Ethereum’s Beacon Chain Staking Hits $115 Billion, Bolstering Economic Security

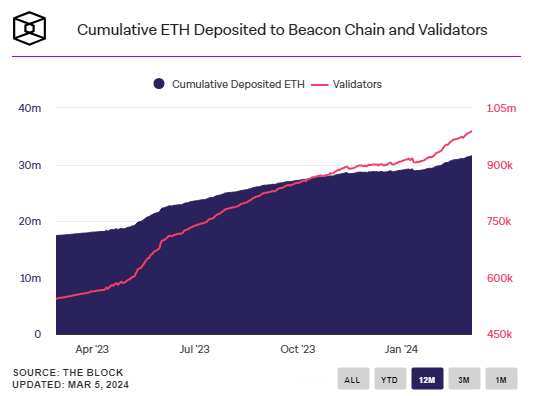

Crypto News – With over 31.5 million ether now staked on Ethereum‘s Beacon Chain, the network’s proof-of-stake consensus layer, the total value has surged to a staggering $115 billion.

This substantial amount of ether staked on the Beacon Chain accounts for nearly 26% of its overall supply, involving participation from over 980,000 individual validators.

The recent uptick in the price of ETH, currently standing at $3700, has further propelled the value of total staked assets beyond the $115 billion mark. This figure represents a significant portion of Ethereum’s market capitalization, which currently stands at $440 billion, highlighting the robustness of Ethereum’s economic security.

In proof-of-stake networks like Ethereum, which made the transition to PoS with The Merge, economic security holds paramount importance. The fundamental concept revolves around the fact that any attempt to attack the network, such as reversing transactions or executing a double-spend attack, would necessitate control over at least half of the total validator stake, equivalent to $57 billion. This formidable financial obstacle renders such attacks economically unfeasible.

The surge in ether staking can be largely attributed to the Shapella upgrade implemented in April 2023. This upgrade enabled users and validators to withdraw their staked ether, resulting in an influx of over 11 million ETH being staked post-upgrade.

Additionally, the introduction of liquid staking solutions like Lido and Rocket Pool has further streamlined the staking process. These solutions allow for staking amounts less than 32 ETH and enable the utilization of staked assets as collateral in the burgeoning DeFi landscape. Notably, Lido Finance validators presently represent over 31% of the total ETH staked, further diversifying and strengthening Ethereum’s staking ecosystem.

Leave a comment