Ethereum Whales Make Waves: $46M Dumped by Crypto Whale Ahead of ETF Verdict

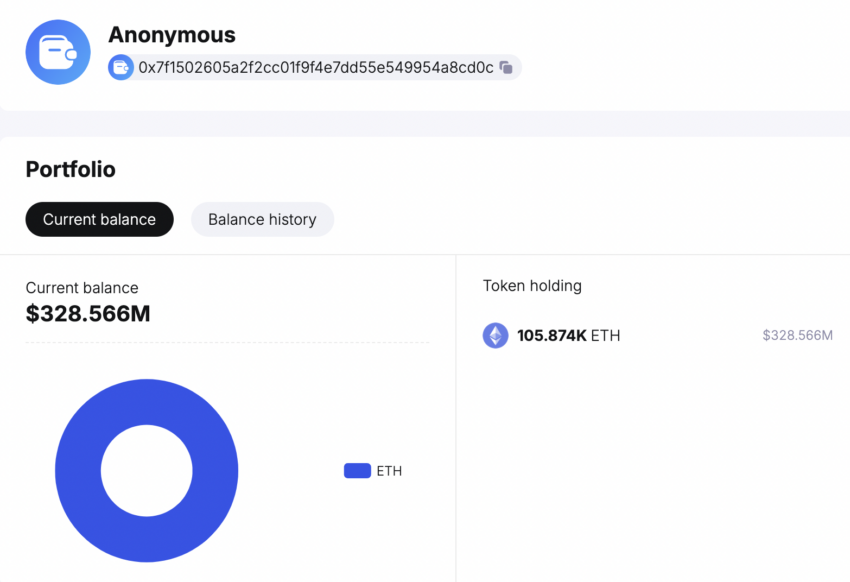

Crypto News- In a move that’s set tongues wagging across the crypto community, a major Ethereum holder, known by their wallet address 0x7f1, has decided to cash out. The timing couldn’t be more critical, as all eyes are on the US Securities and Exchange Commission (SEC), eagerly awaiting their decision on Ethereum exchange-traded funds (ETFs).

According to Spot On Chain, a platform specializing in on-chain analysis, the whale deposited a whopping 15,000 ETH (equivalent to around $46 million) onto Kraken on May 20th. What’s intriguing is that this is the first time such a substantial amount has been moved by this whale to Kraken.

Strategic Brilliance: Ethereum Whale’s $172.4 Million Profit Journey

Spot On Chain also pointed out that this strategic move has brought the whale an estimated profit of $172.4 million, a staggering 86.7% increase. This profit was fueled by shrewd maneuvers, including withdrawing over 120,000 ETH from Kraken back in September 2022, when prices were significantly lower.

This whale’s Ethereum stash now stands at 105,874 ETH, valued at approximately $327 million. And they’re not the only ones making moves. Another prominent Ethereum investor, identified by the wallet address 0x2ce, recently shifted over 4,000 ETH (worth roughly $12.17 million) to Coinbase.

But it’s not just individual investors making waves. Data from Glassnode indicates a 15% drop in the total supply of ETH that has remained untouched for five to seven years, suggesting long-term holders are starting to sell.

All of this activity is happening against the backdrop of the looming SEC decision on spot Ethereum ETFs. Scheduled for May 23rd, the decision could have far-reaching implications for the crypto market.

However, optimism isn’t necessarily high. VanEck CEO Jan van Eck has expressed doubts about the SEC’s willingness to approve spot Ethereum ETFs, citing prolonged regulatory scrutiny. Bloomberg’s senior ETF analyst Eric Balchunas puts the chances of approval at less than 35%, with betting markets giving even bleaker odds.

Regulatory Hurdles: BlackRock’s Delayed ETF and SEC’s Ethereum Scrutiny

The recent delay of BlackRock’s Ethereum ETF application, coupled with the SEC’s concerns over fraud and manipulation in the crypto space, only adds to the uncertainty. Questions around Ethereum’s transition to a Proof-of-Stake consensus mechanism further complicate matters, with the SEC scrutinizing whether Ethereum still falls under securities regulations.

As the countdown to the SEC’s decision continues, the actions of Ethereum whales and the regulatory landscape will undoubtedly shape the future of the crypto industry.

FAQs

What prompted the recent activity of Ethereum whales?

The imminent decision by the US Securities and Exchange Commission (SEC) regarding Ethereum exchange-traded funds (ETFs) has stirred significant activity among Ethereum whales. They are strategically positioning themselves ahead of this critical regulatory announcement.

How much Ethereum did the identified whale deposit onto Kraken, and what was the estimated profit from this move?

According to Spot On Chain, the whale deposited 15,000 ETH, approximately valued at $46 million, onto Kraken. This strategic move resulted in an estimated profit of $172.4 million, representing an astonishing 86.7% increase in wealth for the whale.

Can you elaborate on the actions of other notable Ethereum investors mentioned in the article?

Alongside the identified whale, another prominent Ethereum investor, known by the wallet address 0x2ce, transferred over 4,000 ETH, worth approximately $12.17 million, to Coinbase. This indicates a broader trend of significant movement among Ethereum holders.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment