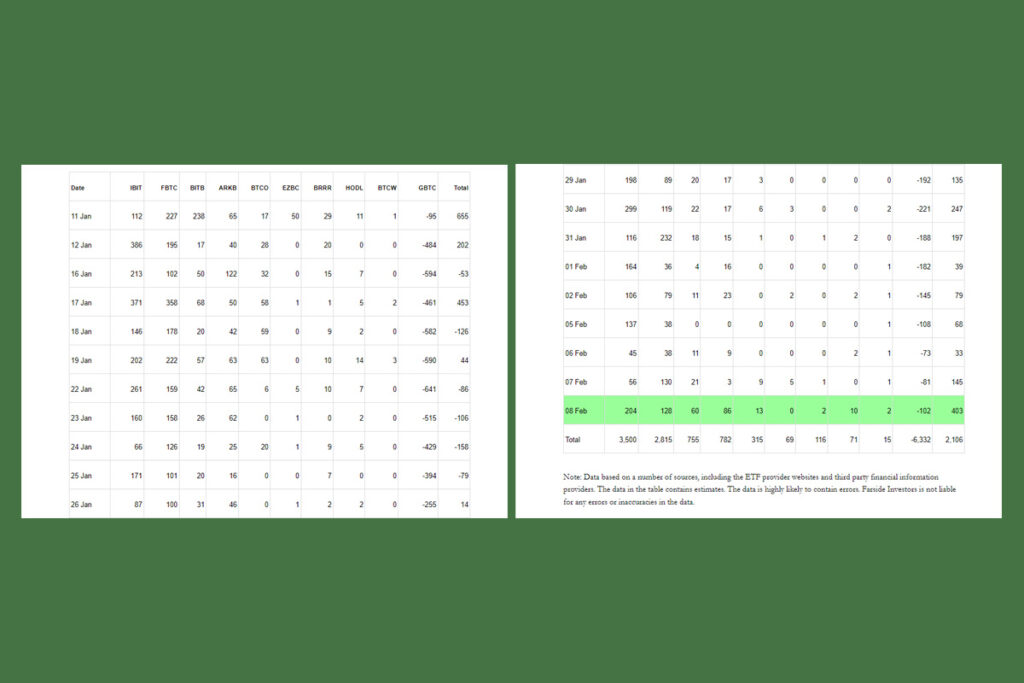

ETFs Experienced $403 Million in Inflows on February 8

Spot Bitcoin ETFs saw their third-largest inflow of $403 million on February 8. Despite more than $100 million leaving the Grayscale Bitcoin Trust (GBTC), there were significant inflows. The ETF flow chart shows that Bitwise has $60 million, Fidelity has $128 million, ARK 21Shares has $86 million, and BlackRock iShares Bitcoin Trust (IBIT) has $204 million. Together, the other seven ETFs experienced inflows of $27 million, while GBTC witnessed outflows of an additional $102 million.

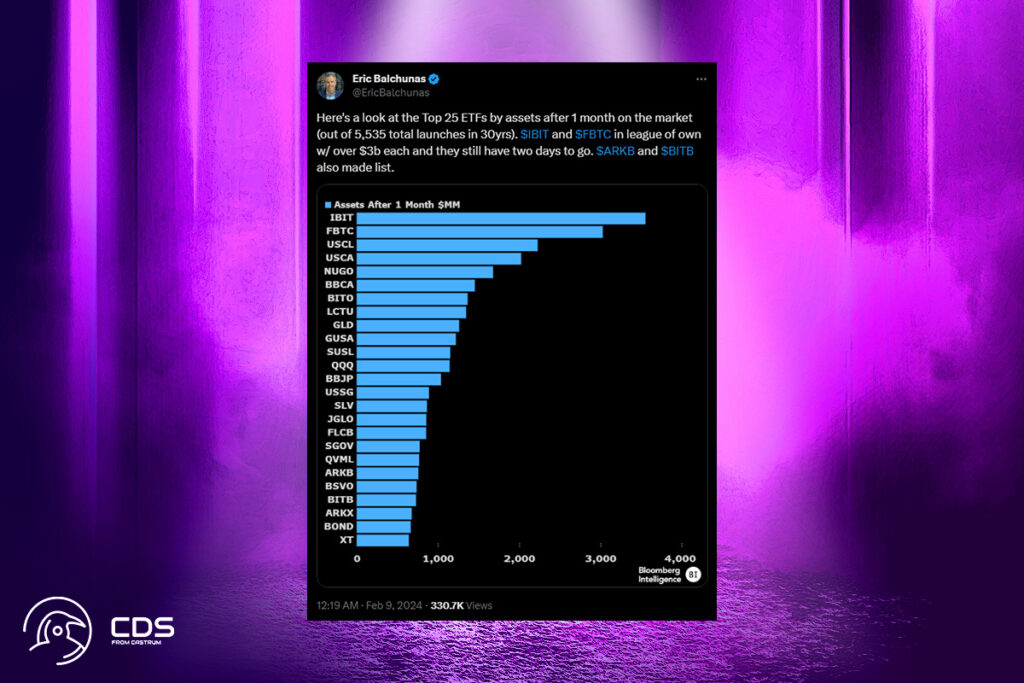

Balchunas Talks About BlackRock and Fidelity Overtaking 30-Year ETFs

Out of a list of over 5,500 ETFs, only BlackRock’s IBIT and Fidelity’s FBTC have each secured more than $3 billion in assets in the first 17 trading days, according to Bloomberg Intelligence data. In a post on X on February 8, Bloomberg ETF analyst Eric Balchunas stated that IBIT and FBTC are in a “league of (their) own.”

Balchunas stated that the Bitcoin ETF findings from BlackRock and Fidelity are even more noteworthy because the majority of the other ETFs that were ranked on the list were “BYOA,” or “Bring Your Own Assets,” ETFs. It indicated that all of the ETF’s managed assets were owned by a single investor.

Kraken Gets Its Fourth License in Europe!

Following the Netherlands’ granting of a virtual asset provider (VASP) license, cryptocurrency exchange Kraken has obtained its fourth license in Europe. Kraken was granted registration by the Dutch Central Bank on February 8. This means that the exchange is now able to provide exchange and transfer services, including wallet and custody services.

The Netherlands has a vibrant startup and technology sector […] It also has one of the highest crypto adoption rates in Europe with around 20% of Dutch citizens owning crypto,

Kraken

Leave a comment