Crypto News – On Thursday, February 8, the spot Bitcoin ETF saw a net inflow of $403 million, marking a significant milestone for the cryptocurrency market.

February 8 Net ETF Inflows Break Record

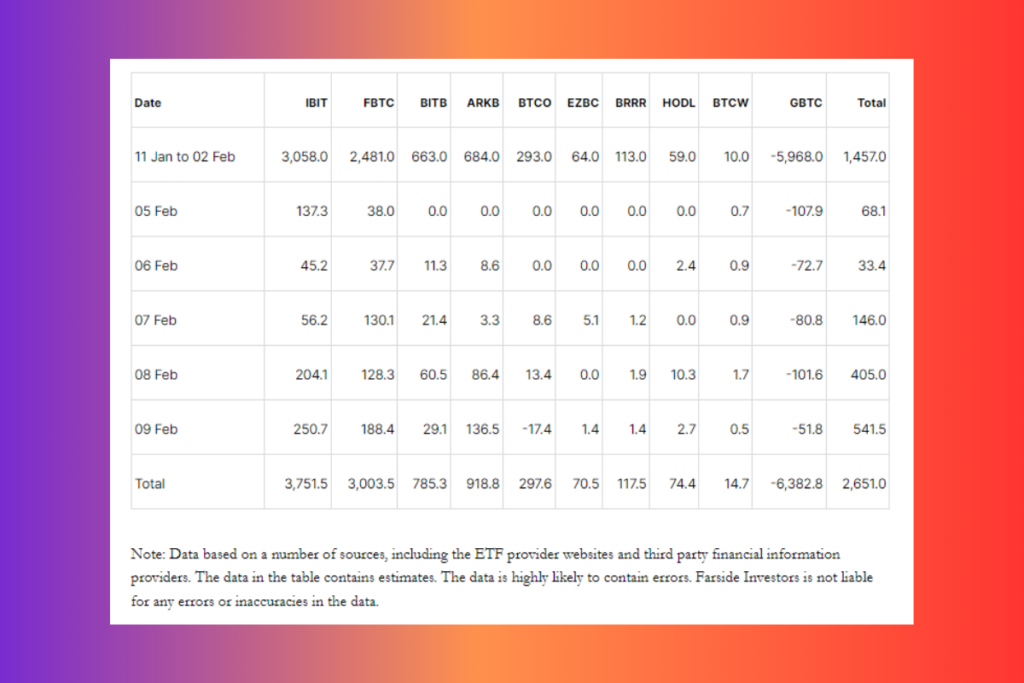

Data from Farside Investors indicates that this spike in investment activity is the largest inflow since January 17.

With a $204 million inflow, BlackRock Inc.’s IBIT led the group. Not far behind, Fidelity Investment’s FBTC showed a significant increase with net inflows of $128 million. Bitwise’s ETF performed admirably as well, registering a $60 million net inflow. The ETF offered by Ark Investment had its second-best day, bringing in a net inflow of $86 million. On the other hand, Grayscale GBTC showed $101.6 million in withdrawals, indicating a different pattern.

9 ETFs Accumulated 203,811 Bitcoin According to Reports

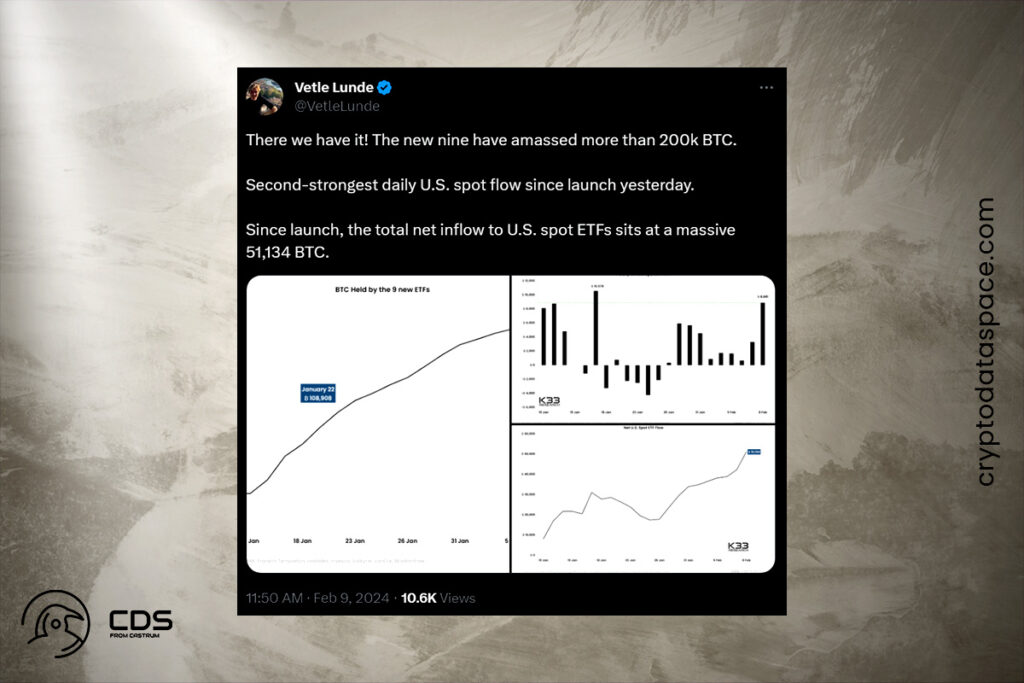

The net flows for all Bitcoin ETFs have now exceeded $2.1 billion with these most recent inflows. With the exception of Grayscale’s converted GBTC fund, the nine recently introduced spot Bitcoin ETFs have amassed over 200,000 Bitcoin in Assets Under Management (AUM) in less than a month of trading.

203,811 Bitcoin, or almost $9.5 billion, were held by these nine ETFs as of Thursday’s close, according to K33 Research. Notably, since their inception, US spot ETFs have received a cumulative net inflow of 51,134 Bitcoin, or about 1% of the 21 million BTC total supply of Bitcoin.

Leave a comment